Exciting News for Cumberland: Approval from Singapore’s Monetary Authority

In a significant step towards enhancing its Asian operations, Cumberland, a major player in the crypto trading arena, has secured an in-principle approval for the Major Payment Institution (MPI) License from the Monetary Authority of Singapore (MAS). This pivotal approval will empower its Singaporean subsidiary, Cumberland SG, to provide regulated digital asset services, marking a major stride in the company’s journey to solidify its presence in the thriving Asian market.

On social media platform X, the firm expressed optimism about this development: “We look forward to expanding our presence in this important region, bringing our disciplined approach to compliance, proven market expertise, and commitment to the digital asset ecosystem to counterparties in Singapore and beyond,” they stated. The company’s excitement reflects their readiness to navigate the nuanced regulatory landscape of one of the world’s leading financial hubs.

We are pleased to announce that Cumberland SG Pte. Ltd. has received in-principle approval for the Major Payment Institution (MPI) License from the Monetary Authority of Singapore (MAS). We look forward to expanding our presence in this important region, bringing our disciplined… pic.twitter.com/G14XvB4VVg— Cumberland (@CumberlandSays) March 18, 2025

Why This Matters

The MPI License is not just a regulatory stamp; it signifies a strong vote of confidence from one of the most stringent financial regulators in the world. Although Cumberland has yet to receive the official license—indicated by the in-principle status—the approval sends a clear message about Singapore’s welcoming stance towards legitimate digital asset firms. The nation has positioned itself as a nexus for blockchain technology, characterized by an environment ripe for innovation and growth.

Singapore’s Rigorous Licensing Landscape

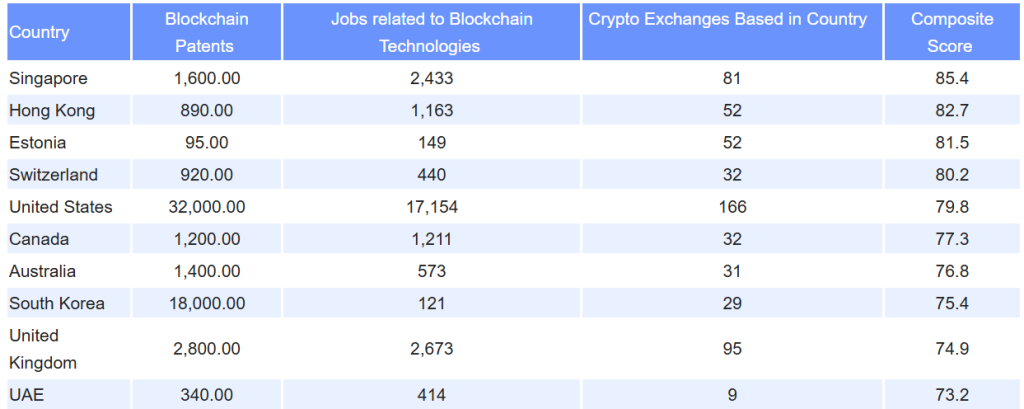

Jason Tay, Head of Commercial at StraitsX, reinforced the significance of the MPI License during a discussion with Cryptonews, emphasizing Singapore’s proactive approach to digital asset regulation. “Whether it’s the MPI license or the forthcoming stablecoin license, all firms seeking to operate as legitimate and recognized entities must undergo the same rigorous licensing process,” he explained. This rigorous approach is part of what makes Singapore a leader in the blockchain space, as evidenced by its impressive statistics in blockchain patents, crypto exchanges, and employment opportunities within the sector. Check out the statistics from a recent study by ApeX Protocol below:

Regulatory Awareness: A Double-Edged Sword

Operating under the MPI framework requires crypto firms, such as Cumberland, to meet stringent capital adequacy and anti-money laundering compliances. This level of oversight is crucial, ensuring that only well-capitalized and compliant entities thrive in the regulatory landscape, thus protecting both investors and the integrity of the market.

Shifting Tides: U.S. SEC Drops Legal Action Against Cumberland

In a turn of events that has caught the attention of the crypto community, the U.S. Securities and Exchange Commission (SEC) recently dropped its case against Cumberland. Previously, the SEC had charged the crypto market maker in October 2024 for operating as an unregistered dealer since 2018. However, the agency’s agreement to put an end to the legal dispute reflects a shifting attitude toward crypto regulation under new leadership, indicating a growing recognition of the challenges and opportunities presented by the crypto market.

Expert Opinions: Insights from the Crypto Community

Industry analysts believe that Cumberland’s approval for the MPI License in Singapore highlights the increasing global acceptance of digital assets. According to a noted expert in the field, this development could signal a broader trend as more traditional financial institutions seek to integrate blockchain technologies into their operations. “We could see a scramble among firms to establish a foothold in Singapore, making it a central hub for crypto-related innovations,” they speculated.

Looking Forward: The Future of Cumberland in Asia

With the potential of the MPI License looming, the future looks promising for Cumberland’s expansion in Asia. Will we witness a new era of digital asset compliance and legitimacy in the region? As regulatory frameworks evolve and more firms seek to enter this rapidly developing market, Cumberland stands poised to play a significant role in shaping the digital financial landscape of Southeast Asia.

Conclusion: A New Dawn for Digital Assets

The recent developments surrounding Cumberland serve as a timely reminder of the transformative potential of digital assets and the crucial role that regulatory frameworks play in shaping their future. As more crypto firms make strides toward compliance in regions like Singapore, the overall landscape may become increasingly sophisticated and stable. What are your thoughts on Cumberland’s journey? How do you think this will impact the broader crypto market? Share your insights and let’s engage in a meaningful discussion!