Tokenized Real-World Assets: A $18.9 Trillion Revolution on the Horizon

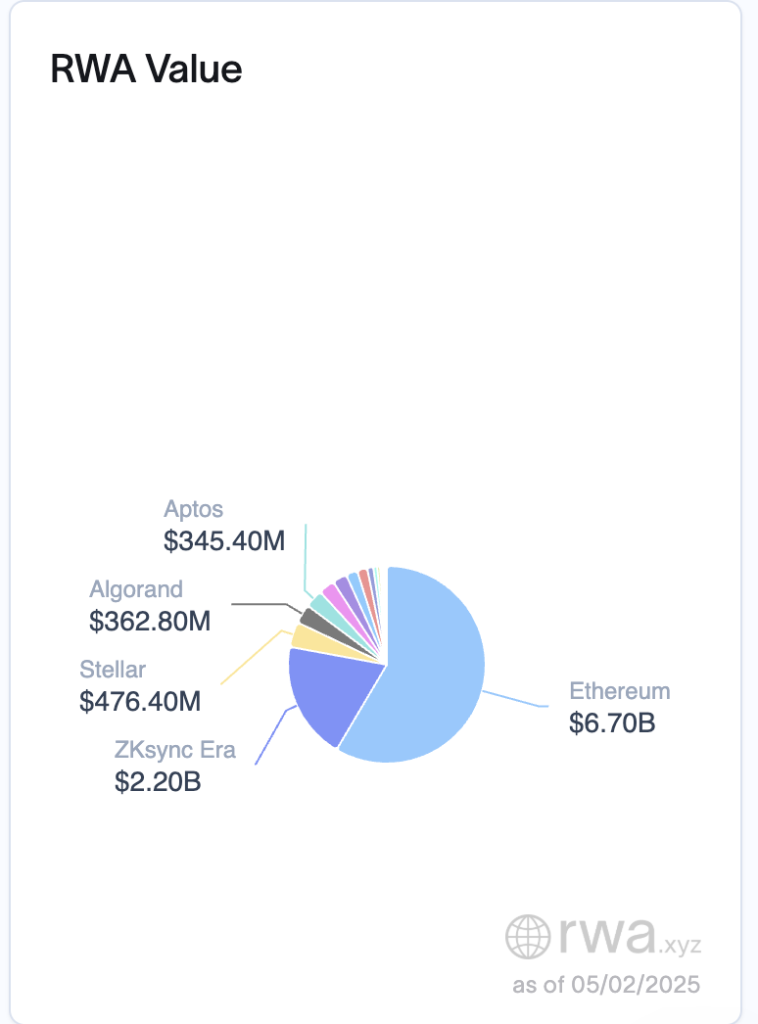

Brace yourself for a seismic shift in the financial landscape! The booming market for tokenized real-world assets (RWAs) is projected to hit an astonishing $18.9 trillion by 2033, a figure that some industry experts suggest may even fall short of reality. As the adoption of stablecoins accelerates, the potential for market expansion appears limitless. In fact, a significant 60% of the value driving RWA tokenization is being anchored by none other than the Ethereum blockchain.

Stellar’s Bold Ambitions in Tokenization

While Ethereum may dominate the RWA landscape, it’s not alone in this transformative journey. Denelle Dixon, the executive director of the Stellar Development Foundation, emphasizes that Stellar stands as the second-largest Layer-1 blockchain for RWA tokenization, achieving an impressive $470 million in tokenized assets, including treasuries and yield-bearing stablecoins.

Dixon highlights a groundbreaking initiative launched in November 2019, when Franklin Templeton—one of the world’s preeminent financial institutions—embarked on building a tokenized money market fund on the Stellar network. This venture has since blossomed into the third-largest tokenized money market fund, known as the “OnChain U.S. Government Money Market Fund” (FOBXX). Astonishingly, out of its total asset value of $701.7 million, an impressive $466.5 million resides on Stellar’s blockchain. The efficiency of this integration is notable; it drastically reduces transaction costs from $1 to mere pennies.

