Bitcoin Cash on the Rise: A Potential Market Leader?

In a landscape dominated by uncertainty in the cryptocurrency market, Bitcoin Cash (BCH) has started to shine, demonstrating remarkable technical strength that positions it for potential supremacy over its more renowned counterpart, Bitcoin (BTC). Looking forward, many analysts are predicting that BCH may very well outpace Bitcoin in value in the upcoming weeks. But what’s driving this bullish sentiment amidst macroeconomic headwinds? Let’s dive in.

Understanding the Current Landscape

For most cryptocurrencies, recent weeks have been anything but smooth sailing. Factors such as trade uncertainties in the U.S., a cooling labor market, and escalating civil unrest have contributed to a downward trend across the altcoin market. However, Bitcoin Cash is defying these trends, inching up by a notable 7% over the past month. This resilience against the backdrop of a struggling market positions BCH as a compelling investment opportunity for June.

On-Chain Activity Suggests Growing Adoption

A closer examination of Bitcoin Cash’s ecosystem reveals intriguing trends. On-chain activity is ramping up, with the 30-day transaction rate showing a drastic reversal from its previous dip, now hitting 1.4 transactions per second (tx/s). This uptick in activity can be interpreted as a strong indicator of increased user engagement and liquidity, essential drivers for sustained price growth.

As on-chain metrics improve, derivatives traders are seizing the moment. According to data from Coinglass, the long/short ratio over the past 24 hours has reached 1.24, revealing that around 55% of traders are anticipating an upward trajectory for BCH’s price. This indicates a growing confidence among traders, despite the recent challenges, particularly after the largest liquidation event for BCH since April, which erased $2 million in long positions.

The Chart Tells a Story: Patterns and Predictions

Overall, the recent rally signifies a continuation of BCH’s breakout from a falling wedge pattern that was formed previously. The month-long trend has occurred since March, where initial upward momentum was stifled but gained momentum after the market hit a low in mid-April. Now, BCH could be poised to make further significant gains.

With potential targets set at around $547.50, driven by previous price action patterns and the 0.236 Fibonacci extension, BCH could be gearing up for a remarkable 30% rally. The recent uptick in the Relative Strength Index (RSI) from 50 to 60 supports this argument, highlighting robust buy pressure that successfully overwhelms seller pushback. But here’s the catch: vigilance is necessary. The Moving Average Convergence Divergence (MACD) poses a potential threat, teetering close to a death cross.

Keep an Eye on Bitcoin: The Larger Picture

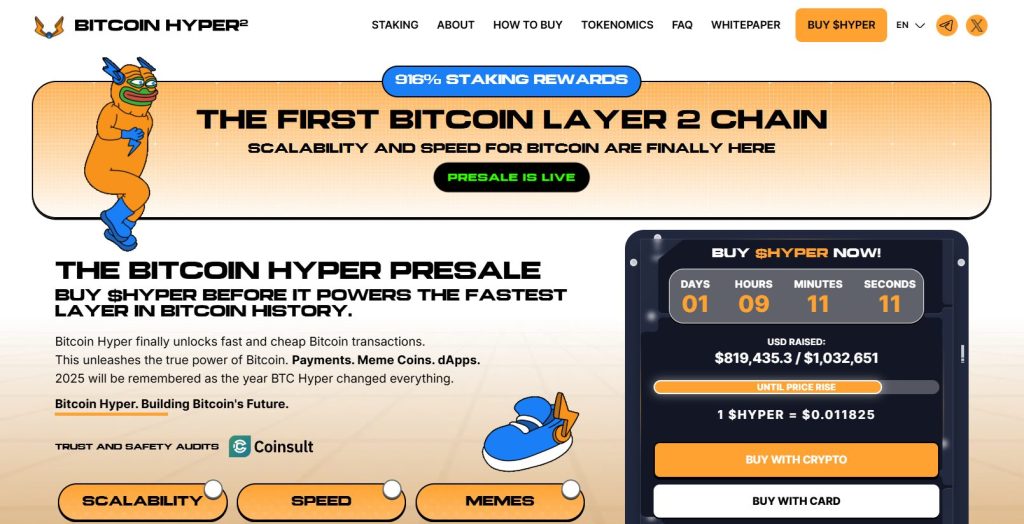

Interestingly, as BCH gains traction, Bitcoin has begun to address its own scalability issues—long considered a competitive disadvantage against networks like Ethereum and Solana. A new entrant, Bitcoin Hyper ($HYPER), aims to revolutionize transactions within the Bitcoin ecosystem by providing Solana-level speeds and smart contracts, potentially redirecting some interest back toward BTC.

Leveraging the Solana Virtual Machine (SVM) and secured by a decentralized Canonical Bridge, Bitcoin Hyper promises fast, affordable, and adaptable decentralized applications (dApps). Already, this innovation has caught the eye of investors—with over $800,000 raised in just its first week of presale, spurred by an eye-popping staking reward of 916% Annual Percentage Yield (APY).

Conclusion: BCH’s Moment to Shine?

The stage is set for Bitcoin Cash to make significant strides in the cryptocurrency market. With a strong emphasis on rising transaction rates, growing trader confidence, and innovative breakthroughs within the Bitcoin ecosystem, BCH may well emerge as a market leader. But as always, prospective investors should approach with a blend of optimism and caution. What are your thoughts? Will Bitcoin Cash maintain its momentum, or will the introduction of Bitcoin Hyper shift the narrative back toward Bitcoin? Let’s talk about it in the comments below!