Ethereum Momentum: Is $10,000 Within Reach?

As we dive into another exciting chapter in the cryptocurrency landscape, Ethereum (ETH) is making headlines with its price hovering around $2,457, marking a 1.27% uptick during the US trading session on Sunday. The buzz is palpable: many enthusiasts and analysts believe that ETH has the potential to soar to an astonishing $10,000 within this market cycle. But what fuels this optimism?

The Historical Context of Ethereum’s Rise

Crypto analyst Ted Pillows sheds light on the significance of Ethereum’s longstanding upward trajectory. Since 2017, ETH has navigated a multi-year channel, where historical touchpoints along the lower band of this channel have ignited remarkable rallies. In 2017, many investors witnessed unbelievable returns of up to 300x, while 2020 brought 50x gains. Although today’s realities are different, with Ethereum’s market cap at an impressive $292 billion, analysts like Pillows still see the $10,000 target as a feasible prospect.

Analyst Spots Long-Term Pattern That Could Send ETH to $10,000 https://t.co/8E8yK0cuaK #Crypto #Ethereum— Coindoo.com (@coindoo) June 29, 2025

Breaking Through Resistance: Challenges Ahead

While the outlook is promising, Ethereum must first tackle key resistance levels. In June, the price encountered significant resistance just below $2,600 on two occasions. According to analyst Crypto Patel, a robust breakout is necessary; specifically, a decisive close above $2,800 would act as a strong bullish confirmation and open the doors to potential targets of $4,000 and beyond.

Whale Activity: A Testament to Long-Term Confidence

On-chain metrics paint a bullish picture for Ethereum enthusiasts. Whale wallets—accounts holding significant amounts of ETH—are increasingly accumulating the cryptocurrency, hinting at a long-term bullish conviction despite the current market’s range-bound price action. For instance, SharpLink Gaming recently invested $4.82 million in Ethereum over-the-counter (OTC), elevating their total ETH exposure to a staggering $478 million.

Sharplink Gaming bought another $4,820,000 $ETH via OTC. They now hold $425,470,000 Ethereum. pic.twitter.com/0QtDdHcUAS— Ted (@TedPillows) June 28, 2025

Supportive indicators of confidence include:

- $4.56 million deposited into Ethereum’s Beacon Chain, likely for staking purposes.

- A significant $293 million withdrawn from exchanges, suggesting a movement to cold wallets for safekeeping.

- Decreased volatility alongside increased high-value transfers, indicative of long-term betting on appreciation.

Network Growth: A Disconnect or a Hidden Opportunity?

Despite the mounting network activity—daily transactions have exceeded 1.5 million, and active addresses have crossed 356,000, reaching levels not seen since early 2023—the price of Ethereum appears to be lagging. Interestingly, gas fees have escalated by 130% in just a week, now sitting at $10.26 million, reflecting soaring demand for DeFi and NFT projects. Yet, key valuation indicators paint a more cautious picture:

- The NVT Ratio has surged to 2044, insinuating that the price may have outpaced actual usage.

- Meanwhile, the MVRV Z-score has dipped into the negative, suggesting that many holders are currently at a loss.

This disparity between Ethereum’s price and the fundamentals could represent an exciting buying opportunity or, alternatively, reflect excessive market speculation.

The Crucial Levels for a Potential Breakout

While many analysts remain bullish on Ethereum’s price trajectory, the road to $10,000 is contingent upon several pivotal factors:

- A decisive break above the $2,800 resistance level to confirm the bullish trend.

- Continuous whale interest and stable staking growth.

- A clear correlation between network usage and price gains.

If Ethereum can uphold its support around $2,400 and Bitcoin maintains its dominance, a breakout may be on the horizon. Analysts at XForceGlobal even foretell a potential Wyckoff-style move that could propel ETH towards $9,400 if momentum builds.

Wrapping Up: The Dawn of a New Era?

The bullish momentum surrounding Ethereum remains intact, yet the path forward requires overcoming essential resistance levels and substantiating the long-term conviction of investors through consistent volume and accumulation patterns. The landscape is evolving rapidly, urging investors to stay informed and engaged in the dialogue surrounding this transformative digital asset.

Bitcoin Hyper: A Layer 2 Solution to Watch

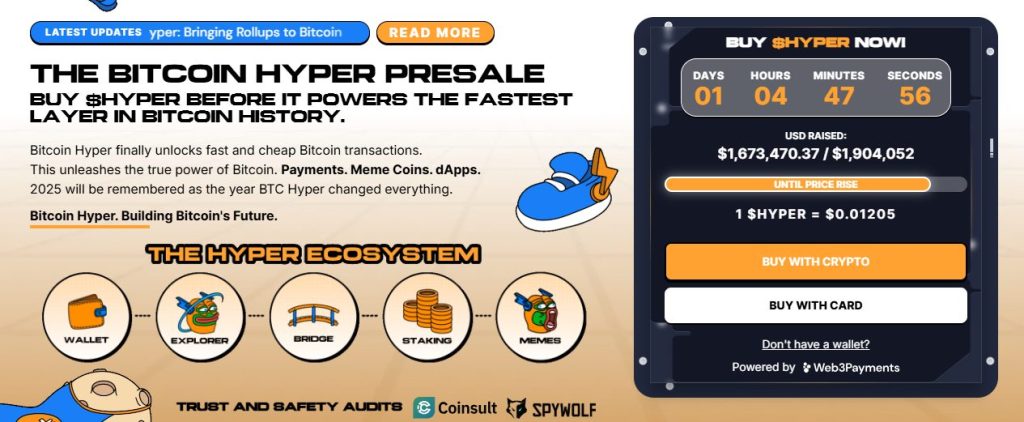

In parallel with Ethereum’s developments, another project, Bitcoin Hyper ($HYPER), has recently surged in popularity, raising over $1.74 million in its public presale. Set to revolutionize the space by combining Bitcoin’s security with the agility of Solana’s ecosystem, Bitcoin Hyper aims to facilitate quick, low-cost smart contracts and decentralized applications. As it evolves, $HYPER promises exciting opportunities in the burgeoning Layer 2 arena.

As we watch these developments unfold, one can’t help but wonder: How will Ethereum’s saga evolve? Share your thoughts in the comments below!