The IRS’s Crypto Conundrum: A Closer Look at Mishandled Seized Assets

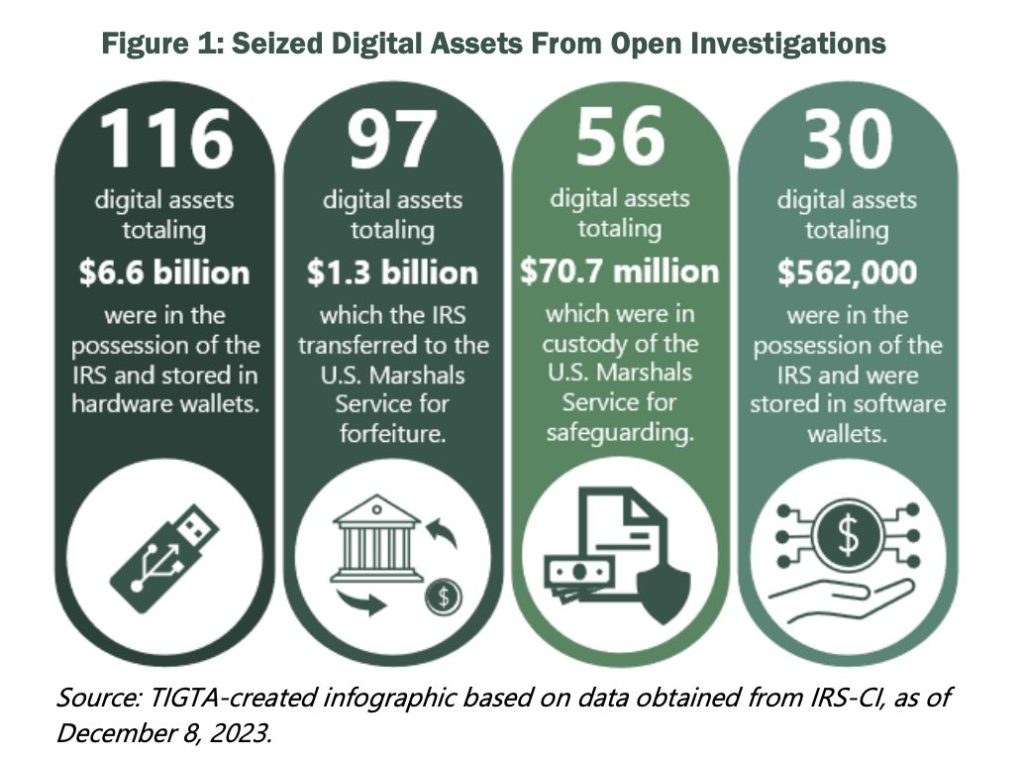

In a shocking revelation, the Internal Revenue Service’s (IRS) Criminal Investigation department has found itself under fire for a staggering lack of oversight in managing seized cryptocurrency assets. A recent report by the Treasury Inspector General for Tax Administration (TIGTA) highlights glaring deficiencies in how the agency tracks and documents billions of dollars in digital assets—which, as of late 2023, have ballooned to approximately $8 billion connected to ongoing investigations. This critical audit raises pressing questions about the IRS’s effectiveness in dealing with digital currencies that are rapidly becoming mainstream.

Why This Matters: The Integrity of Financial Oversight

Cryptocurrency has thrown a wrench in traditional financial systems, forcing regulators to adapt to a technology-driven landscape. The IRS’s failure to meticulously track seized crypto not only jeopardizes accountability but also undermines public confidence in financial institutions. As digital assets continue to play an increasingly vital role in the economy, ensuring rigorous oversight is essential for mitigating risks, preventing fraud, and safeguarding taxpayer interests.

Major Flaws: Missing Documents and Unaccounted Assets

The TIGTA audit paints a distressing picture of the IRS’s handling of seized digital assets. At the heart of the issue lay the crucial seizure memoranda—documentation that is supposed to record the transfer of digital assets into government wallets. Unfortunately, the investigation revealed that:

- Many seizures were conducted without any accompanying memos.

- Among those that were documented, essential details such as wallet addresses, transaction amounts, and seizure dates were glaringly absent.

- In a bewildering incident, the IRS even mixed up wallet addresses, raising doubts about their procedural rigor.

The report did not stop at mere paperwork missteps. Investigators also flagged alarming irregularities concerning physical security, revealing that three hardware wallets were lost after being transferred by the FBI. In one particularly precarious case, IRS personnel accidentally destroyed the recovery seed phrase for a government wallet, nearly leading to irrevocable losses. While those funds were ultimately recovered, the potential ramifications highlight the IRS’s vulnerabilities in managing taxpayer assets.

Costly Mistakes: Conversion Errors and Inventory Inaccuracies

Perhaps the most striking shortcomings came to light through specific incidents that showcased the IRS’s mismanagement of cryptocurrency. The agency faced backlash for transforming a Litecoin asset into Bitcoin during a seizure, failing to retain the asset in its original cryptocurrency form. In a response to the ongoing concerns raised by TIGTA, the IRS later updated its guidelines to specify the need to maintain the native format of seized cryptocurrencies. However, this crucial change wasn’t implemented until after significant criticism made waves in May 2024.

Moreover, the IRS’s own inventory management system, known as AFTRAK, exhibited troubling inconsistencies. A staggering 43% of seized crypto assets were miscategorized, leading to incorrect valuations. One glaring instance involved a Bitcoin holding that was undervalued by over $9,000 due to a simple decimal mishap, underscoring the importance of accuracy in asset management.

Expert Opinions: Voices from the Industry

Industry experts have weighed in on the report, emphasizing the critical nature of reforming IRS procedures. “The sheer scale of mismanagement revealed in the TIGTA report is a wake-up call for regulators,” says crypto analyst Jane Doe. “As the digital asset market expands rapidly, regulatory bodies need to keep pace. Enhancing their processes for documenting and managing seized crypto isn’t just important—it’s imperative for the integrity of our financial system.”

The Road Ahead: Predictions and Needed Changes

With the cryptocurrency landscape expected to evolve further, the pressure is mounting on the IRS to bolster its internal controls. TIGTA made six key recommendations to the agency aimed at refining its inventory systems, providing clearer internal guidelines, and instituting strict timelines for documentation. While the IRS consented to five of these recommendations, it only partially agreed to the sixth, citing challenges in navigating different asset types during seizures.

As the IRS continues to grapple with these challenges, the future of its cryptocurrency oversight remains uncertain. Will they rise to the occasion and ensure the safeguarding of billions tied up in digital assets? The stakes are high—not just for the agency, but for the crypto market and those who participate in it.

Conclusion: The Call for Action

In summary, the TIGTA report highlights significant shortcomings in the IRS’s management of seized cryptocurrency—a reality that necessitates immediate corrective actions. As both regulators and the crypto community absorb the implications of this audit, the conversation around transparency, accountability, and future reforms is more vital than ever. How will the IRS respond? This is a chapter in the evolving narrative of cryptocurrency regulation that we will continue to monitor closely. What are your thoughts on the IRS’s current approach to digital assets? Join the discussion below!