The Crypto Market: A Mixed Bag Amid Uncertain Times

As the crypto market navigates a turbulent landscape today, there’s a slight glimmer of hope breaking through the gloom. While overall market momentum remains muted with a 2.3% dip in total capitalization, the scene is not entirely bleak. Almost 30 of the top 100 cryptocurrencies have shown positive movement over the past 24 hours, suggesting pockets of resilience within the digital ecosystem. Currently, the cryptocurrency market capitalization hovers around $3.38 trillion, with trading volumes touching $101 billion—a noticeable decline from the highs of the previous days.

📌 Why This Matters

In the ever-evolving world of cryptocurrencies, a downturn can trigger a ripple effect across investor sentiment. The current market dip reflects not just price fluctuations but broader economic uncertainties and geopolitical tensions that investors are closely monitoring. Understanding these dynamics is crucial not only for trading decisions but also for assessing the future trajectory of the cryptocurrency landscape. With significant events unfolding, such as the recent US Federal Reserve meeting, the stakes are higher than ever for traders and enthusiasts alike.

🔍 A Closer Look at Major Players

For many, Bitcoin (BTC) and Ethereum (ETH) serve as the barometers for the broader crypto market. Over the last day, BTC has seen a minor decline of 0.1%, stabilizing around $104,812, while ETH has slightly climbed by 0.1%, now trading at $2,524. Both cryptocurrencies have danced around key price levels, with Bitcoin struggling to maintain the $105,000 mark while Ethereum witnessed fluctuations between $2,471 and $2,541. This tight trading range reflects uncertainty as investors wait for clearer signals in the market.

Among the top ten cryptocurrencies, the landscape appears divided. Famous tokens like XRP have managed to hold their ground, with a commendable increase of 0.4% bringing its price to $2.16. Conversely, Solana (SOL) faced a steeper drop of 1.3%, falling to $145, illustrating the unpredictable nature of market dynamics.

🔥 Expert Opinions on Current Trends

Analysts are weighing in on the current trend with cautious optimism. “We’ve seen a slight shift as funding rates for both BTC and ETH have turned positive,” remarked an analyst from Glassnode, hinting at a potential recovery in market sentiment. Additionally, resources like YouHodler note that increasing geopolitical tensions, particularly the US’s involvement in the Middle East, could pose hurdles for price stability, underscoring a delicate balance that requires careful navigation.

Essentially, rising inflation could either position cryptocurrencies as a hedge against economic instability or deter investment through increased interest rates. “As the Fed signals a possibility of maintaining elevated rates, the interplay between traditional asset classes and cryptocurrencies becomes even more significant,” they stated.

🚀 Future Outlook: What Lies Ahead?

The journey ahead for the crypto market is fraught with challenges but also ripe with opportunities. As Bitcoin settles at $104,812 and Ethereum at $2,524, observers are keenly considering the implications of the upcoming economic reports. If the crypto market experiences a resurgence, bolstered by regulatory developments, it could pave the way for renewed investor interest amidst fluctuating conditions.

The recent influx into US spot Bitcoin ETFs signals that institutional confidence might be re-emerging. With net inflows spiking, particularly from influential players like BlackRock and Fidelity, the stage is set for potential upward shifts in asset allocations that could rejuvenate prices in the near term.

🌐 Market Sentiment: A Snapshot of Current Mood

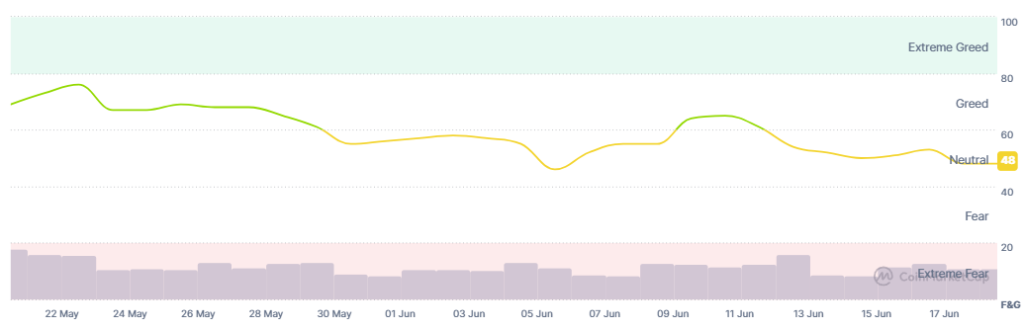

The current market sentiment mirrors a fragile equilibrium. The Fear and Greed Index remains steady at 48, indicating a state of ambivalence. While fear can prompt buying opportunities, there’s still room for the mood to shift towards greed if more positive indicators emerge.

✨ Key Developments and Market Movements

Today’s trading session has also been notable for various-sized players. Kaia (formerly Klaytn) continues to make waves with a substantial 9% increase, now valued at $0.1779, while Sei (SEI) follows closely with a 7.8% rise to $0.1836, showcasing the potential of emerging cryptocurrencies. Meanwhile, Hyperliquid (HYPE) faced a challenging day, dropping 5.4% to $37.93.

🚀 Kaia Hub is live! Your all-in-one gateway to explore @KaiaChain just got easier. Track assets, discover dApps, swap tokens, and more. Built by @Xangle_official to celebrate their GC membership. 👉 Dive in: https://t.co/zTpHEKUGED pic.twitter.com/yjAXvWg8cQ

🔮 In Conclusion: Keeping a Close Eye on Developments

The crypto market remains a thrilling ride, characterized by volatility and potential. As we absorb the latest news and market data, it’s clear that staying informed is paramount. With institutional money flow trending upwards and key economic insights on the horizon, the next steps for cryptocurrencies could be defining for investors and enthusiasts alike.

Join the discussion below! What are your thoughts on the market’s direction? Are you feeling bullish or bearish in these uncertain times?