The Golden Cross: A Bullish Signal for Bitcoin Market Enthusiasts

Bitcoin is creating quite a buzz in the crypto scene as it appears to be forming a potent bullish indicator known as a golden cross. With current trading hovering around $105,597 and daily volumes surpassing an impressive $35 billion, traders are fixated on the tantalizing prospect of reaching the $150,000 milestone. But what exactly does this golden cross mean, and how can it shape Bitcoin’s trajectory in the coming months?

A golden cross occurs when the 50-day moving average crosses above the 200-day moving average, a technical phenomenon that often signals the beginning of a robust long-term uptrend in an asset’s price. However, it’s essential to examine the patterns that unfold around these markers. Chain Mind, a prominent voice in the crypto analyst community, has pointed out that such pullbacks after a golden cross are not particularly rare.

Historical Insights: Lessons from Late 2024

3/➫ Back in Q4 2024, $BTC dropped 10% right after the golden cross.❍ Then it reversed hard and rallied over 60% in two months.❍ That pattern is repeating now – $BTC has already dropped 8% post-cross.❍ The similarities are striking— 𝗖𝗛𝗔𝗜𝗡 𝗠𝗜𝗡𝗗 ⛓🧠 (@0xChainMind) June 5, 2025

Chain Mind asserts that investors should exercise patience; a common expectation following a golden cross is an immediate surge in price, but history often tells a different story. The recent 8% decline in Bitcoin’s price appears to echo the events of late 2024, where after a 10% drop, Bitcoin eventually embarked on a staggering 60% ascent in just two months. Are we witnessing a similar pattern unfold once more?

Bitcoin’s Bullish Fundamentals: The Support Zone

What bolsters the bullish sentiment surrounding Bitcoin is its persistent strength above its 200-day moving average, currently set at approximately $94,700. This threshold acts as a pivotal long-term support level. So long as Bitcoin remains above this mark, the forecast for its price growth stays bright and optimistic.

Bitcoin Price Chart – Source: TradingView

Additionally, analysts have noted an increase in Bitcoin’s market dominance, now at a three-year peak. This trend indicates that investors are reallocating their resources from altcoins and returning to Bitcoin, which they regard as a relatively safer investment amid ongoing market volatility. Consider the following indicators of Bitcoin’s strength:

- Dominance rising while altcoins languish.

- Ethereum (ETH) struggles to maintain levels above $2,500.

- Key altcoins such as Solana (SOL) and Cardano (ADA) have broken through critical support levels.

- Long-term Bitcoin holders are holding firm, resisting the urge to sell.

Institutional Interest: Whales Favor Bitcoin

The current landscape also suggests a distinct preference among larger investors—often referred to as “whales”—for Bitcoin over altcoins. On-chain analytics reveal that a significant majority of Bitcoin’s supply has remained static for months, underscoring that many long-term holders are neither anxious nor inclined to divest their assets. In contrast, altcoins are facing significant downward pressure, with many not only lagging behind Bitcoin but also losing value relative to the U.S. dollar.

Chain Mind has pointed out that until market sentiment improves and crucial metrics (such as ETH/BTC or SOL/BTC ratios) begin moving in a favorable direction, Bitcoin is likely to continue its dominance. To summarize:

- The golden cross is a historically bullish sign, even if short-term fluctuations occur.

- Holding above $94,700 strengthens the bullish outlook.

- Rising dominance and consistent institutional investment signal a potential price surge ahead.

The Future Beckons: What’s Next for Bitcoin?

For both traders and long-term investors, this scenario highlights an essential strategy: “zooming out.” While short-term price fluctuations can be disconcerting, the underlying setup indicates the possibility of a powerful Bitcoin rally that could pave the way toward the much-anticipated $150,000 target by the year’s end.

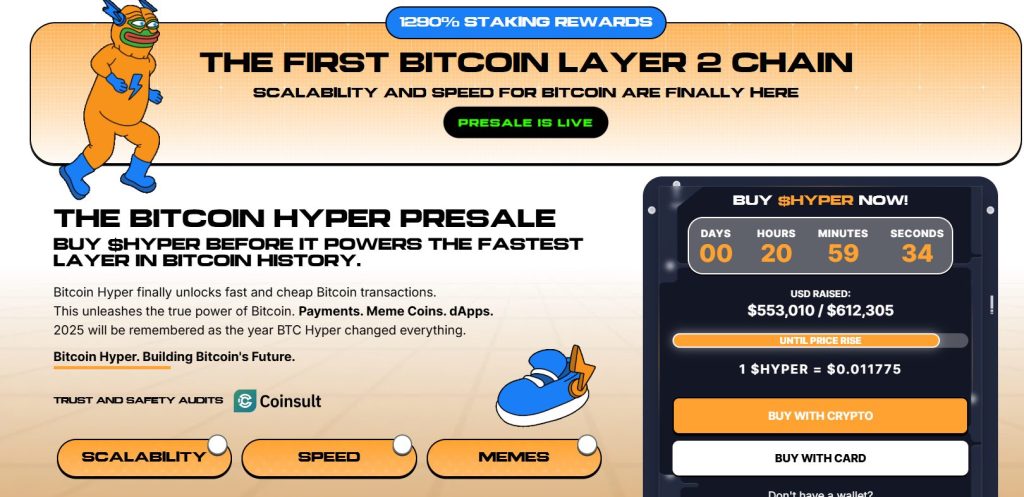

The Bitcoin Hyper Presale: An Exciting Development

In a related development, Bitcoin Hyper ($HYPER) is generating excitement as the first Bitcoin-native Layer 2 solution, aimed at addressing some of Bitcoin’s key limitations, such as transaction speed and associated fees. By leveraging the Solana Virtual Machine (SVM), Bitcoin Hyper promises to deliver rapid and cost-effective smart contracts to the Bitcoin ecosystem.

Bitcoin Hyper – Fueling the Future of Bitcoin Transactions

With over $552,000 raised so far, early investors are banking on the innovative combination of technology and meme culture that Bitcoin Hyper represents. The presale is currently live, and prospective buyers are encouraged to act quickly, as the price is projected to rise with the next funding tier.

Conclusion: The Road Ahead

In conclusion, as Bitcoin approaches a crucial juncture, the combination of historical trends, market dynamics, and emerging projects like Bitcoin Hyper suggests that both new and seasoned investors have reasons to be optimistic. What are your thoughts? Are you ready to ride the next wave in Bitcoin’s journey toward new heights? Let’s discuss in the comments!