The Ethereum Market Faces a Northerly Storm: Current Drop Explored

Ethereum has taken a significant plunge, recently trading at $1,874 and putting immense pressure on a critical support level amid broader market sell-offs. As prices inch perilously close to liquidation thresholds around $1,805, analysts are sounding the alarm; a sharper correction could be looming. The market is now in a precarious state where $238 million worth of ETH faces the threat of liquidation, predominantly affecting two major MakerDAO whales. As traders take positions, eyes are glued to whether bullish support can emerge or if the bears will impose a deeper decline.

Understanding the Liquidation Risk

The ongoing ETH sell-off is a harsh test for the resilience of over-leveraged DeFi positions. Blockchain analytics firm Lookonchain reveals that two substantial Ethereum holders on the MakerDAO platform teeter on the edge of liquidation. Together, these whales control a massive 125,603 ETH, currently valued at around $238 million. As Ethereum lingers near $1,874, the open positions of these whales hover close to their liquidation points at $1,805 and $1,787.

What does this mean for the market? If Ethereum dips below these crucial levels, the Maker protocol will automatically trigger the liquidation process, potentially unleashing a deluge of ETH into the market. Such an influx could intensify systemic selling pressure throughout the DeFi landscape, sending shockwaves across investor sentiment. The health rate of these vaults—a pivotal metric indicating the stability of collateral—has dropped to a concerning 1.07, further raising fears of forced asset sales.

As the $ETH price drops, the 125,603 $ETH($238M) held by these two whales on #Maker is at risk of liquidation again. The health rate has dropped to $1.07, with liquidation prices at $1,805 and $1,787, respectively. https://t.co/0QEJXGq0Lg pic.twitter.com/iEEDZTg945— Lookonchain (@lookonchain) March 29, 2025

Current Price Trends and Indicators Signaling Weakness

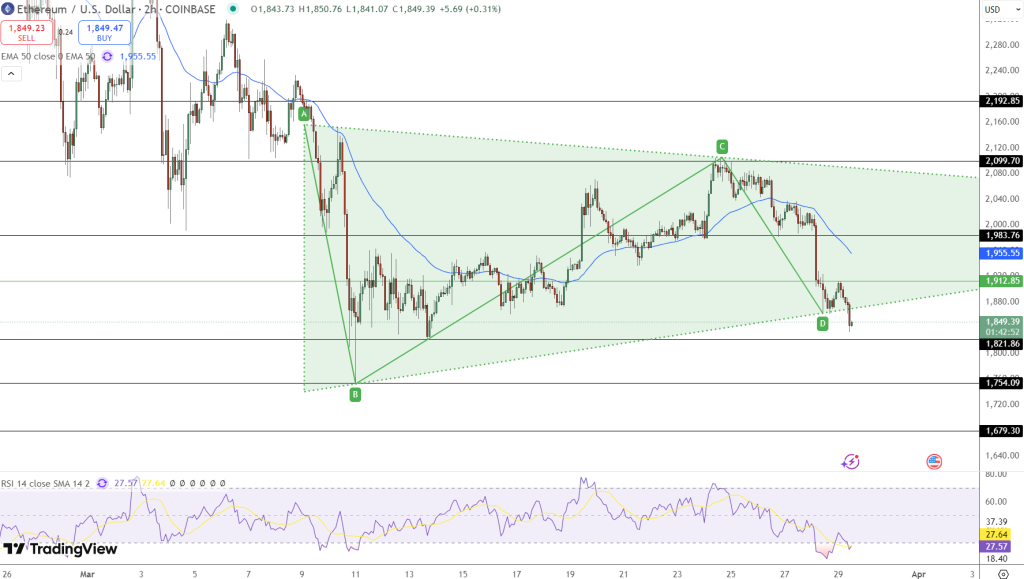

Ethereum’s recent movements have skidded past significant support, breaking down a symmetrical triangle pattern at $1,880—an essential level that had held strong for weeks. Current trading around $1,850 points to increasing selling pressure, and technical indicators lend little support to the bullish case. The Relative Strength Index (RSI) has plummeted to a concerning 28, signaling an extreme oversold condition.

Ethereum price chart analysis indicating bearish trends and key support levels.

Further compounding the bearish outlook, the 50-period Exponential Moving Average (EMA) on the 2-hour chart stands at $1,955—significantly higher than current prices—implying a struggle for bulls to gain traction. Additionally, a completed ABCD harmonic pattern close to recent lows suggests the likelihood of continued bearish momentum. Breaking below $1,822 may find additional support zones at $1,754 and $1,680. For any hopes of a recovery, ETH must reclaim the $1,880-$1,955 range decisively.

Market Sentiment: Evaluating Risks and Potential Outcomes

The looming threat of large-scale liquidations not only underscores the inherent risks of the decentralized finance sphere but also reflects the automated, rigid mechanics that might trigger abrupt market shifts during heightened volatility. Key points of focus for traders include:

- A decisive breakdown below $1,805 could trigger liquidation for a staggering 125,000 ETH.

- Despite the RSI signaling oversold conditions, a genuine recovery remains in question.

- Reclaiming the price points of $1,880 and $1,955 is crucial for building any bullish structure.

While oversold readings might hint at a brief recovery, the pervasive risk of significant liquidations keeps the potential for downside threats firmly in play, contingent on a rapid sentiment shift.

Beyond Ethereum: Exciting Developments in the Crypto Space

On a related note, the cryptocurrency community is buzzing about BTC Bull ($BTCBULL)—a groundbreaking token that offers holders real Bitcoin rewards as BTC hits key price milestones. Unlike fleeting meme tokens, BTCBULL focuses on long-term growth, rewarding investors through a combination of airdrops and staking opportunities.

Staking and Passive Income with BTC Bull

The BTC Bull token features a high-yield staking program offering an impressive 119% APY, empowering participants to earn passive income. The staking pool has swiftly accumulated 882.5 million BTCBULL tokens, reflecting enthusiastic community involvement.

Visual representation of BTC Bull token with current presale data and community interest.

Presale Insights and Opportunities

Current Presale Price: $0.002435 per BTCBULL

Total Raised: $4.2M out of a projected $4.8M target

As demand escalates, this presale represents a unique chance to secure BTCBULL at early-stage pricing before the next anticipated increase.

Conclusion: Navigating the Crypto Tides

The current volatility surrounding Ethereum presents a critical juncture for traders and investors alike. With the threat of massive liquidations and bearish market momentum, strategic vigilance is required. Meanwhile, developments like BTC Bull demonstrate an evolving landscape within crypto, providing alternatives for those seeking stability amidst chaos. What are your thoughts? How will you navigate the shifting tides of the cryptocurrency market? Join the conversation!