🚀 Crypto Market Soars: A Groundbreaking Week for Digital Assets

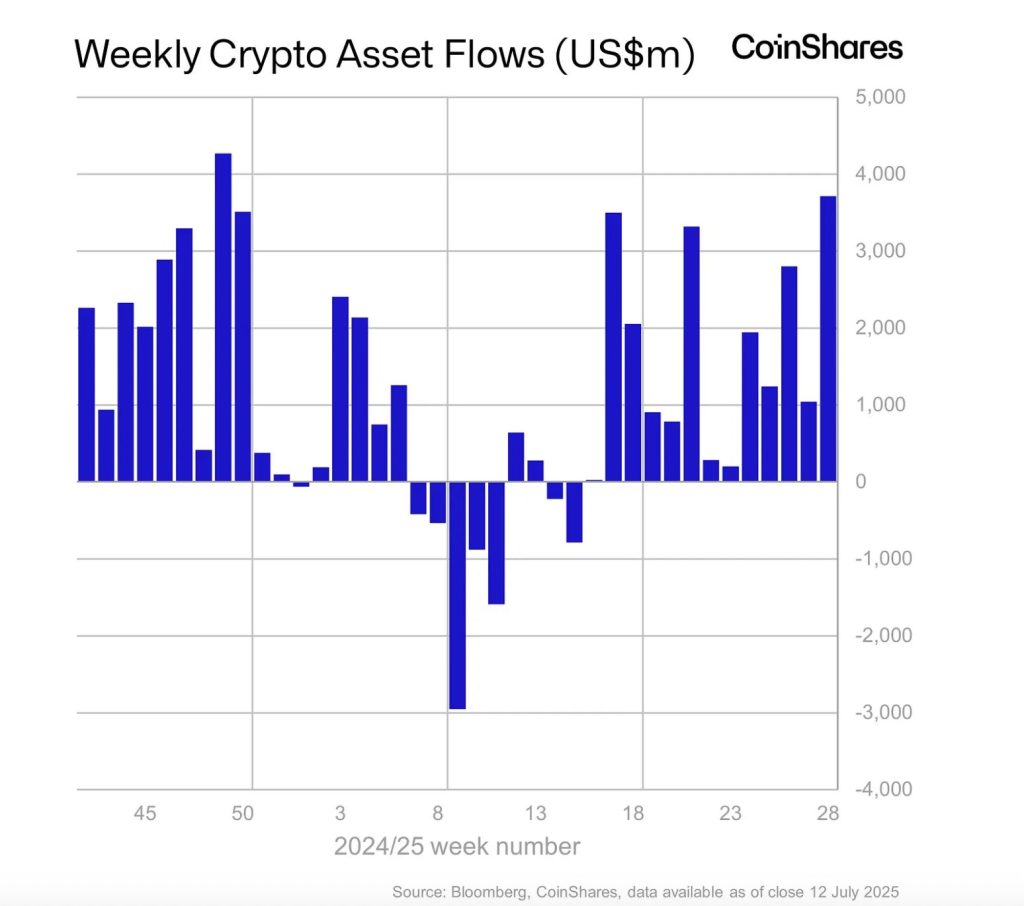

In a remarkable turn of events, digital asset investment products have seen an astonishing inflow of $3.7 billion in just one week. This surge represents the second-largest weekly total ever recorded, a feat highlighted by CoinShares analyst James Butterfill. As a result, total assets under management (AuM) across cryptocurrency exchange-traded products (ETPs) have reached a staggering all-time high of $211 billion. Not only did dollars flow in, but trading was brisk, with ETP volumes doubling to $29 billion—significantly higher than the average weekly volume this year.

📈 Why This Matters: The Surge in Institutional Interest

What does this massive influx of capital mean for the cryptocurrency ecosystem? The implications are profound. The significant inflows underscore a robust institutional interest in digital assets, marking an era where cryptocurrencies are increasingly recognized alongside traditional assets. A trend like this typically fuels a bullish sentiment that can stabilize and enhance the overall market performance, attracting more investors to join the fray.

🌟 Bitcoin and Ethereum: Leading the Charge

Bitcoin continues to thrive, drawing in a whopping $2.7 billion and pushing its total assets under management to $179.5 billion. This achievement is monumental, as Bitcoin ETPs now constitute 54% of the total value held in gold ETPs, further solidifying its position as the “digital gold” of our times. Interestingly, short positions in Bitcoin have seen minimal activity, hinting at a prevailing positive outlook among investors.

Meanwhile, Ethereum is making its mark, recording its twelfth consecutive week of positive inflows. Last week alone, it attracted $990 million—its fourth highest weekly inflow to date. Cumulatively, these twelve weeks have seen Ethereum garner nearly 19.5% of its AuM, surpassing Bitcoin’s 9.8% during the same period. This growing momentum suggests that investors are increasingly confident in Ethereum’s long-term value.

🌍 Regional Insights and Altcoin Trends

Diving into regional performance, the United States has completely dominated last week’s inflows, accounting for the entire $3.7 billion. In stark contrast, Germany experienced outflows of $85.7 million, which could suggest profit-taking or a shift in the regulatory landscape impacting investor sentiment. Switzerland and Canada, however, showcased resilience with moderate inflows of $65.8 million and $17.1 million, respectively.

Among alternative cryptocurrencies, Solana emerged as a standout, capturing $92.6 million in inflows and reinforcing its position as a leading layer-1 platform beyond Ethereum. Contrarily, XRP faced the most significant outflows, losing $104 million, which may reflect diminishing investor confidence following recent volatility. Butterfill emphasized that, despite mixed results from certain altcoins, the sustained capital inflow across the overall market signals a renewed commitment from both institutional and retail investors in digital assets.

🔥 Expert Opinions: Analyst Insights on Recent Trends

Experts are buzzing with excitement over these market movements. “The inflow patterns we’re witnessing can be interpreted as strong market validation for both Bitcoin and Ethereum,” says crypto market analyst Sarah Thompson. “Institutional investors appear to be increasingly cognizant of the unique value propositions of these assets, notably in a world that prioritizes digital transformation.” Such insights suggest that the current momentum is not just a fleeting trend, but potentially a paradigm shift in investment strategies.

🔮 Future Outlook: What Lies Ahead for Crypto?

Looking ahead, the outlook for the cryptocurrency market remains optimistic. As institutional appetite grows, many speculate that this may be the beginning of a longer bull run. With the integration of cryptocurrencies into diversified portfolios becoming more common, we may see continued growth in both investor interest and capital inflows. Furthermore, regulatory clarity in various markets could bolster this trend, leading to a more stable environment for crypto trading.

💬 Conclusion: Join the Conversation

The market’s recent surge reflects an evolving landscape where cryptocurrencies are gaining serious traction among investors. As excitement continues to build, it begs the question: Are you ready to embrace this digital asset revolution? Whether you’re a long-time crypto enthusiast or a curious newcomer, now is the time to engage with the community and explore the potential of digital currencies. Share your thoughts on the current market trends and how they might shape the future of investment!