The cryptocurrency market is experiencing a notable downturn today, with the total market capitalization slipping by 1.4% and now standing at approximately $3.88 trillion. Among the top 100 cryptocurrencies, a staggering 93 have faced declines within the last 24 hours. As trading activity remains robust, the total cryptocurrency trading volume has reached about $194 billion. It’s a reflection of the ongoing volatility that crypto enthusiasts have come to expect.

As of Thursday morning (UTC), the details of the market reveal some concerning trends. Bitcoin (BTC), once a symbol of hope and growth, has seen a decrease of 2.2%, now hovering around $110,774. Ethereum (ETH) isn’t faring any better, falling by 4.4% to approximately $3,993. Notably, this latest decline has forced many top buyers into a loss as BTC has dropped below the critical cost-basis zone between $117,000 and $114,000.

This latest contraction is particularly troubling, echoing sentiments from analysts regarding the fragility of the current market landscape. Amidst this backdrop, a previously dormant Bitcoin wallet suddenly sprung back to life, transferring 2,000 BTC—worth around $222 million—across 51 new addresses, leading to speculations about potential sell-offs or simply fund shuffling among early holders.

Just In: #Bitcoin OG has moved 2,000 $BTC ($222.13M) into 51 new wallets.Of these, 50 wallets received 37.576 $BTC each, while one wallet received 121.18 $BTC. https://t.co/hR8Dy1qOa9 pic.twitter.com/NTGinarEae

Investors and observers are left wondering what this means for the broader market. Could this indicate a shift in sentiment, or is it simply a case of market mechanics at work?

Expert analysts from Glassnode have pointed out that Bitcoin’s surge to $126,100 was abruptly halted by macroeconomic stresses and a massive $19 billion futures deleveraging—one of the most significant we’ve seen. Their report raises a crucial point: the recent drop below the $117,000–$114,000 range has left many investors—especially seasoned ones—dipping into loss territory. The report emphasizes a provable pattern: when the price of Bitcoin fails to maintain this crucial support zone, history suggests it often precedes a deeper correction.

An Early Black Friday: Bitcoin’s rally to $126k reversed amid macro stress and a $19B futures wipeout… Read the full Week On-Chain below👇 https://t.co/Osm96VjuJg

What’s next for Bitcoin? As it trades at $110,774, its intraday movements paradoxically showcase both resilience and vulnerability. After touching an intraday high of $112,697, BTC fell to as low as $110,392. A breakthrough above $114,600 could open doors toward $117,600, possibly leading to levels around $120,000. Conversely, a downturn could see Bitcoin testing critical thresholds around $109,500 or even slipping beneath the $100,000 mark.

Turning our attention to Ethereum, the second-largest cryptocurrency, it currently trades at $3,993 after seeing peaks of $4,165 truncate into lows of $3,944. The current price action places ETH in a consolidation phase between the $3,900 and $4,700 mark—an equilibrium that traders are anxiously monitoring, with possibilities of further declines toward $3,700 and potentially $3,550, or a surge that could break the $4,200 barrier to target $4,450.

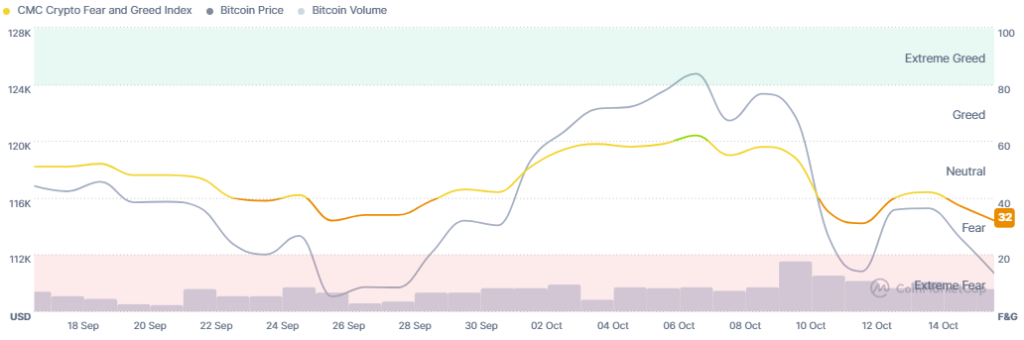

Meanwhile, the sentiment across the crypto landscape has been muted, with the market oscillating in the ‘fear’ zone, reaching lows last seen in April. The crypto fear and greed index has plummeted from 37 to 32, indicating a growing caution among traders and investors alike. It raises intriguing questions: Is this fear a prelude to further price drops, or could it create opportunities for savvy buyers willing to dive in during the downturn?

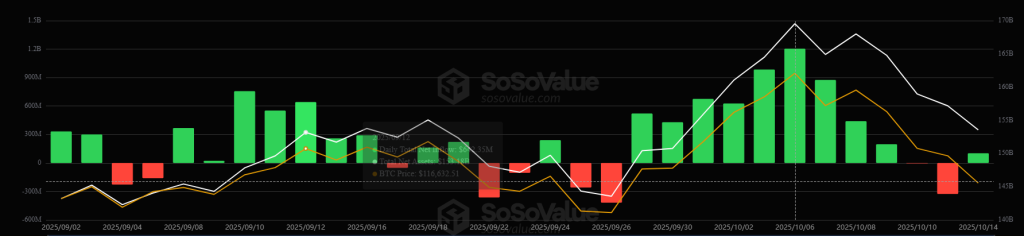

In the realm of exchange-traded funds (ETFs), the latest data presents a mixed bag. During a rare inflow, US BTC spot ETFs saw a stark turnaround, facing $94 million in outflows just a day after experiencing positive flows. This indicates a palpable shift in institutional demand, sparking concerns among market observers. In contrast, ETH spot ETFs enjoyed a slight uptick with inflows of $5.32 million, bringing their total to $14.72 billion.

Perhaps more notably, BitMine Immersion Technologies has made headlines by bolstering its Ethereum stash with an additional 104,336 ETH valued at around $417 million. This acquisition boosts their total holdings to a staggering 3.03 million ETH—an ambitious strategy aimed at achieving 5% of Ethereum’s total supply.

It looks like Bitmine(@BitMNR) just bought another 104,336 $ETH($417M)… despite the crypto market crash, Tom Lee still predicts $ETH will hit $10K by year-end. https://t.co/KewyZ4cAeP

Additionally, excitement is brewing as the US Office of the Comptroller of the Currency (OCC) has granted preliminary conditional approval to Erebor Bank, a new financial institution supported by notable figures like Peter Thiel. These developments could serve as a counterbalance to the market’s current unease, potentially paving the way for more stable investment avenues.

The OCC granted preliminary conditional approval to Erebor Bank… https://t.co/9G7WkRRohN

As we navigate this turbulent period in the crypto market, the key takeaway is that volatility is the new norm, and staying informed can mean the difference between capitalizing on dips and succumbing to market fears. Will we see a recovery, or are we on the brink of more drastic adjustments? Only time—and informed decision-making—will tell.

Stay tuned for our next updates as we continue to bring you the latest from the world of cryptocurrency. How are you preparing for the next move in this ever-changing market landscape?