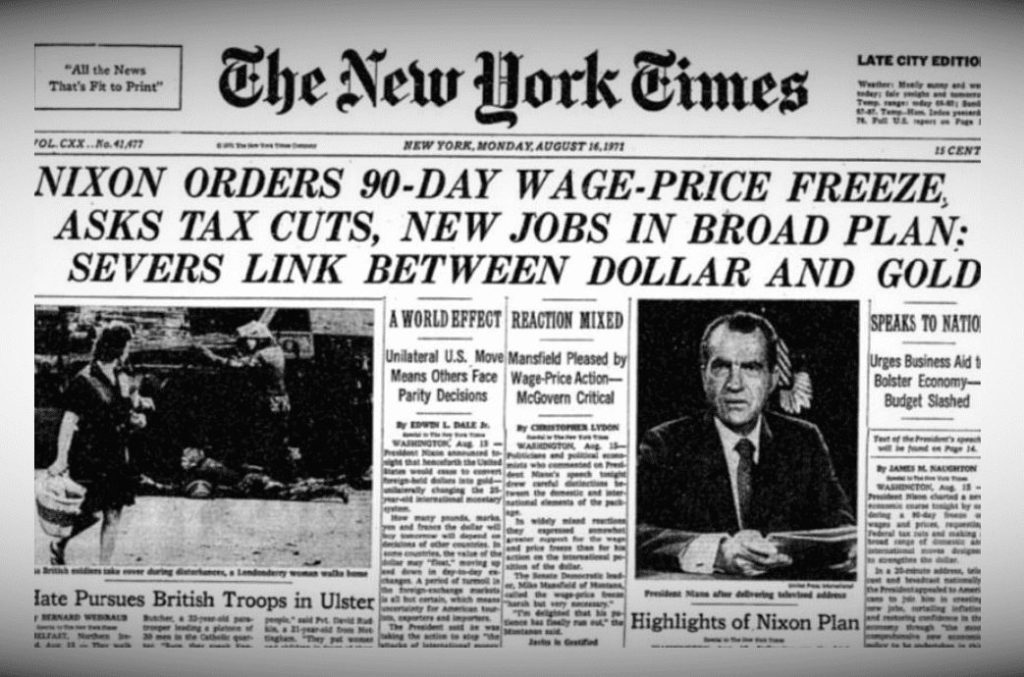

In a recent conversation with Cathie Wood, CEO of ARK Invest, Tom Lee, Chairman of BitMEX, stirred up excitement in the crypto community by suggesting that Ethereum might one day eclipse Bitcoin’s market dominance. He drew an intriguing parallel between the potential rise of Ethereum and the shift in financial assets when U.S. equities overtook gold in the years following the abandonment of the gold standard in 1971. Lee stated, “Ethereum could flip Bitcoin similar to how Wall Street and equities flipped gold post-’71.”

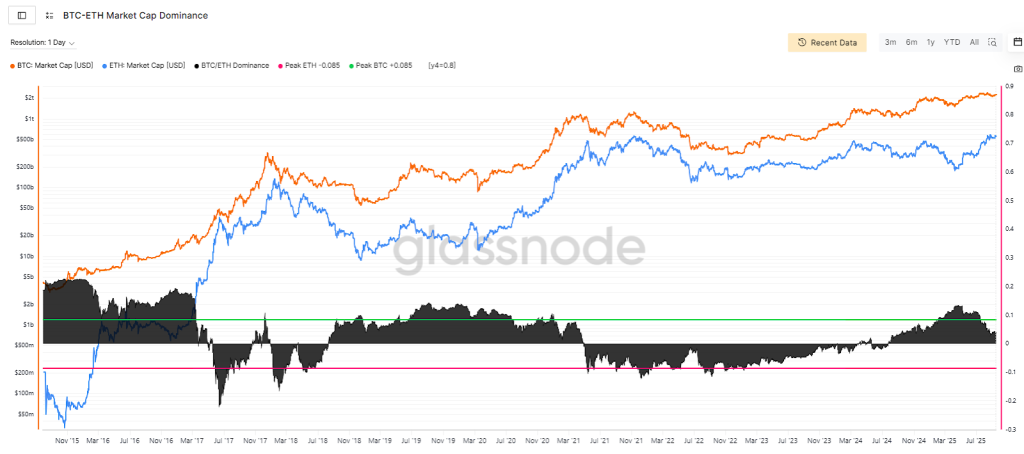

Currently, Bitcoin’s market capitalization towers at approximately $2.17 trillion, dwarfing Ethereum’s at around $476.33 billion, as noted by CoinMarketCap. However, Lee contends that Ethereum’s trajectory mirrors that of the U.S. dollar after 1971. Back then, the dollar transitioned to a “fully synthetic” fiat currency, leading to an economic transformation that saw equities flourish.

