The cryptocurrency market is showing a vibrant resurgence today, with a wave of green sweeping across the charts of top coins. Although the total market capitalization has dipped slightly by 2.7% in the past 24 hours, it still stands robustly above the pivotal $4 trillion mark at $4.03 trillion. Meanwhile, trading volumes have receded to approximately $148 billion, a decline from the previously seen levels of around $220 billion.

In a nutshell, here’s what you need to know: Bitcoin (BTC) is trading at $118,976, while Ethereum (ETH) is valued at $3,886. Binance Coin (BNB) has made headlines by reaching an impressive all-time high of $852. Analysts are optimistic, with future projections suggesting Bitcoin could escalate to $132,000 shortly, and surge up to $150,000 by year-end. Equally exciting is the soaring likelihood of Ethereum hitting the $6,000 mark by December 25, which has increased more than fourfold recently.

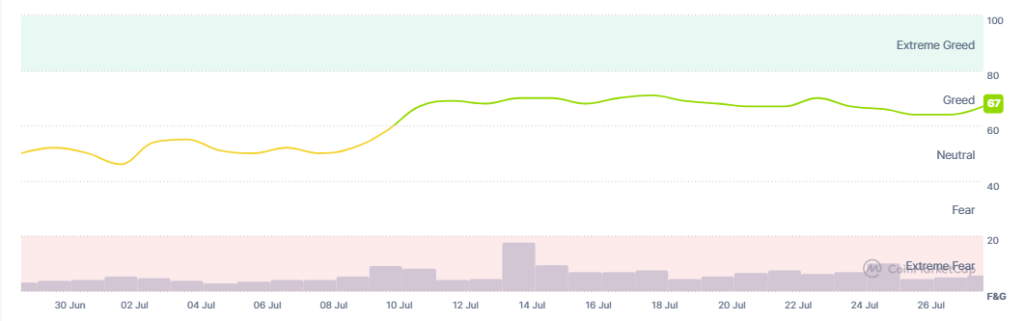

Moreover, the U.S. Ethereum spot ETFs have experienced 16 consecutive days of inflows, signaling robust institutional interest. Bitcoin spot ETFs also report a healthy inflow of $130.69 million, making it a promising time for crypto enthusiasts and investors alike. Interestingly, the market sentiment is firmly planted in the lower end of the greed zone, indicating a cautious yet optimistic outlook from traders.

When we examine the dynamics of the top 10 cryptocurrencies, we see a remarkable performance across the board. Bitcoin has appreciated by 0.6% within a day, while Ethereum boasts a larger increase of 2.8%. Notably, Binance Coin leads the pack with a stellar rise of 6.6% and now rests at its all-time high. Meanwhile, the notable underperformers include Tron (TRX), which registered a minor increase of 0.2%.

Among the top 100 coins, three have achieved remarkable double-digit gains, with SPX6900 (SPX) surging by 12.1%. Optimism (OP) and Ethena (ENA) follow closely with gains of 11.2% and 10.7%, respectively. On the flip side, fewer than ten coins have experienced declines, with Curve DAO (CRV) standing out with a 5.9% drop.

As the market reacts positively to signals of increasing adoption despite ongoing macroeconomic challenges, some analysts have embarked on bold predictions. Matt Hougan, chief investment officer at Bitwise, argues that traditional models may not fully capture the volatility and potential of Bitcoin. He suggests we might break away from historical patterns and instead experience a robust upward trajectory over the next few years.

🚨DID I HEAR SUPER CYCLE??? The four-year cycle is dead and adoption killed it.@Matt_Hougan says we’re going higher in 2026. Early profit takers will be left behind!!! Full breakdown with @JSeyff and @Matt_Hougan in comments👇 pic.twitter.com/Ffn9penapN— Kyle Chassé / DD🐸 (@kyle_chasse) July 25, 2025

Taking a closer look at Bitcoin’s trajectory, experts like John Glover, CIO of Ledn, suggest that we are in a pivotal phase of price development. He notes that Bitcoin is currently completing a “wave 4” of a larger cycle and anticipates a move towards $132,000 before experiencing a correction. Meanwhile, the options market reflects growing confidence in Bitcoin’s performance, with a compelling 52% implied chance of reaching $150,000 by year-end.

BTC Price Chart Analysis: The outlook for Bitcoin’s price trajectory suggests an upward momentum.

Nick Forster, founder of the on-chain options platform Derive.xyz, further emphasizes the invigorated optimism surrounding Ethereum. He points to a quadrupled probability for ETH reaching $6,000 by Christmas, surging from just below 7% at the start of July to over 30% currently. This shifting marketplace seems to illustrate a substantial re-pricing of risk appetites.

Ethereum Price Trends: The probability of ETH rising has dramatically increased, indicating a growing bullish sentiment.

Market watchers are keenly monitoring critical price levels for Bitcoin and Ethereum. As of the latest updates, Bitcoin is trading at $118,976, having fluctuated between a daily low of $117,914 and a high of $119,754. Interestingly, Bitcoin has remained stable over the past week, showcasing an impressive 10.7% rise over the month.

Ethereum, too, has demonstrated solid resilience. After commencing the day at $3,762 and reaching a peak of $3,936, it is evident that ETH is performing favorably, with many analysts confidently predicting a push toward the $4,000 milestone in the coming days.

The cryptocurrency sentiment has remained robust, as indicated by the Crypto Fear and Greed Index, which reflected a shift from 64 to 67, suggesting growing bullish sentiment among investors. This steady sentiment has persisted in what many hope could lead to a prolonged rally.

Crypto Sentiment Overview: The sentiment remains steadfast, indicating confidence among traders and investors.

The activity surrounding Bitcoin and Ethereum ETFs in the U.S. further paints a promising picture for the market. Recent records show Bitcoin spot ETFs inviting positive inflows, such as an impressive $130.69 million on July 25, while cumulative inflows have exceeded $54.82 billion. Notably, BlackRock is leading the charge in attracting these investments.

ETF Inflows Overview: Bitcoin and Ethereum ETFs are becoming increasingly popular, drawing substantial investments.

In an intriguing market development, Metaplanet, a Tokyo-listed firm, has recently expanded its Bitcoin holdings by adding 780 BTC to its treasury, bringing the total to 17,132 BTC. This reflects a growing interest in Bitcoin accumulation among institutional investors. Furthermore, SharpLink Gaming made headlines with its acquisition of 77,210 ETH for $295 million, signaling robust institutional support for Ethereum as well.

*Metaplanet Acquires Additional 780 $BTC, Total Holdings Reach 17,132 BTC* pic.twitter.com/0gw3HwpUCH— Metaplanet Inc. (@Metaplanet_JP) July 28, 2025

SharpLink(@SharpLinkGaming) bought another 77,210 $ETH($295M) and currently holds 438,017 $ETH($1.69B). https://t.co/143CVq5E6U— Lookonchain (@lookonchain) July 28, 2025

As we navigate through this dynamic landscape, it’s crucial for investors and enthusiasts alike to keep a keen eye on market fluctuations and emerging trends. The convergence of institutional interest, positive market sentiment, and predictions of significant price movements sets the stage for an exciting future in the crypto space.

With this in mind, it’s worth pondering: Will the current upward trend hold, or are we poised for corrections ahead? While uncertainty lingers, the enthusiasm surrounding cryptocurrencies remains palpable. Should you dive into this market now or wait for potential dips? Only time will tell, but remaining informed and vigilant is key to navigating these exciting yet unpredictable waters.