The Rollercoaster Ride of Bitcoin: What’s Happening Now?

Bitcoin, the leading cryptocurrency, is currently experiencing turbulence, with its price dipping by 2.4% in the last 24 hours to hover around $83,797. As the trading volume sits at a staggering $24.98 billion, market experts and traders alike are intensely surveilling the situation. BTC is grappling to reclaim the coveted $86,000 mark, but recent movements of large fund transfers may herald significant volatility ahead.

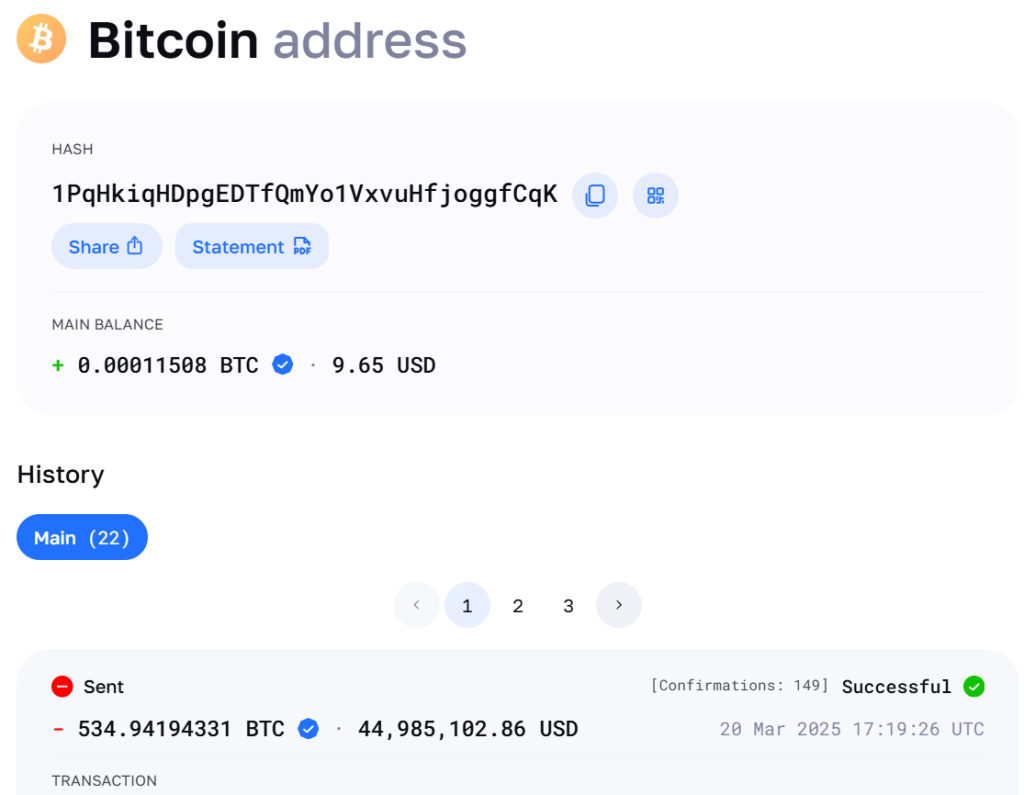

In a surprising turn of events, a dormant Bitcoin wallet—inactive since 2016—has come back to life, transferring a hefty amount of 534.94 BTC, valued at approximately $45 million, to a new address. This transaction has ignited speculation regarding a potential sell-off and spooked many in the crypto community. With Bitcoin already down 10% over the past month, could this be the precursor to a market shake-up, or is it simply a routine wealth management maneuver?

Whale Activity: The Catalyst for Market Movements

The whale transaction, which was flagged by btcparser.com, saw this dormant wallet—created back in March 2016—conduct a high-value transfer at block height 888,655.

Originally acquired for just $222,000, this Bitcoin has witnessed a stunning appreciation of 20,272%, a testament to the remarkable growth trajectory of cryptocurrency over the years.

Interestingly, the associated Bitcoin Cash (BCH) from this wallet was already utilized back in 2017, intensifying curiosity about the current whale’s intentions. As of now, the transferred BTC resides in a legacy address, and there are no immediate signals of liquidation. However, concerns loom over the potential likelihood that the whale may decide to unload these assets in the near future, subsequently exerting further downward pressure on BTC’s value.

📌 Why This Matters: The Implications of Whale Movements

Whale movements often foreshadow price volatility and shifts in market sentiment. For traders, the current landscape is rife with uncertainty—a single large transaction can catalyze fear, influencing decisions to buy or sell across the board. As such movements unfold, they could steer Bitcoin toward unexpected price changes that reverberate through the entire cryptocurrency ecosystem.

Whether this particular transaction signals a larger trend or is merely a one-off move remains to be seen. Nonetheless, market players are on high alert, understanding that such shifts can affect not only Bitcoin but also broader digital asset markets.

🔥 Expert Opinions: What Analysts are Saying

Amidst these fluctuations, experts provide varied perspectives on Bitcoin’s direction. Grayscale’s Zach Pandl remains resolutely optimistic, suggesting that the current price correction could serve as an opportune moment for savvy investors to accumulate more Bitcoin. He emphasizes Bitcoin’s historical correlation with favorable monetary policies, forecasting that future interest rate cuts may rejuvenate BTC’s performance.

On the flip side, analysts reiterate caution amid the potential for a market sell-off if the whale decides to liquidate a significant portion of its holdings. Will fear override optimism, or will the historical resilience of Bitcoin prevail?

🚀 Future Outlook: What’s Next for Bitcoin?

The current technical landscape presents a mixed picture. Bitcoin is consolidating around $84,085, while maintaining crucial support amid rising volatility. Traders have noted the formation of a symmetrical triangle pattern—often indicative of an impending breakout. The 50-day exponential moving average (EMA) at $84,002 reinforces the bullish sentiment.

Here are key price levels for traders to keep their eyes on:

- Immediate resistance at $84,341 could open the door to potential rallies toward $87,411 and $89,901.

- Should BTC dip below the $84,000 mark, subsequent support levels are positioned at $81,552 and $79,087.

Final Thoughts: Is Bitcoin at a Crossroads?

As Bitcoin navigates through waves of uncertainty propelled by whale activities and macroeconomic pressures, the immediate future is a waiting game. Key support levels will be critical in determining whether Bitcoin can stabilize or aspire to push through higher resistance levels. Traders are encouraged to tread cautiously, watching on-chain activities and remaining alert to shifts in market dynamics.

For those captivated by the potential of Bitcoin, the time may be ripe to strategize and contemplate risk management options. What will your next step be as the world of cryptocurrency keeps evolving?

Introducing BTC Bull: The Community-Driven Cryptocurrency

For crypto enthusiasts looking to leverage emerging opportunities, BTC Bull ($BTCBULL) is gaining traction as a community-centric token designed to reward holders with real Bitcoin at key price milestones. Unlike typical meme tokens, BTCBULL prioritizes long-term investor benefits through innovative incentives like airdrops and staking options.

Staking & Passive Income: Tap Into Growth with BTC Bull

BTC Bull’s staking program boasts a staggering 119% annual percentage yield (APY), enabling participants to earn passive income as they contribute to the community’s growth. With strong engagement reflected by 882.5 million BTCBULL tokens already in the staking pool, it’s clear that interest is surging.

As the presale gains momentum, the current price sits at an attractive $0.00242 per BTCBULL, with a target of raising $4.4 million. Investors have a unique chance to acquire BTCBULL at its early-stage price before the next upswing. Join the movement, embrace the potential, and let Bitcoin’s evolving story unfold!