Bitcoin Holds Steady as Market Dynamics Shift

As Thursday unfolded, Bitcoin marked its territory close to the $82,000 level, with a slight dip of 0.6%. However, behind this modest decline lies a wealth of news and developments that are stirring both optimism and interest in the crypto market. Recent regulatory shifts and signs of institutional adoption are influencing market sentiment, leading many experts to speculate on Bitcoin’s imminent path.

A highlight of the day was the Senate’s confirmation of Paul Atkins as the new Chair of the SEC, a move that many view as ushering in a promising phase for U.S. crypto regulation. In addition, the prediction market Kalshi has introduced Bitcoin deposits, while a new lawsuit has raised intriguing questions about the identity of Bitcoin’s enigmatic creator, Satoshi Nakamoto. Collectively, these events suggest a swell of institutional interest and potential improvements in regulatory frameworks that could significantly impact Bitcoin’s future.

The SEC’s New Chapter: Paul Atkins Takes the Helm

The U.S. Senate recently cast a pivotal vote, confirming Paul Atkins as the next Chair of the Securities and Exchange Commission (SEC) with a vote margin of 52-44. This change comes as a breath of fresh air for cryptocurrency enthusiasts and investors alike, as Atkins is known for his pro-crypto stance. A former SEC commissioner, Atkins has vocalized intentions for a “coherent and principled” approach to digital asset regulation, aiming to foster a more inviting environment for innovative projects in the crypto space.

Atkins’ appointment is particularly noteworthy as it follows the discontinuation of several enforcement actions that marked the SEC’s previous strategy. With his prior experience leading the Token Alliance and a personal crypto asset portfolio valued up to $6 million, analysts expect his leadership to enhance institutional confidence and catalyze new investments into Bitcoin and Web3 projects.

JUST IN: Pro-#Bitcoin Paul Atkins confirmed as Chairman of the SEC 🇺🇸

pic.twitter.com/nkfCMUXikt

DHS Lawsuit Sparks Curiosity About Bitcoin’s Mysterious Creator

In a surprising twist, attorney James Murphy has filed a lawsuit against the Department of Homeland Security (DHS) demanding the release of documents that allegedly detail interviews with Satoshi Nakamoto, the pseudonymous architect of Bitcoin. This lawsuit is igniting discussions about the origins of Bitcoin and has the potential to create ripples in its market dynamics.

Murphy references a 2019 DHS presentation that hinted at discussions with multiple individuals claiming to be Bitcoin’s founders. Although concrete transcripts remain elusive, this case could reignite volatility in Bitcoin’s price as speculation swirls over potential government affiliations with its enigmatic creator. As discussions rise concerning U.S. lawmakers contemplating a national Bitcoin reserve, credible links to its past could reinforce Bitcoin’s legitimacy in institutional frameworks.

JUST IN: CRYPTO LAWYER JAMES MURPHY SUES THE U.S. DEPARTMENT OF HOMELAND SECURITY TO REVEAL WHO THEY BELIEVE IS BITCOIN’S CREATOR, SATOSHI NAKAMOTO.

Source: @Cointelegraph

pic.twitter.com/RUz0dXyq2B

Kalshi Embraces Bitcoin: Expanding Crypto Engagement

In an exciting development, the prediction market Kalshi has begun accepting Bitcoin deposits, further integrating the leading cryptocurrency into its platform. With regulatory oversight from the CFTC, Kalshi now features over 50 BTC-based event contracts, providing traders with novel ways to engage with Bitcoin’s future.

The platform has already managed to process $143 million in trading volume for Bitcoin-related events, showcasing its growing influence. Kalshi’s structure allows users to convert BTC to USD seamlessly via its partnership with ZeroHash, reinforcing Bitcoin’s use case beyond mere investment vehicles and demonstrating rising interest among traders and speculative users alike.

Fund your Kalshi account with Bitcoin, trade on anything.

Powered by @ZeroHashX

The Technical Landscape: Is Bitcoin on the Brink of a Breakout?

Currently, Bitcoin is engaged in a tight contest near the $82,000 mark, approaching a critical resistance level at $83,500. This particular price zone intersects with both a noteworthy supply area and the 50 EMA at approximately $80,800. Analysts are keeping a vigilant eye on Bitcoin’s performance as it attempts to either break through this barrier or face a downturn.

- A breakthrough above $84,000 could pave the way for price movements toward $86,400.

- However, a failure to surpass this resistance may result in a retreat to $80,000—or even $77,800.

- The RSI currently at 56 indicates growing momentum, although not in overbought territory just yet.

Bitcoin Price Chart – Analysis from Tradingview

Exciting New Opportunities Ahead: BTC Bull Presale

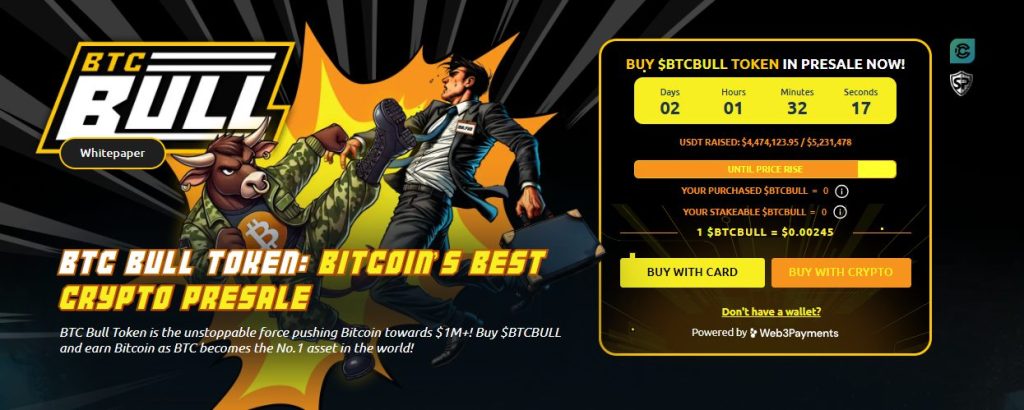

Another innovative entry into the cryptocurrency landscape is the BTC Bull ($BTCBULL) presale, which is making waves by merging the playful aspects of meme culture with genuine utility. This token is designed for long-term investors, offering rewards of real Bitcoin as BTC reaches crucial price milestones—connecting community interests directly with Bitcoin’s growth trajectory.

The BTC Bull project also features a staking program that boasts an impressive 119% APY, allowing participants to generate passive income while supporting the network. With over 882.5 million BTCBULL tokens already staked, engagement in this community initiative is on the rise.

Latest Presale Updates:

- Current Token Price: $0.00245 per BTCBULL

- Funds Raised So Far: $4.47 million of $5.23 million target

With the presale gaining traction and demand intensifying, now is a critical moment to secure BTCBULL at presale prices before the next anticipated jump. The crypto landscape continues to evolve rapidly, and staying informed is essential for those looking to navigate this exciting frontier.

Conclusion: Stay Engaged and Informed

The dynamics of Bitcoin’s price movement and the broader cryptocurrency market remain compelling and complex. As regulatory landscapes shift and institutional interest grows, there are profound implications for the future of digital assets. Whether you are a seasoned trader or a crypto enthusiast, the unfolding events present an abundance of opportunities for engagement and investment.

What do you think about the recent moves in the crypto space? Will the new SEC leadership bring about lasting changes? Join the conversation and share your insights with others!