In the world of cryptocurrency, the movements of “whales” — large investors with significant capital — can send ripples through the market. Recently, a wave of bullish sentiment has washed over Ethereum as multiple whales collectively snapped up a staggering 394,682 ETH, valued at approximately $1.37 billion, in just three days. This strategic accumulation hints at a serious confidence in Ethereum’s long-term potential, even amidst the ebbs and flows of current market conditions.

Source: Lookonchain

Source: Lookonchain

“Whales keep accumulating $ETH — over the past 3 days, many whales have collectively bought 394,682 $ETH ($1.37B).”

— Lookonchain (@lookonchain) November 6, 2025

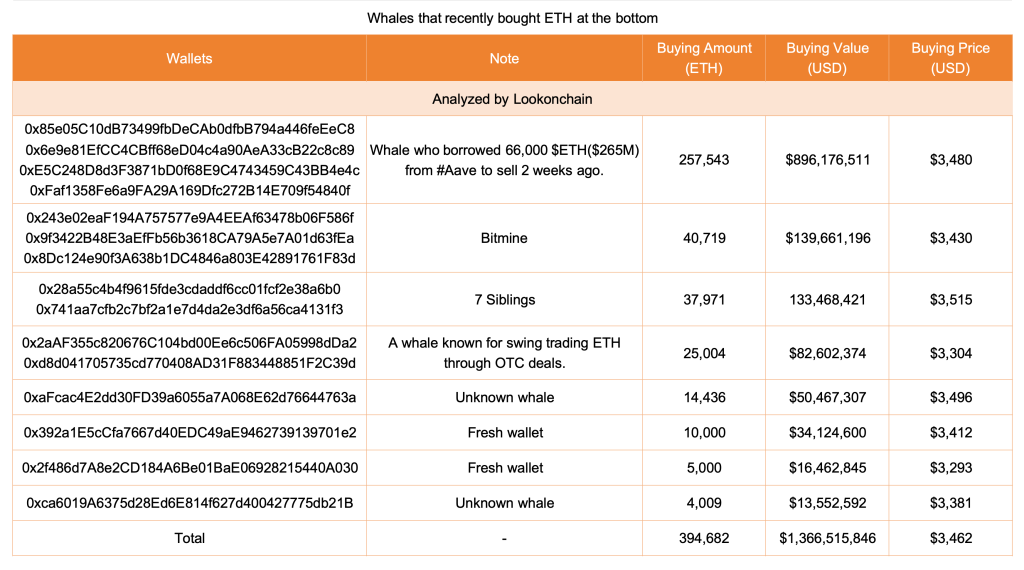

This recent surge in buying activity came to light through on-chain analysis, revealing that the most notable buyer is an entity that had previously borrowed a significant 66,000 ETH from the lending platform Aave. Now, this whale has strategically repurchased a whopping 257,543 ETH at a price point of roughly $3,480, totaling up to $896 million. In addition to this major player, other notable influencers in the market, such as Bitmine, 7 Siblings, OTC traders, and a variety of new wallets, have been ramping up their Ethereum stakes during this market correction.

Why does this matter? Well, historically, substantial accumulation by whales has been a precursor to major market shifts. Analysts are closely monitoring these developments, with many predicting that Ethereum could be on the verge of a significant rebound, potentially reaching new all-time highs. Some projections are optimistic, forecasting prices soaring as high as $10,000.

As of now, Ethereum is trading at $3,421, showing a robust 3.72% increase in the last 24 hours. Technical indicators suggest a bullish uptrend, particularly following a series of short liquidations and renewed institutional interest. According to the Indian cryptocurrency exchange CoinDCX, Ethereum is aiming for a promising target of $4,800, with some analysts believing it could soon make its way to $5,000. They highlighted that improvements in network scalability, paired with increasing institutional adoption, may pave the way for a potential upside of 25-30% by the end of 2025.

Lacie Zhang, a Research Analyst at Bitget Wallet, shared insights with Cryptonews, describing the current crypto market environment as entering a phase of “cautious calm.” Zhang mentioned that if macroeconomic trends remain favorable, Ethereum could edge closer to the $4,200 mark. However, she also warned that several factors could influence its near-term direction.

The upcoming Fusaka upgrade in December is also generating buzz, further boosting institutional interest in Ethereum. On-chain data reflects this trend, revealing that Bitmine has recently added 40,719 ETH, valued at nearly $140 million, to their portfolio. Analyst Ted Pillows emphasized the significance of Bitmine’s ongoing acquisitions, reportedly ranging from $200 million to $300 million each week, suggesting that such large buys may quickly tighten supply in the market. “A few more whales like Bitmine, and the market’s tone could change overnight,” he noted.

Zhang describes the current consolidation phase as “constructive,” stating it flushes out leverage and speculative excess, ultimately providing a solid foundation for long-term growth and institutional re-entry. There’s an air of optimism about what’s to come, and the movements of these influential investors highlight the potential winding road ahead for Ethereum.

As we navigate through these fluctuating market conditions, it’s essential for investors and enthusiasts alike to stay informed. Could this shear accumulation be the calm before a bullish storm? Only time will reveal the full impact of these powerful movements within the Ethereum network. In the meantime, keeping an eye on the giants of the market may just provide the insights we need to understand the future of cryptocurrency.

For ongoing updates, expert insights, and real-time analysis of the crypto market, consider following leading platforms like CoinTelegraph and CoinDesk. Stay up-to-date and be part of the evolving narrative of cryptocurrency!