Bitcoin Trading Volume Takes a Dive: Analyzing the Trends

The cryptocurrency landscape has seen dramatic shifts lately, especially in terms of Bitcoin trading activity. Following a peak in early February, the excitement has dulled with spot trading volumes nosediving significantly. What does this mean for traders, investors, and the crypto market at large? Let’s break it down.

From Boom to Bust: The Numbers Tell the Story

As of earlier this year, Bitcoin trading volumes were soaring at an impressive $44 billion on February 3. Fast forward to the end of the first quarter, and that number plummeted to a stark $10 billion. This staggering decline was accompanied by a similar slump in altcoin trading volumes. From a robust $122 billion in early February, altcoin trades dwindled to just $23 billion by the end of March, as highlighted in the recent CryptoQuant Report.

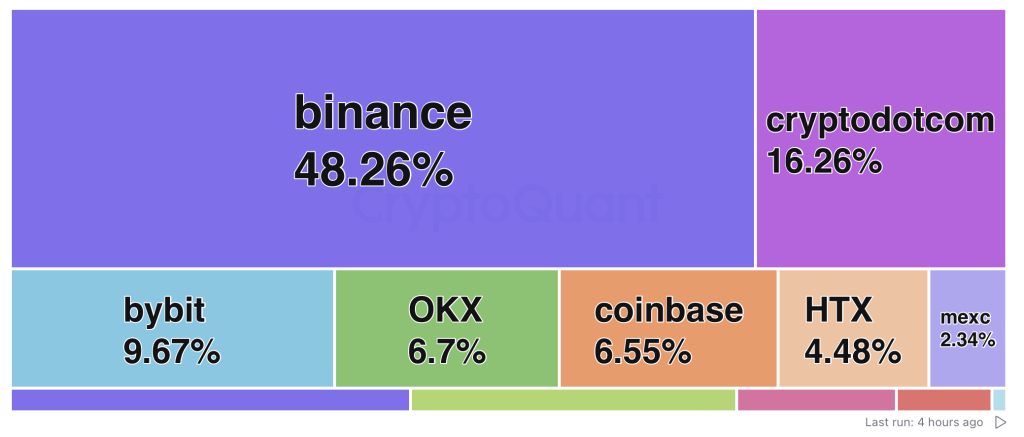

Binance Emerges as the Dominant Player

In a surprising twist, Binance, the leading cryptocurrency exchange, has not only weathered this storm but has also significantly increased its market share. The platform’s share of Bitcoin spot trading volume surged from 33% on February 3 to an impressive 49% by the end of the first quarter. This increase signals a clear trend: while overall trading volumes decreased, Binance is effectively capturing a larger slice of the pie.

This fortification of Binance’s position points to its crucial role as a liquidity provider, particularly during unpredictable market phases. As competition among exchanges stiffens, Binance has adeptly maneuvered to emerge as a liquidity haven, attracting traders when other platforms struggle.

Why This Matters: Investor Confidence Shaken

The decline in trading volumes across the market signals a potential waning of investor enthusiasm. As Bitcoin’s volatility intensifies, curiosity gives way to caution. Since Bitcoin’s price tumbled from $96,000 to $90,000 in late February, many traders have grown hesitant. In stark contrast, Binance recorded trading volumes that surpassed those of all other exchanges combined during these turbulent times, exhibiting its ability to draw in traders even when others falter.

Binance is winning the volume war.Since Feb 3, BTC spot volume fell from $44B to $10B, alts from $122B to $23B.As others shrank, Binance took 49% of BTC trades and 64% of altcoin volume during the market drop. pic.twitter.com/PbPCP4XaYz— CryptoQuant.com (@cryptoquant_com) April 9, 2025

Expert Insights: What Analysts Are Saying

Market experts are weighing in on these developments. Tom Smith, a cryptocurrency analyst at CryptoInsights, stated, “Binance’s ability to maintain and even grow its market share during this downturn emphasizes the importance of liquidity. Traders are gravitating towards platforms that can handle significant fluctuations and provide immediate access to trades.” The message is clear: choose your exchange wisely, especially during volatile phases.

Future Outlook: Is This the New Normal?

As we gaze into the future, the question on everyone’s mind is: will this trend continue? Some analysts suggest that as long as Bitcoin remains volatile, exchanges like Binance will likely thrive. The resilience shown by specific altcoins such as Binance Coin (BNB), Toncoin (TON), and EOS indicates that despite a broader market decline, pockets of interest remain vibrant. This could signify a shift in liquidity towards certain tokens, suggesting that targeted investments may become a more favorable strategy.

Conclusion: Navigating the Shifting Tides of Crypto Trading

In summary, the cryptocurrency space is experiencing a significant transformation as trading volumes dwindle amid increasing volatility. Binance’s ascendancy suggests that liquidity and reliability are becoming critical components for traders. As the market continues to evolve, participants should stay attuned to these shifts to make informed trading decisions. Are you adapting to the changes in trading volume and liquidity? We’d love to hear your thoughts in the comments below!