“If 50,000 transactions are processed in the traditional financial system, the fees alone amount to about $50,000. However, when they utilized Stellar to tokenize RWA (Real-World Assets) and manage operations, the cost of processing 50,000 transactions is just $120.”— Dao world (@Koreanteacher1) January 4, 2025

Escalating Efficiency for Financial Giants

For a financial powerhouse like Franklin Templeton, which oversees assets worth a whopping $1.7 trillion, such significant gains in efficiency could fundamentally alter its operational economics. Looking ahead, Dixon aims for Stellar to empower $3 billion in on-chain RWA value this year alone, bolstered by promising new partnerships. For instance, investment firm Societe Generale-Forge has successfully launched its EUR-backed stablecoin (EURCV) on Stellar, while Ondo eyes the launch of its yield-bearing stablecoin—the United States Dollar Yield (USDY)—on the same platform. Furthermore, Etherfuse plans to introduce “stablebonds” on Stellar, which are asset-backed products designed for stabilité and potential returns.

Avalanche: Partnering with Traditional Financial Institutions

Not one to be left behind, the Avalanche blockchain is also aggressively pursuing a chunk of the tokenized RWA market. Morgan Krupetsky, senior director of business development for Ava Labs, shares that Avalanche’s mission is to digitize and tokenize assets on an unprecedented scale. She states, “Avalanche was purpose-built for this next generation of blockchain-enabled finance,” highlighting its high throughput, low transaction costs, and customizability as key attributes that make it ideal for RWA tokenization.

Recently, asset management firm WisdomTree has expanded its institutional investment platform, WisdomTree Connect, to include 13 tokenized funds, including those on the Avalanche blockchain. “We are committed to nurturing a vibrant tokenized asset ecosystem by strengthening collaborations with esteemed asset managers and issuers,” Krupetsky asserts.

To visualize their ambition, Krupetsky describes finance company Intain’s innovative platform, devised on Avalanche’s architecture. Known as “IntainMARKETS,” this on-chain marketplace opens the doors to asset-backed securities, facilitating the issuance, investment, administration, and trading of tokenized loans exceeding $6 billion.

“Intain has launched the first institutional Subnet on #Avalanche. IntainMARKETS aims to facilitate efficient, cost-effective, and transparent asset issuance, investment, and administration.” — Ava Labs 🔺 (@AvaLabs) January 31, 2023

Injective’s DeFi Revolution and RWA Utility

Injective is setting its sights on redefining traditional finance by ensuring RWA tokenization compliance through a native token factory and permissions module. According to Eric Chen, co-founder of Injective, the platform allows issuers to create secondary markets for their tokens. Recent launches include tokenized versions of a BlackRock money market fund and a new Laser Digital fund. “This creates a seamless market for over 15 institutional market makers, allowing users to navigate these funds with ease,” Chen explains.

Injective’s commitment extends beyond simple RWA issuance; it’s about unlocking liquidity and democratizing access to assets that were typically restricted to a privileged few. Chen reveals that Injective will also allow users to margin Bitcoin or Ethereum perpetuals with yield-bearing stablecoins, enhancing its appeal in the decentralized finance (DeFi) landscape. “We’re aiming for significant market capture in the already booming RWA sector, which has surpassed $10 billion in total value locked,” he adds.

The Roadblocks on the Path to Tokenization

Despite the enthusiastic projections, significant hurdles remain. While the tokenization of assets has become increasingly simplified, Krupetsky points out that building consistent demand and ensuring liquidity in secondary markets continues to be a challenge. Without active markets integrated into broader DeFi or traditional finance (TradFi) ecosystems, tokenized RWAs risk becoming stagnant assets rather than dynamic financial instruments.

To tackle this, the industry must embrace a “distribution-first tokenization” approach. By integrating RWAs into DeFi offerings before exploring more traditional distribution channels, the sector can foster a more robust market. While the entrance of heavyweights like BlackRock and Franklin Templeton is encouraging, many financial institutions are still tethered to outdated systems that hinder seamless integration.

Furthermore, variable regulatory frameworks across different jurisdictions create further complications. Yet, industry leaders remain optimistic about 2025 as a pivotal year for RWA tokenization. Bhaji Illuminati, CEO of RWA platform Centrifuge, remarks that institutional interest is evolving into tangible actions. “We observe a gradual improvement in regulatory clarity and the infrastructure supporting tokenization is maturing,” she concludes. “Tokenized RWAs are transitioning from pilot programs to genuine allocation strategies, potentially leading to exponential increases in on-chain volumes as we integrate tokenization into asset issuance and trading.”

Conclusion: The Future is Tokenized

As blockchain technology continues to revolutionize the financial landscape, the tokenization of real-world assets is set to unlock unprecedented opportunities for efficiency, access, and innovation. With major players like Stellar and Avalanche spearheading this movement, coupled with evolving regulatory landscapes, we are witnessing the dawn of a new era in finance. Are you ready to explore the potential of tokenized RWAs? Join the conversation below and share your insights!