Ethereum has recently seen a dip, trading down 2% to $4,457 following significant news from SharpLink Gaming (SBET). Despite the loss, which totaled $103.4 million in their latest quarterly report, the company made a bold move by increasing its Ethereum holdings to an impressive 728,804 ETH, valued at over $3.2 billion. This marks their first financial update since refining their treasury strategy to focus on Ethereum back in June.

Another day, another $603,500,000 worth of $ETH bought by SharpLink Gaming! SharpLink has now accumulated 728,804 ETH since June, bringing their total ETH reserve to $3.38 BILLION. Ethereum is becoming the treasury asset of the world! $SBET is setting the blueprint.

— Crypto-Gucci.eth ᵍᵐ🦇🔊 (@CryptoGucci) August 15, 2025

SharpLink’s focus on Ethereum comes despite recent financial challenges. The company has raised over $2.6 billion through various offerings to bolster its Ethereum treasury, funneling nearly all of its holdings into staking, where they have earned 1,326 ETH in rewards. This strategic shift was accompanied by significant leadership changes, with Ethereum co-founder Joseph Lubin stepping in as chairman and former BlackRock executive Joseph Chalom taking over as co-CEO.

NEW: SharpLink reports Q2 2025 results: ✅ Total Raised: $2.6B ✅ Holdings: 728,804 ETH ($3.3B) ✅ ETH Concentration: 3.95 (98% increase) ✅ New Chairman: Joe Lubin @ethereumJoseph ✅ New Co-CEO: Joseph Chalom @joechalom

— SharpLink (SBET) (@SharpLinkGaming) August 15, 2025

In addition to its ETH accumulation, SharpLink has formed a partnership with Consensys and incurred $16.4 million in stock-based compensation as part of their advisory service ties. Chalom emphasized the rapid growth of their Ethereum strategy, noting how they have effectively scaled their position “in a highly accretive manner.” However, it was a difficult quarter for the company as revenues plummeted by 30% year-over-year, dropping from $1.0 million to $0.7 million, while gross profit stood at a mere $0.2 million. Much of the loss stemmed from an $87.8 million non-cash impairment concerning liquid staked ETH, a requirement under U.S. GAAP that mandates assets to be marked down to their lowest trading value—$2,300 per ETH during that period.

Significantly, SharpLink stated that, despite these accounting losses, it did not sell or redeem any Ethereum, reaffirming its commitment to a long-term treasury model focused on the digital asset. This dedication has captured the attention of the cryptocurrency community, and investors are closely monitoring its implications for both SharpLink and the Ethereum ecosystem.

In the immediate aftermath of the financial report, SharpLink’s stock dropped 15% to $19.85, while Ethereum faced increased volatility. The broader market also felt the impact, with futures liquidations surging to $169 million in just 24 hours, illustrating a climate of apprehension among investors.

SharpLink’s earnings yesterday sent SBET shares lower, resulting in the mNAV now dropping below 1. So, what’s the next move? 🤔

— Nic (@nicrypto) August 16, 2025

Analysts are observing that SharpLink’s ETH-centric strategy represents a high-risk, high-reward approach. While the large reserves and staking rewards could potentially lead to future gains, they have yet to mitigate the immediate challenges represented by declining revenues and losses driven by asset impairments. For Ethereum itself, current technical analysis suggests critical support levels are around $4,100. If this level fails, prices could see a drop to $3,500. Conversely, if ETH manages to stay above $4,350, it could signal a green light for further rises.

As traders dive into the technical specifics, Ethereum is presently trading near $4,405, situated within an ascending channel that points to bullish sentiments for the longer term. Key indicators such as the 50-period SMA are at $4,379, while support is clustered between $4,350 and $4,400. A rebound from here might allow Ethereum to aim for higher targets, potentially reaching up to $4,785, with the psychological barrier of $5,000 closely in sight.

Traders should keep a close eye on these key levels:

- Support: $4,350 to $4,400; deeper support at $4,170

- Resistance: $4,785, followed by the crucial $5,000

- RSI: Currently at 44, recovering from oversold levels

- MACD: Showing a negative trend that is weakening, indicating a potential reduction in bearish pressure

A bullish engulfing candle above $4,450 could serve as a confirmation signal for a return to upside momentum. Sustained trading above this level may propel Ethereum towards $5,000. However, a close below $4,170 would invalidate the current bullish channel, raising the possibility of a deeper pullback toward $3,950.

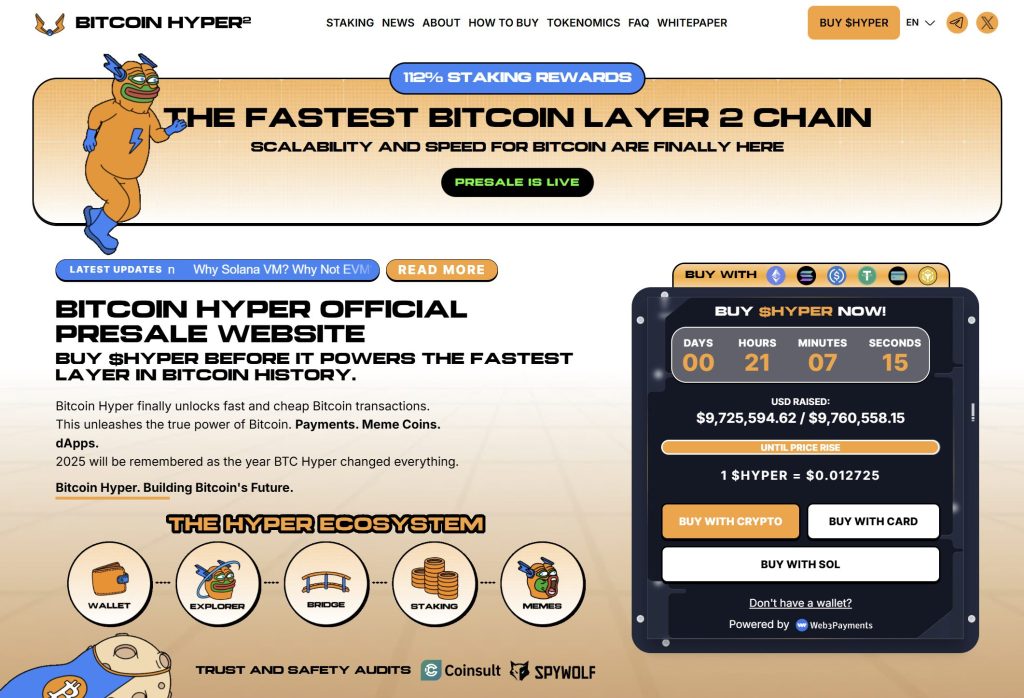

In other news, the crypto landscape continues to evolve, with the emergence of Bitcoin Hyper ($HYPER) blending the security of Bitcoin with the speed of Solana’s architecture. This new layer 2 solution aims to enhance the Bitcoin ecosystem, making smart contracts, decentralized applications, and even meme coin creation not only possible but efficient.

Investor enthusiasm is palpable for Bitcoin Hyper, with its presale already exceeding $9.7 million and only a limited allocation remaining. HYPER tokens are currently priced at just $0.012725, but this is set to increase soon. Get in on the ground floor by participating in the presale for a chance to be part of this exciting project.

As the cryptocurrency market continues to shift, the unfolding events at SharpLink and developments like Bitcoin Hyper signal the persistent interest and evolution within the space. What do you think lies ahead for Ethereum and the broader crypto ecosystem? Share your thoughts!