In a bold move that could redefine the future of monetary policy in Europe, France’s lawmakers have rallied to take a stand against the European Central Bank’s (ECB) suggested digital euro. Instead, they’re voicing their support for Bitcoin and euro-denominated stablecoins as viable alternatives. This pivotal resolution was introduced on October 22, 2025, by Éric Ciotti and the members of the Union of the Right for the Republic (UDR). It calls for the French government to reject the European Commission’s draft regulation aimed at establishing a digital euro, and advocate for a robust crypto framework in the nation.

So, why does this matter? This resolution isn’t just about rejecting the ECB’s digital euro proposal; it taps into a broader sentiment that links monetary technology with individual freedom and national sovereignty. The documented rationale identifies central bank digital currencies (CBDCs) as potential threats to privacy and economic autonomy.

Ciotti described this proposal as a critical move to safeguard “fundamental individual rights.” French lawmakers have expressed deep concerns that central oversight could lead authorities to track and freeze citizens’ funds—a scenario they compared to China’s digital yuan, which they argue endangers basic freedoms across Europe. The resolution expects the ECB’s exploration of the digital euro to culminate around 2029, with predictions from ECB Executive Board member Piero Cipollone indicating potential circulation by then.

🏛️ A digital euro could launch in 2029, says ECB board member Piero Cipollone, citing growing momentum and progress in member-state talks.#digitaleuro #ECB https://t.co/yn43I38DdH— Cryptonews.com (@cryptonews) September 24, 2025

Moreover, the lawmakers fear that the adoption of a digital euro could jeopardize European banks. By allowing users to direct deposits to the ECB, they warn it could trigger significant bank runs, concentrating financial power dangerously. This proposal points out that such centralization would be harmful to economic freedom and insists that it is inappropriate for the ECB to function as a commercial bank.

In response, the French resolution outlines an ambitious pro-crypto agenda focusing on three pivotal areas: establishing a national Bitcoin reserve, endorsing euro-denominated stablecoins, and nurturing local crypto industry development. Their plan includes managing a Bitcoin reserve amounting to 2% of the entire Bitcoin supply—around 420,000 BTC—over a period of seven to eight years. This “national digital gold” reserve is aimed at diversifying France’s foreign exchange assets and reinforcing financial sovereignty.

Funding for this initiative will be derived from public mining of surplus energy, retention of Bitcoin seized in legal cases, and allocating portions of savings from the Livret A and LDDS schemes toward ongoing Bitcoin purchases. Additionally, the proposal entertains the idea of allowing tax payments to be made in Bitcoin, contingent on receiving constitutional approval.

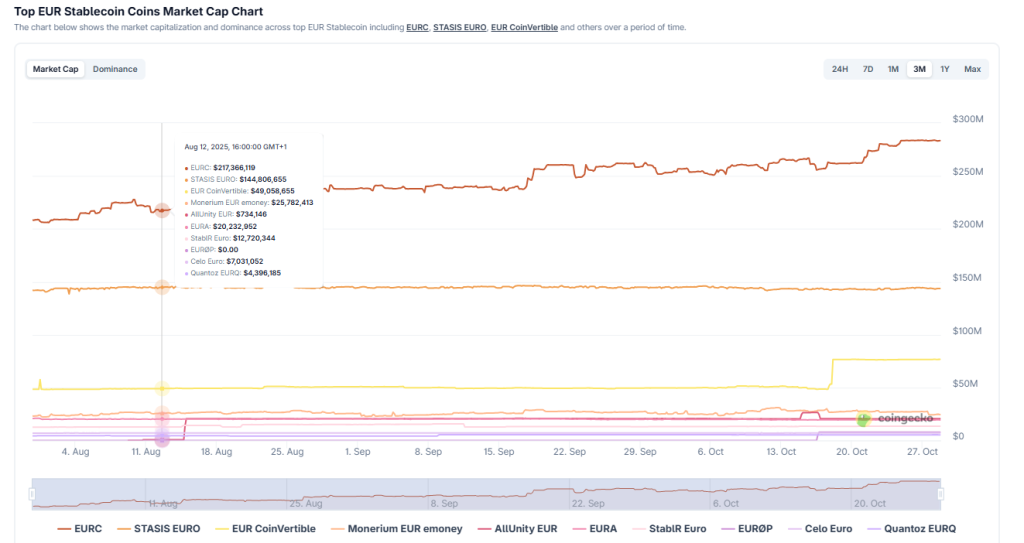

France’s lawmakers are also positioning euro-denominated stablecoins as a counterweight to the overwhelmingly dominant U.S. dollar-backed tokens like Tether (USDT) and Circle’s USD Coin (USDC), which dominate the stablecoin market. They point out striking statistics: about 91% of global stablecoin capitalization sits in U.S. dollars, a clear indication of Europe’s overreliance on U.S. firms. The proposal urges the European Commission to rethink the stringent regulations surrounding euro stablecoins to enable local banks and firms to compete on a global level.

France’s Central Bank Governor, François Villeroy de Galhau, has cautioned that Europe’s reluctance could deepen its dependence on non-European digital currencies. He has emphasized the importance of developing euro-denominated stablecoins as an alternative to reliance on dollar-centric products.

🏛️ France has urged the European Union to give ESMA direct authority over major cryptocurrency firms operating across the bloc.#ESMA #EU https://t.co/V98VhQzUDi— Cryptonews.com (@cryptonews) October 9, 2025

This resolution coincides with a transformative period for France’s cryptocurrency space. The Autorité des Marchés Financiers (AMF) has recently green-lighted BPCE’s subsidiary, Hexarq, to offer crypto custody and trading services, signaling stronger engagement from major banking institutions. Furthermore, the approval of the Lightning Stock Exchange (Lise) represents France’s first fully tokenized equity platform, under the EU’s Distributed Ledger Technology (DLT) Pilot Regime, demonstrating an increasing national interest in blockchain infrastructure.

🚨 France just approved Lise Exchange, a tokenized stock exchange that aims to redefine how IPOs work for SMEs.#France #IPO #LiseExchange https://t.co/56RhlDLw3A— Cryptonews.com (@cryptonews) October 16, 2025

On the regulatory front, French authorities have ramped up their scrutiny of crypto exchanges. The ACPR (Autorité de Contrôle Prudentiel et de Résolution) has been inspecting firms like Binance and Coinhouse for compliance with anti-money laundering regulations, ensuring they align with the full implementation of the MiCA framework expected across the EU by 2026.

As crypto activities continue to surge in France, data indicates a booming market, with the country processing a whopping $180 billion in cryptocurrency transactions from July 2024 to June 2025. This positions France among the most vibrant crypto markets in Europe, trailing only Germany and the United Kingdom. With these developments, it’s clear that France is not just making headlines but could also be setting the stage for a paradigm shift in European monetary policy and digital finance.

As we look ahead, the strategic choices made by France will likely have rippling effects across the broader European landscape. Are we witnessing the dawn of a new era where nations prioritize individual freedom and innovation in the digital economy? The world will be watching closely.