Fartcoin: From Meme Magic to Market Misery

The meme coin Fartcoin has experienced a staggering 360% price surge since April, but the thrill of that meteoric rise may soon be grounded as market dynamics shift. A significant breakdown of a two-month-long bear pattern has triggered a crucial sell signal, suggesting that the currently buoyant days of Fartcoin might be numbered. As the euphoria wanes, the cryptocurrency is finding itself increasingly sidelined in the quest for the “best crypto to buy” ranking.

The Current Market Landscape

As economic ramifications from former President Trump’s trade decisions begin to ripple through global markets, investors are caught in a web of cautious optimism. Amidst rising fears, investment markets are fraught with FUD (Fear, Uncertainty, Doubt). The situation appears grim for Fartcoin as speculation escapes this once-enigmatic token, pushing traders toward more promising avenues.

Shocking Liquidations: Fartcoin’s Price Plunge

Recent developments have seen a dramatic sell-off, with the Fartcoin derivatives market buckling under pressure. This late-week downturn marked the largest liquidation event yet, wiping out $7.74 million in long positions during Friday trading, according to data from CoinGlass.

A Market in Flux: The Long/Short Ratio

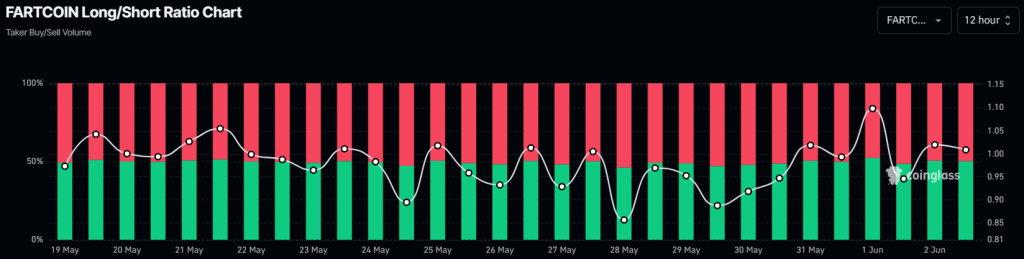

In the face of these aggressions, Fartcoin’s open interest has shown signs of life, experiencing an 8% bounce since the weekend. However, bullish sentiment appears tentative, with the long/short ratio stabilizing near 1.0088, illustrating a market that is nearly split down the middle between bulls and bears. Is this a sign of a potential recovery, or merely the calm before another storm?

Price Analysis: What Lies Ahead for Fartcoin?

The anticipated full breakdown of Fartcoin’s rising wedge pattern still looms large without a complete resolution. This situation could leave the token vulnerable to an additional 40% drop, potentially dragging it down to $0.66.

Currently, support appears fortuitously stationed around the $1 mark, aligning with the 0.5 Fibonacci retracement level—a common reversal zone in corrections. Though momentum indicators such as the RSI show signs of a downtrend with an index reading of 44, the MACD offers a glimmer of hope, hinting at slight upward movement, albeit still below the signal line which suggests seller dominance remains potent.

If Fartcoin hopes to recover, retaking the 20-day simple moving average (SMA), which recently provided strong support during its ascent, is imperative. The immediate resistance to monitor is at $1.15, with recent candles failing to pierce through, indicating potential rejection ahead.

Time for New Horizons: Eyes on SUBBD

As Fartcoin’s hype fades, the spotlight shifts to a newcomer: SUBBD ($SUBBD), an AI-enhanced content platform poised to disrupt an $85 billion industry. By giving creators more control and fans greater access, SUBBD is reshaping how digital content is monetized.

Never miss a sale again.As a top creator, your audience is global. It’s just not possible to cater to everyone – you can’t be online 24/7 🫠That’s where your personal AI Assistant comes in, to handle requests and secure payments. Sleep peacefully knowing you’re making money… pic.twitter.com/ju9VjLBmea— SUBBD (@SUBBDofficial) March 26, 2025

Unlike traditional platforms that burden creators with high fees, SUBBD eliminates inefficiencies by directly connecting them to their audience. The platform has already garnered substantial support, raising nearly $600,000 in its ongoing presale, attracting momentum with its innovative approach toward token-gated content and enhanced fan engagement.

Conclusion: What’s Next for Investors?

The trajectory of Fartcoin serves as a stark reminder of the volatility within the cryptocurrency landscape, particularly for meme-based tokens. As traders reassess their positions amidst shifting market sentiments, all eyes will be on whether Fartcoin can recover its previous momentum or if a deeper decline is in store. Meanwhile, with platforms like SUBBD emerging in the space, the evolution of crypto and content monetization continues to take shape. What implications will these changes have for the future of digital assets? The conversation is just getting started.