The cryptocurrency market is riding a wave of optimism today, bouncing back from a weekend slump with impressive gains. As of Monday morning (UTC), the total market capitalization has surged by 4.4%, reclaiming the significant milestone of $4 trillion. Out of the top 100 cryptocurrencies, a striking 97 have witnessed an uptick in price over the past 24 hours, signaling a robust rally in digital assets. With total trading volumes hitting an eye-watering $270 billion, it appears the market is shaking off the weekend’s correction.

So, what does this mean for investors and the future of crypto? Let’s break down the happenings and analyze the potential implications of this resurgence.

As observed, all of the top ten cryptocurrencies have experienced price increases. Bitcoin (BTC) has surged by 2.9%, currently trading around $115,097. This may seem modest, but given its previous volatility, stability is key. Ethereum (ETH), on the other hand, has rebounded sharply, climbing 8.7% to reach $4,152. Dogecoin (DOGE) is also making waves, advacing 10% to a price of $0.2087. In stark contrast, Tron (TRX) recorded the lowest increase among the top 100, with just a 2.2% uptick, landing at $0.3227.

The weekend correction, which saw some steep declines across the board, effectively “cleaned out the excessive leverage” and reset market risks, according to experts. As noted by Nick Forster, founder of the options platform Derive.xyz, this kind of volatile fluctuation can serve as a necessary reset button for the market. Notably, this downturn was partly driven by renewed fears over US-China trade relations, a situation that has kept investors on edge.

Many industry analysts have pointed out that while the arrival of spot crypto ETFs and increasing institutional interest sparked a sense of security among investors, the current environment is a reminder that the crypto market still harbors significant risks. The panic selling and forced liquidations that occurred over the weekend were exacerbated by thin order books and leveraged positions, resulting in a rapid cascade of losses.

🔍 Expert Insights

Crypto analyst Nic Puckrin highlighted that the recent market developments should serve as a wake-up call. “What we witnessed is a brutal lesson in the nature of crypto trading,” he stated. “As the market matures, the risks simply become more amplified. Now that the dust has settled, however, many blue-chip tokens have rebounded remarkably, with Ethereum particularly showing resilience above the $4,000 mark.” Puckrin cautioned that investors should remain vigilant, especially given the fluctuations in liquidity and the geopolitical uncertainties that loom.

🚀 Looking Ahead

Looking into the future, Bitcoin currently faces a critical juncture at $115,097. Analysts are eyeing key resistance levels closely. If it surpasses $117,000, a rally towards $124,000 could be on the horizon, potentially retesting previous highs. However, there are scenarios where a drop below $108,000 could spiral the price downwards toward $103,000 and potentially below the psychological barrier of $100,000.

Ethereum finds itself in a similar predicament, having fluctuated between $3,802 and $4,196 in the past day. Observers believe that a breakout above $4,055 could set the stage for further upward movements, possibly reaching $4,200 and beyond. But a slip below $3,720 could prompt a revisitation of the $3,512 zone.

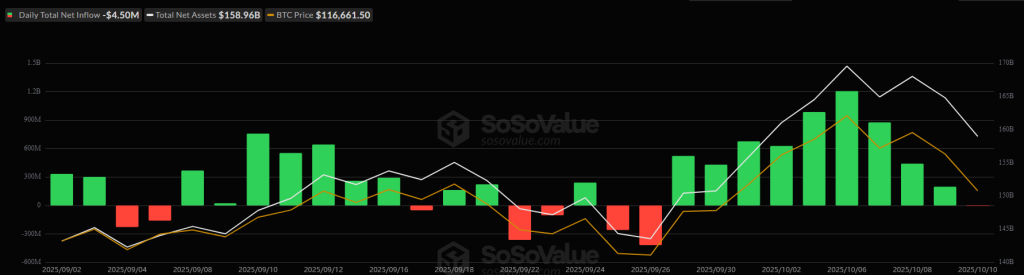

Adding to the intrigue, the recent outflows from spot ETFs in the U.S. raise questions about investor confidence. On Friday, BTC ETFs saw outflows of $4.5 million, while ETH ETFs experienced a staggering $174.83 million in outflows, with major players like BlackRock and Grayscale leading the pack in divestments. This mixture of flight and recovery adds complexity to the current market scenario.

Meanwhile, notable institutional actions are notable. MARA Holdings has acquired an additional 400 BTC on Monday, adding nearly $46.31 million worth of Bitcoin to its already sizable portfolio of 53,250 BTC, illustrating how institutional interest remains a significant factor in this market landscape.

MARA Holdings, which holds 52,850 $BTC($6.12B), bought another 400 $BTC($46.31M) through #FalconX 2 hours ago.https://t.co/pz4qGMyLze pic.twitter.com/2R42GgwLn4— Lookonchain (@lookonchain) October 13, 2025

As investors keep one eye on the market and the other on global events, one question lingers: is this rally sustainable? With the backdrop of geopolitical tension and fluctuating liquidity, only time will tell whether the recent rebound is a precursor to lasting growth or just another blip in the volatile crypto landscape.

What do you think? Can Bitcoin and Ethereum maintain these upward trends, or are we on the brink of another pullback? Let us know your thoughts in the comments below!

For more information on cryptocurrency trends and live updates, check out [CoinMarketCap](https://coinmarketcap.com) and [CoinGecko](https://www.coingecko.com).