Ethereum’s Resurgent Rally: A Closer Look

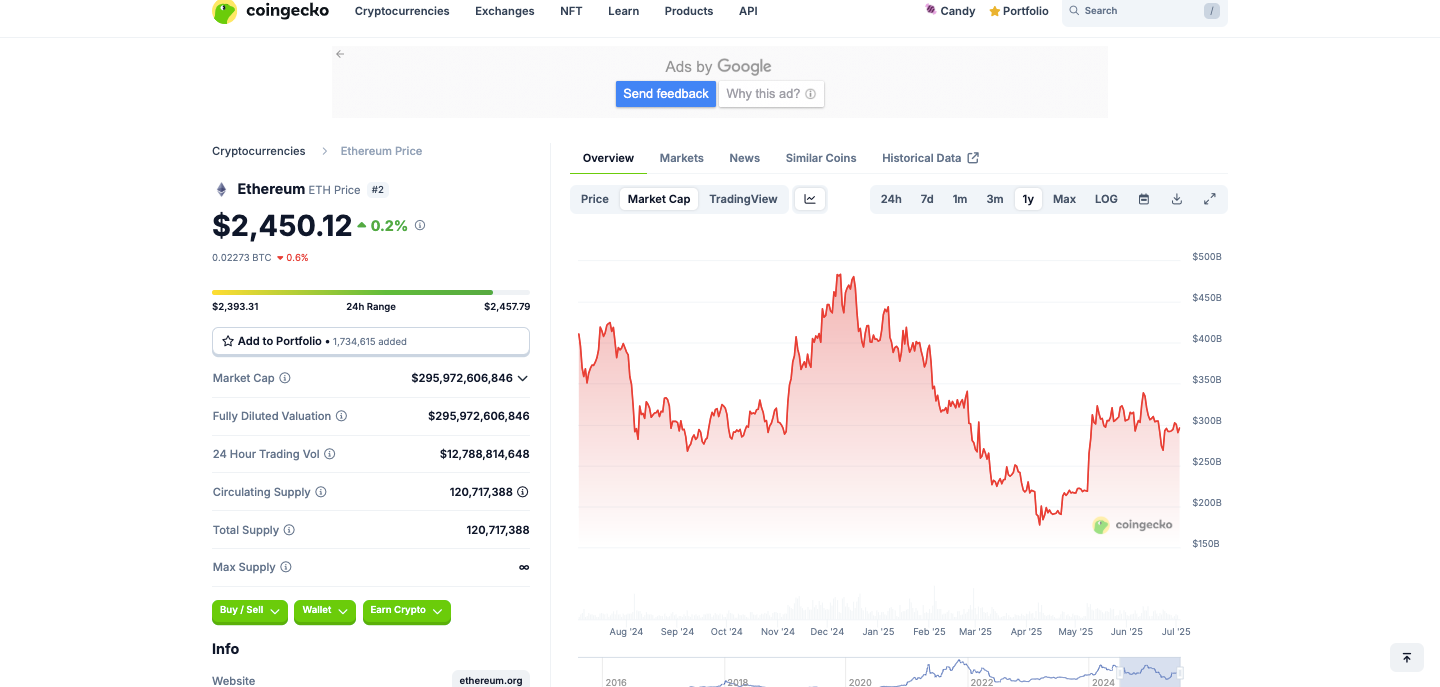

Ethereum ($ETH) has strikingly rebounded by $200, bouncing off the critical support level of $2,400, igniting renewed interest among traders and investors alike. This rebound comes on the heels of a brief bearish phase characterized by a rounded top formation last week. Market sentiment is now squarely focused on whether Ethereum can successfully breach the $2,600 resistance level—a move that could open the floodgates for a significant price surge.

🌟 Why This Matters: Implications for Traders and Investors

This sudden price movement is more than just a technicality; it signifies Ethereum’s ongoing resilience and its pivotal role in the cryptocurrency ecosystem. With institutional inflows steady and Layer-2 solutions gaining traction, Ethereum remains a formidable player. The ability to regain the $2,600 threshold could not only enhance investors’ confidence but also solidify its position as a leading network for decentralized finance (DeFi) applications.

💬 Expert Opinions: Insights from Industry Analysts

Market experts are weighing in on Ethereum’s performance, with many acknowledging its potential for growth. “If Ethereum can hold above $2,400 and effectively challenge the $2,600 level, we could see a wave of bullish momentum,” said a notable analyst specializing in cryptocurrency trends. Others caution that the recent recovery may be fleeting without a decisive break above resistance levels, indicating the need for vigilance among traders.

🚀 Future Outlook: What Lies Ahead for Ethereum?

Looking ahead, Ethereum’s trajectory will likely be influenced by several factors:

- Layer-2 Solutions: Innovations like Arbitrum and Optimism continue to reduce transaction fees, enhancing user experience and potentially driving more activity on the Ethereum network.

- Institutional Adoption: With companies like Bit Digital and SharpLink Gaming increasingly adopting Ethereum for their treasury holdings, a robust institutional backing may drive demand.

- Market Sentiment: Trading patterns and broader market dynamics, including Bitcoin’s performance, will also play significant roles.

Ethereum’s Unmatched Network Activity and Layer-2 Innovations

Since its inception in 2014, Ethereum has disrupted the blockchain landscape, establishing itself as the most significant platform for developers to build smart contracts and decentralized applications (dApps). Its adaptable framework has seen an explosion of innovation, from decentralized finance protocols to non-fungible token (NFT) marketplaces and efficient Layer-2 solutions—elements that collectively bolster Ethereum’s ongoing appeal.

The network currently boasts a total value locked (TVL) of $62.6 billion, commanding 53% of the global DeFi TVL. This figure eclipses that of rivals such as Tron, Solana, and Avalanche, further cementing Ethereum’s status as the go-to platform for DeFi activity.

Analyzing Technical Patterns: The Bearish Rounded Top

While the recent bounce has instilled some optimism, technical analysis provides a more cautionary perspective. Ethereum experienced a bearish rounded top formation on its 30-minute chart, a pattern often indicative of a market reversal. This formation began to materialize on June 29, coinciding with a loss of upward momentum just below the $2,530 mark. Traders often interpret this as a signal to take precautions, particularly when buyer interest begins to wane.

The completion of this pattern led to a decline below the neckline near $2,470, marking a significant shift in control from buyers to sellers. As a result, $ETH tumbled to approximately $2,390, reflecting a retracement of over 5% from its local high.

🔍 Conclusion: Proceeding with Caution

As Ethereum navigates these dynamic market conditions, traders should proceed with caution. While the recent bounce from the $2,400 support level indicates potential resilience, a convincing reclaim of the $2,470 to $2,600 zone is necessary for any sustained bullish sentiment. Keeping an eye on upcoming developments—including Layer-2 adoption and institutional interest—will be crucial for anticipating Ethereum’s next moves. What are your thoughts on Ethereum’s future? Join the conversation in the comments below!