Bitcoin’s journey over the past week has been nothing short of exhilarating, with the price recently soaring to an impressive peak of $123,200. However, after reaching this new summit, the cryptocurrency has entered a period of sideways trading, creating an intriguing moment in the market. While some may view this price stabilization as a signal of caution—or even downturn—others see a compelling opportunity, particularly influenced by the significant movements of smart money and institutional investors.

After briefly flirting with the $120,000 resistance zone, Bitcoin has managed to reclaim a position above the pivotal $119,000 threshold thanks to these savvy buyers. This current behavior in the Bitcoin market has analysts buzzing, as many are predicting an impending surge that could set new all-time highs. In fact, several experts believe that this dip might be the final chance for investors to grab Bitcoin before it potentially escalates toward an ambitious target of $150,000. What could this mean for the future of cryptocurrency as a whole?

🚀 Experts tell Cryptonews that Bitcoin still has plenty of room to run — but not everyone’s convinced#BTC #ATH https://t.co/IcWwb580o3— Cryptonews.com (@cryptonews) July 11, 2025

Interestingly, analytics from CryptoQuant reveal a notable shift in the dynamics of Bitcoin accumulation. While numerous retail investors have begun selling off their holdings, larger players—often referred to as “whales”—are ramping up their acquisitions. This divergence has raised eyebrows and stirred a healthy debate among market watchers. Many are now asking critical questions: Is this retail exodus a sign of concern, or is it a unique opportunity for institutions to dominate the market?

The Source of the Bitcoin Rally is not Retail “While retail investors are selling, institutional and large investors continue to accumulate.” – By @burak_kesmeci pic.twitter.com/SeFTl26p0Z— CryptoQuant.com (@cryptoquant_com) July 24, 2025

According to Fadi Aboualfa, head of research at Copper, Bitcoin’s recent rally back to historical highs is largely powered by institutional capital. He asserts that the speculation-driven enthusiasm from retail investors seems to be diminishing, potentially leaving the stage clear for a robust institutional-led push. Citing the growing interest from investment funds and ETFs, Aboualfa envisions a significant surge that could target the $140,000 to $200,000 range in the near future. This perspective opens up a spectrum of possibilities for existing and prospective investors.

Conversely, not all projections are rosy. On-chain analytics firm Glassnode has raised alarms about the potential “froth” developing in the Bitcoin market and beyond. This phenomenon refers to the heightened open interest levels seen in derivatives markets, which could pose risks to Bitcoin’s upward momentum. As the landscape fluctuates, investors must remain vigilant and well-informed about market conditions.

As of now, Bitcoin is trading around $119,100, having cooled off from its all-time high. This consolidation below the critical $120,000 resistance forms a tightening pattern, often indicative of a potential breakout or breakdown in the price action. A bearish divergence noted on the Relative Strength Index (RSI) is also worth watching, as it signifies a weakening bullish momentum, which could open the door for a brief retreat toward the $116,000 level is the current resistance cannot hold.

Should Bitcoin dip towards $116,000, it may find support within this gap, creating a point of interest for buyers. If that level also fails, we could see further declines to the $112,000–$108,000 area, although such a scenario seems less likely without a significant shift in market sentiment. On the brighter side, a decisive breakout above $120,000 could invalidate bearish concerns, reigniting the pursuit of recent highs and pushing Bitcoin toward the $130,000–$150,000 range.

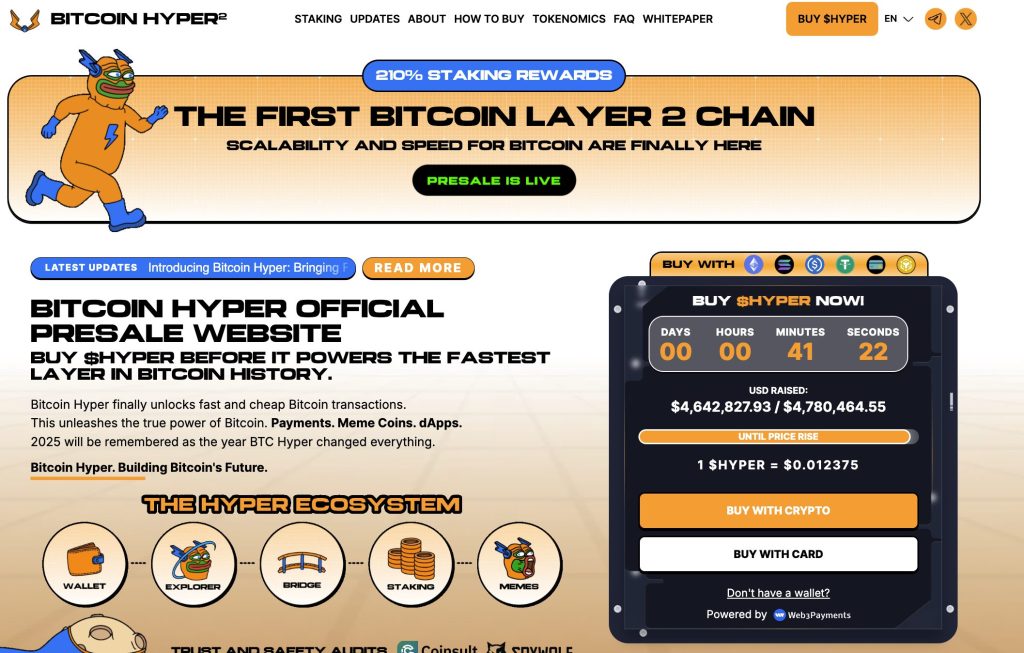

As Bitcoin marks time, savvy investors are also casting their nets toward smaller altcoins that embody the promise of even greater returns. One standout project gaining attention is Bitcoin Hyper ($HYPER). Already having raised over $4.5 million in early funding, it showcases strong interest from early adopters.

So, what makes Bitcoin Hyper so intriguing? Positioned as a “Layer 2” enhancement to Bitcoin, it aims to make transactions faster, cheaper, and capable of supporting smart contracts. This could give Bitcoin the agile functionality akin to modern blockchain platforms while retaining its foundational strengths. Anyone looking to be part of the next wave of Bitcoin innovation should pay close attention to $HYPER. To seize this opportunity, potential investors can visit the official Bitcoin Hyper website to participate in the presale. Options for payment include both cryptocurrency and traditional card transactions.

With the Bitcoin narrative evolving day by day and the crypto landscape shifting around it, there’s never been a better time to stay apprised of developments. Whether you’re an experienced trader or a curious newcomer, the world of cryptocurrency offers endless possibilities, prompting the question: how will you position yourself for the future?

For further insights and updates on cryptocurrency trends, be sure to check out CoinDesk and The Block.