Ethereum’s Price On The Brink: A Critical Moment for Traders

Ethereum (ETH/USD) finds itself at a pivotal junction, trading around $1,829 as it wrestles with a formidable technical challenge— the $1,871 resistance zone. This critical level has halted price surges on three separate occasions, culminating in a classic “triple top” pattern that now serves as a psychological barrier to eager buyers. Yet, even as Ethereum grapples with this resistance, it is bolstered by a rising trendline and the 50-period exponential moving average (EMA), which currently hovers around the $1,821 mark. This convergence of support adds intrigue, presenting traders with a crucial decision-making point.

The implications of a successful breach of the $1,871 resistance are substantial. Should Ethereum manage to break through on strong volume, bullish momentum could potentially propel its value to target levels of $1,910 and $1,950. Traders are advised to steer clear of impulsive moves—patience can be a virtue in volatile markets. A confirmed breakout is essential to avoid the pitfalls of whipsaws inherent in tight trading ranges.

📌 Why This Matters

Ethereum’s struggle with the $1,871 resistance isn’t merely a technical issue; it’s indicative of broader market sentiments and investor psychology. If ETH can decisively break this barrier, it may serve as a bellwether for a more significant shift in market dynamics, ultimately influencing the sentiment not just toward Ethereum, but the entire cryptocurrency landscape. As traditional markets face challenges, the appetite for digital assets could see a dramatic increase.

🔥 Expert Opinions: What Analysts Are Saying

Market analysts and cryptocurrency enthusiasts are closely watching the situation. “If ETH breaks through the $1,871 mark, it could result in a substantial influx of capital as traders seek to capitalize on bullish momentum,” says a leading crypto strategist. Another analyst points out, “This price action could reflect a shift in risk sentiment amid uncertain economic conditions, making Ethereum an attractive alternative for investors.”

🚀 Future Outlook: What’s Next for Ethereum?

As we gaze into the crystal ball, several potential scenarios unfold for Ethereum. A successful breakout above $1,871 could usher in a new bullish phase, potentially pushing prices toward $1,910 and $1,950. Conversely, a failure to breach this key resistance may set the stage for a deeper corrective phase, where the $1,800 level could come under scrutiny. Additionally, the unfolding macroeconomic landscape in the U.S. could have significant ramifications for Ethereum’s price trajectory. As economic growth shows signs of faltering, alternative investments like Ethereum could gain popularity among risk-averse savers.

U.S. Economic Landscape: A Mixed Bag

In juxtaposition to Ethereum’s price activity, the broader U.S. economy is signaling red flags. Recent data from the Commerce Department revealed a contraction in gross domestic product (GDP) at an annualized rate of -0.3% for Q1 2025, marking the first quarterly decline since early 2022. This downturn largely stemmed from a staggering 41.3% spike in imports. Analysts believe these were anticipated purchases grippingly made to circumvent impending tariffs amid President Trump’s turbulent trade policies.

🚨 BREAKING: US GDP growth slows to -0.3%, marking the first negative growth since Q1 2022. Welcome to the Finding Out Stage. pic.twitter.com/5MLEo9Qt2q— Maine (@TheMaineWonk) April 30, 2025

While the negative GDP print may appear grim, it’s essential to consider that imports detract from GDP calculations, potentially overstating the economic frailty. Nevertheless, Wall Street had anticipated a 0.4% expansion, causing many economists to rethink their forecasts leading up to this surprising release. The Federal Reserve is now challenged to navigate these recessionary signals while keeping inflation in check.

Labor Market Shows Resilience, For Now

Despite the economic contraction, indicators from the U.S. labor market signal resilience. The Labor Department reported an addition of 177,000 new jobs in April, outperforming expectations, while the unemployment rate remained stable at 4.2%. However, a deeper dive reveals mixed sentiments, with over 105,000 job cuts reported by Challenger, Grey & Christmas and ADP’s latest payroll survey revealing a disappointing increase of only 62,000 jobs—the weakest in nearly a year.

#NFP LS PREVIEW | Apr US Nonfarm Payrolls Expected At 135K; Unemployment Rate At 4.2% What Top Economists Are Forecasting From Friday’s 13:30 BST US Job Report: pic.twitter.com/yIERIrINSF— LiveSquawk (@LiveSquawk) May 2, 2025

This juxtaposition of solid job creation against rising corporate caution could signal a potential slowdown in hiring, and analysts are urging caution as market participants turn to digital currencies like Ethereum as hedges against the uncertain waters of traditional finance. The growing disconnect between positive headlines and corporate earnings guidance remains a significant concern.

🔚 Final Thoughts: The Convergence of Digital and Traditional Markets

Ethereum’s ongoing price action aligns closely with the broader economic backdrop, marking a significant moment for both traders and investors. As U.S. growth stagnates and traditional markets grapple with various challenges, digital assets like ETH are emerging as more appealing investment avenues. If Ethereum successfully surpasses the $1,871 mark, it could act as a lighthouse guiding investors toward a higher conviction stance on cryptocurrencies amidst an uncertain economic horizon.

BTC Bull Token: A Rising Star in the Crypto Space

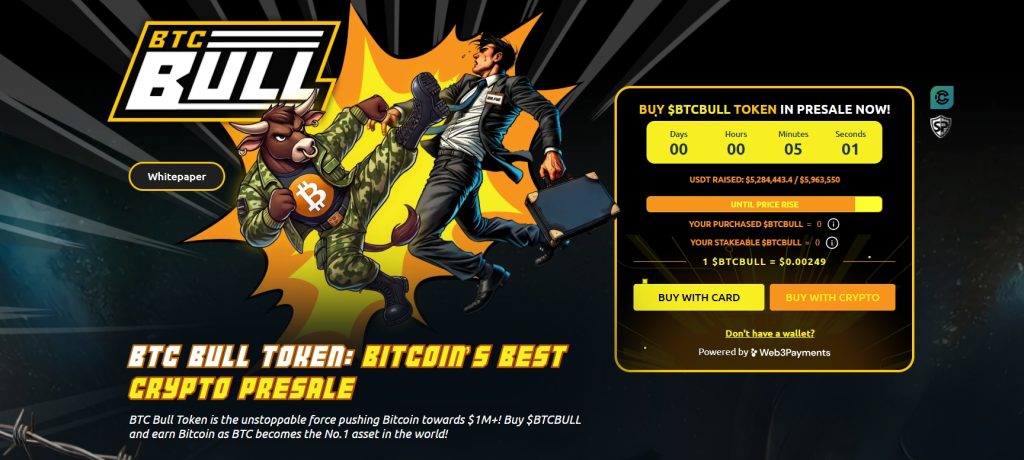

While Ethereum is capturing attention, the BTC Bull Token ($BTCBULL) is also making waves, having surpassed $5.28 million in funds raised, drawing closer to its $5.96 million presale cap. Priced at $0.00249, BTCBULL is carving a niche for itself as a utility-driven token, diverging from the typical pattern of meme coins.

Current Presale Stats:

- USDT Raised: $5,284,443 of $5,963,550

- Current Price: $0.00249 per BTCBULL

- Staking Pool Total: 1,342,549,903 BTCBULL

- Estimated Yield: 78% annually

As the presale narrows down with less than $680K left before reaching its next milestone, BTCBULL is reinventing investment strategies for those seeking high yields and flexibility in an unpredictable crypto landscape. The momentum is building—could this token be among the big winners of the crypto cycle in 2025?