The Ethereum Breakout: Are We on the Brink of a Historic Rally?

As the cryptocurrency landscape continues to evolve, analysts are paying close attention to Ethereum’s price movements, drawing intriguing parallels to the exhilarating events of the 2017 market cycle. With recent volatility keeping the leading altcoin in a tight consolidation range, many are wondering if we’re approaching a significant breakout. Let’s delve into the current market dynamics, expert opinions, and what the future might hold for Ethereum.

Why This Matters: Echoes from 2017

Understanding the market patterns can often illuminate potential future movements. Analysts are observing a strikingly similar technical setup between Ethereum’s current phase and that of 2017, when it entered a monumental bull run. As we witness the month-long volatility in Ethereum’s price, we stand at a pivotal moment that could set the stage for a dramatic resurgence.

So, why is this significant? A bullish breakout could not only propel Ethereum’s price skyward but could also rejuvenate overall market sentiment, particularly as the Federal Reserve navigates economic uncertainties. With Fed Chair Jerome Powell recently stating that the U.S. economy is in a “solid position,” we might see an uptick in risk appetite among investors, leading to more funds flowing into cryptocurrencies.

JUST IN: 🇺🇸 Fed Chair Jerome Powell says “the economy is in a solid position.” pic.twitter.com/Je7vHTKeuc— Watcher.Guru (@WatcherGuru) June 18, 2025

Ethereum’s 2025 Chart: A Familiar Narrative

A closer inspection reveals that Ethereum is currently hovering just below the 50 Simple Moving Average (SMA) after enduring months of pressure and stagnation. As highlighted by renowned crypto analyst Merlijn, this phase bears a striking resemblance to the 2017 pattern where Ethereum similarly consolidated beneath the 50 SMA before embarking on a meteoric rise.

The conditions suggest that Ethereum may soon experience a buildup of bullish momentum, leading to a breakout. However, unlike the previous cycles, Merlijn argues that the cryptocurrency market’s increasing maturity—fueled by regulatory clarity, institutional participation via ETFs, and a surge in retail adoption—could send Ethereum to unprecedented heights.

Ethereum Price Potential: Eyes on the $10,000 Milestone?

The question on many investors’ minds is, “Could we see Ethereum reach $10,000?” While this target seems ambitious, the historical setup points to a valid possibility. Current charts indicate a potential breakout from a significant 3-year ascending triangle pattern, which could act as a precedent for reaching such a price point.

Momentum indicators appear favorable for an impending breakout. The Relative Strength Index (RSI) shows buying pressure dominating, maintaining a position above the neutral zone at 52. Additionally, the MACD line is expanding its gap above the signal line, signaling a solidifying uptrend since mid-April.

If Ethereum manages to cross above the 50 SMA, analysts project a potential 53% surge, positioning the altcoin to revisit the upper limit of the consolidation range at around $4,000. Further, if this breakout is sustained, the ascending triangle pattern suggests a staggering target of about $7,335, representing a 188% increase from current levels. However, traders should remain vigilant of resistance around $3,350, as failure to breach this could result in a temporary downturn.

Will Bitcoin Outperform Ethereum This Time?

Historically, many have opted for Ethereum over Bitcoin due to its expansive capabilities. However, the tides may be turning as Bitcoin is evolving to tackle its biggest limitations. With the upcoming launch of Bitcoin Hyper ($HYPER), a real-time Layer 2 solution, Bitcoin could soon match Ethereum’s speed and programmability.

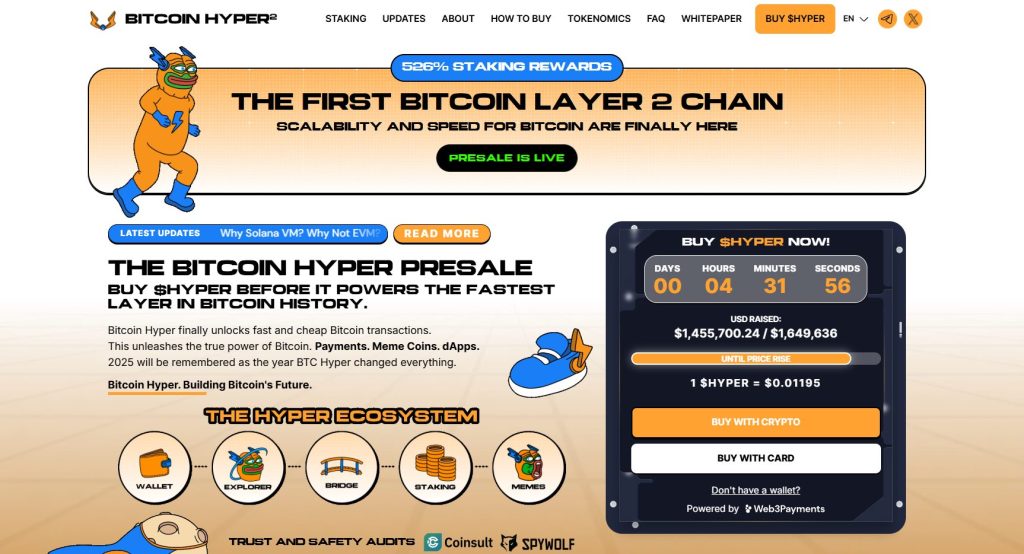

Bitcoin Hyper aims to bring the speed of Solana to Bitcoin’s ecosystem through its decentralized architecture and innovative Canonical Bridge. As traction grows—evidenced by nearly $1.5 million raised in just the second week of its presale—investors are flocking to $HYPER, thanks to an attractive 526% Annual Percentage Yield (APY) for staking rewards.

Conclusion: A Tipping Point for Ethereum?

The echoes of 2017 resonate strongly in the current Ethereum landscape. With positive macroeconomic signals and a resemblance to past breakout patterns, many anticipate that Ethereum could soon rise to new heights. Investors are keenly watching the resistance points and upcoming trends that could define the near future of Ethereum and the broader cryptocurrency market.

Whether you’re a seasoned crypto enthusiast or new to the game, the question remains: Will Ethereum reclaim its throne, or will Bitcoin’s innovation pave a new path for dominance? Engage with us in the comments below—what are your thoughts on Ethereum’s potential breakout versus Bitcoin’s growing capabilities?