To illustrate his perspective, Lee highlighted a significant historical shift: when President Nixon cut the dollar’s tie to gold, junior shocks initially propelled gold prices higher, but equities eventually surged, immensely outpacing gold’s value. “When the U.S. left the gold standard, the immediate beneficiary was gold,” Lee remarked. “But Wall Street created products that made the dollar dominant. Today, equities’ market cap is $40 trillion, while gold’s stands at $2 trillion.” This transformation suggests a similar trajectory could be in store for cryptocurrencies.

Lee emphasizes that, while Bitcoin has established its reputation as the “digital gold”—a reliable, finite asset—its intrinsic value lies in storing wealth rather than facilitating economic growth. On the other hand, Ethereum thrives as a dynamic ecosystem, fueling smart contracts, decentralized finance (DeFi), and a multitude of innovative applications, positioning it to be the “financial substrate of the digital economy,” as aptly described by Lee.

Recent signs also suggest shifting dynamics in the crypto landscape. Ethereum’s price surged by 6.6% in just 24 hours, now sitting at approximately $3,731.69, meanwhile Bitcoin experienced a 5.1% increase, resting at $104,737. This vitality in Ethereum’s market performance has reignited discussions about the long-awaited phenomenon known as the “flippening”—a term describing Ethereum surpassing Bitcoin in market capitalization.

In a bullish forecast, Joseph Lubin, Ethereum’s co-founder and CEO of ConsenSys, remarked in August that Ethereum could potentially increase by “100 times,” leveraging Wall Street’s growing adoption of decentralized technologies. This consensus highlights the compelling narrative around Ethereum’s future, especially as institutional players begin to embrace staking, validator nodes, and technological advancements such as Layer-2 solutions.

🚀 Ethereum co-founder @ethereumjoseph predicts a 100x $ETH rally as Wall Street adopts DeFi with the potential to flip Bitcoin’s monetary base through institutional staking.#Ethereum #Bitcoin https://t.co/l6YqzBQGbL

Adding weight to this narrative, financial author Robert Kiyosaki recently touted Ethereum as both a robust store of value and an industrial asset, characterizing it as “hot, hot, hot” for wealth preservation in the upcoming cycle. In a different appearance on CNBC, Lee echoed this enthusiasm, describing Ethereum’s smart contracts as “the next layer of the internet.”

🚀 Tom Lee predicts Ethereum rally to $5,500 soon, $12,000 by year-end as BitMine accumulates $7.65B treasury. #Ethereum #Rally https://t.co/HV8oQB807D

Predicting a near-term rally, Lee estimates Ethereum could soar to $5,500 shortly—with a bullish target of up to $12,000 by the end of the year. While Bitcoin maintains its supremacy in terms of market capitalization and name recognition, Ethereum’s ever-expanding utility and enhanced network activity are catalyzing a renewed belief in the viability of the flippening within the next market cycle.

For Ethereum to truly reach or exceed Bitcoin’s market value, it faces a significant hurdle. The cryptocurrency would need to appreciate approximately 4.6 times its current price to match Bitcoin’s towering market cap. As of October 17, this estimate places Ethereum’s price at around $17,379 per ETH, marking an impressive potential surge.

With around 120.7 million ETH circulating in the market compared to Bitcoin’s 19.9 million BTC, Ethereum’s larger supply explains its comparatively lower price. Analysts often find market capitalization a more accurate measure of asset value than price alone, considering that Bitcoin’s limited supply supports its higher per-unit valuation. In contrast, Ethereum’s strength lies in its rich ecosystem that underpins various applications in finance, DeFi, and tokenization.

Historically, Ethereum has demonstrated impressive performance. For instance, data indicates that Ethereum’s average annualized returns have outpaced Bitcoin’s across certain five-year periods—60.4% for Ethereum compared to Bitcoin’s 59.1%. However, for Ethereum to fully close the market capitalization gap, it would need to exhibit sustained outperformance. With a compounded annual growth rate of 20%, it could take over eight years, 30% would shave this down to about six years, while 50% per annum growth could potentially achieve parity in less than four years—assuming Bitcoin maintains its current market position, an unlikely but conceivable scenario.

As we approach nearly a decade since Ethereum’s launch, the cryptocurrency commands about 21% of Bitcoin’s market cap. Its relentless expansion, coupled with institutional adoption, makes it a formidable contender against Bitcoin’s reign. However, predictions about the long-anticipated “flippening” remain speculative, highlighting the complexities and uncertainties of the ever-evolving cryptocurrency landscape. How the narrative unfolds will hinge on technological advancements, market dynamics, and the broader acceptance of decentralized finance. One thing is certain: the race between Bitcoin and Ethereum promises to keep the crypto community enthralled for years to come.