Ethereum’s Price Soars: What You Need to Know

Ethereum (ETH) has been making headlines with a striking price surge. Just this past Tuesday, ETH climbed a remarkable 11%, followed by a further increase of 2% on Thursday, ultimately stabilizing around $1,744. However, recent trends show a slight dip of 3.4% in the last 24 hours, as the broader cryptocurrency market takes a breather following an impressive rally.

Despite four challenging months leading up to this resurgence, the latest technical indicators are hinting at a potentially bullish turnaround for Ethereum. Could we be witnessing the dawn of a new favorable cycle for this major cryptocurrency?

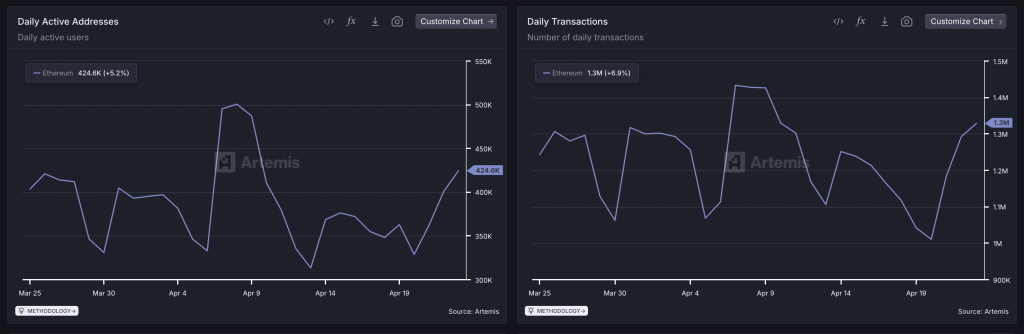

📊 Unpacking the On-Chain Data

On-chain analytics from Artemis unveil a remarkable uptick in Ethereum’s network activity. Between April 20 and April 23, daily active addresses surged by 29.2%, while daily transactions skyrocketed by 30%. This marked a significant rebound in user engagement, arguably the most substantial in the past month, and coincided with Ethereum’s bullish price action on the daily chart.

📈 Breaking Key Technical Levels

Tuesday’s impressive rally enabled Ethereum to break above the critical 21-day exponential moving average (EMA). What’s noteworthy is that this breakout was sustained by stronger-than-normal trading volumes, a phenomenon we haven’t seen since December.

While yesterday’s price ascension reinforced this bullish breakout, some intraday profit-taking led to a modest pullback. Nevertheless, ETH now steadies around $1,744, facing a trading volume drop of 30% to $18.7 billion. This suggests that while there is some selling pressure, it lacks the strength to cause widespread concern among investors.

📈 Technical Indicators That Point to Strength

Momentum indicators are flashing enthusiastic signals for Ethereum. The Relative Strength Index (RSI) is currently hovering about 21% above its signal line, with the MACD histogram observing an 11-day upward streak—the longest positive run in over two years. This is a clear indication of the increasing strength behind the current price rally, particularly as the RSI reaches levels not seen since January.

🚀 What Happens Next?

With the momentum gathering around ETH, industry experts are optimistic about the potential for Ethereum to target the $3,000 mark in the near future. This enthusiasm is further fueled by alternatives in the cryptocurrency ecosystem, such as Solana (SOL), which are enjoying renewed interest in smart contracts and meme coins.

🔥 Expert Opinions: What Analysts Are Saying

Analysts are divided yet hopeful. Some suggest the recent movements signify early-stage bullish consolidation, while others caution against potential price corrections before a final breakout. “The market often takes a step back before it takes two steps forward,” notes a prominent crypto analyst, highlighting the volatility inherent in this space.

📌 Why This Matters

The dynamics surrounding Ethereum’s price action are significant for multiple reasons. A sustained increase could reinvigorate interest from institutional investors, attract new retail investors, and bolster confidence in the broader crypto market. Additionally, as Ethereum continues to evolve with various updates and enhancements, the implications on its usability and adoption cannot be understated.

🌟 Solana’s Emergence: A Parallel Journey

As Ethereum builds momentum, Solana (SOL) is not resting on its laurels either. Driven by the resurgence of meme coins—like the recently launched Fartcoin (FART) and Bonk (BONK)—Solana is witnessing a surge in network activity. To address this growing demand, Solana is introducing innovative scaling solutions, such as Solaxy ($SOLX), designed to maintain its speed and efficiency.

Having already raised over $30 million during what is proving to be one of the year’s hottest presales, Solaxy is poised for significant growth. Their testnet features an explorer that allows investors to monitor performance in real-time. Investors can participate in this growth by purchasing $SOLX during its presale phase with a variety of payment options, including SOL, USDT, ETH, or even a bank card.

🧐 Conclusion: A Market to Watch

Ethereum’s recent surge amid a cooling crypto market highlights its potential for recovery and future gains. As investors and analysts keep a close eye on momentum indicators and market sentiment, the outlook for ETH seems promising. Keep your portfolios ready—this is a market that could shift rapidly, and both Ethereum and Solana seem set to play pivotal roles in the coming weeks. What do you think? Is this the beginning of a new upward trend for ETH, or are we in for more twists and turns? Share your thoughts below!