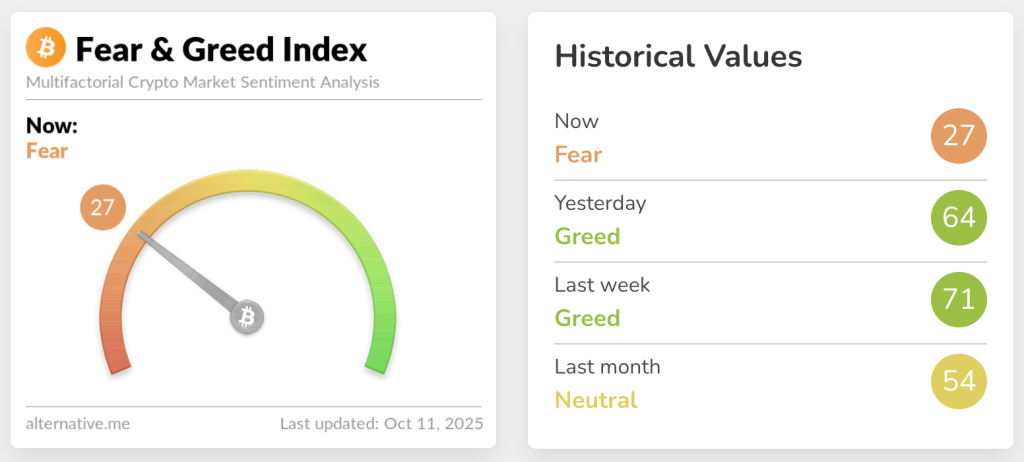

The cryptocurrency world has been rocked by a seismic shock as the Fear and Greed Index made a dramatic leap from a robust score of 64 (indicative of greed) to a worrying 27 (indicating fear) in just 24 hours. This upheaval followed President Donald Trump’s startling announcement of a 100% tariff on Chinese imports, a move that CoinGlass has dubbed “the largest liquidation event in crypto history.” With over 1.66 million traders facing liquidation, estimated total losses reportedly exceeded $19.33 billion, and some estimates suggest the figure could soar beyond $30 billion due to discrepancies in reporting from exchanges like Binance, which only logs one liquidation order per second.

In a matter of mere hours, the crypto market cap experienced a staggering 9% drop, plummeting alongside Bitcoin, which tumbled from above $122,000 to a low of $102,000. Ethereum also felt the pinch, sliding from $4,783 to $3,400 before attempting a recovery. This rapid descent saw approximately $1 trillion wiped from the market cap in the blink of an eye, particularly in an hour where over $7 billion in long positions were liquidated. It was a harsh reminder of just how volatile the crypto market can be.

Long positions bore the brunt of this wave of liquidations, incurring losses of $16.83 billion, while short positions faced losses of $2.49 billion. Leading the charge in liquidations was Bitcoin, erasing $5.38 billion, followed closely by Ethereum at $4.43 billion, and other major players like Solana and XRP. Notably, Hyperliquid experienced the largest single liquidation, with an ETH-USDT position burning through $203.36 million. The exchange accounted for about 53% of all liquidations, a staggering $10.3 billion, with Bybit, Binance, and OKX trailing behind.

“The $10B liquidation figure floating around is fake; the real number is likely much higher, somewhere in the $30B–$40B+ range…” — MLM (@mlmabc) October 11, 2025

The sheer scale of this liquidation dwarfed previous catastrophic events in cryptocurrency history, rivaling the COVID crash of March 2020, which saw $1.2 billion in liquidations, and the FTX collapse of November 2022, with $1.6 billion. Friday’s event was approximately 20 times larger than the drastic drops seen during COVID, shifting the focus of many analysts to potential market contagion and counterparty risks.

Historically, October has been a strong month for Bitcoin. Economist Timothy Peterson pointed out that significant drops of over 5% in October are “exceedingly rare,” occurring only four times in the last decade. Previous rebounds following such declines have typically mirrored impressive recoveries: Bitcoin bounced back by 16% in 2017, 4% in 2018, and a remarkable 21% in 2019. However, 2021 saw a dip of 3% after a similar drop. Given this history, many are wondering if Bitcoin can conjure a rebound from its current $102,000 low, potentially pushing it towards the $124,000 range if past trends hold.

Yet, looming policy uncertainty adds a layer of complexity to these predictions. Trump’s anticipated tariff announcement on November 1 related to China’s rare earth element export restrictions casts a long shadow over the market. His suggestion of reversing the tariffs if China alters its approach might offer a glimmer of hope for short-term recovery, yet the damage from the recent liquidations has already set a precedent for caution.

Market analysts are divided over the implications of this liquidation event. While some, like Jan3 founder Samson Mow, maintain an optimistic view of Bitcoin’s future, stating that there are still 21 days left in October, others like MN Trading Capital’s Michael van de Poppe express a belief that we may have witnessed the bottom of the current cycle. The crypto community is rife with diverse opinions, with some advocating for a long-term approach, projecting a future where prices could crash from $1 million to $800,000 in mere hours.

The Fear and Greed Index—now at 27, down from 64 yesterday—reflects one of the fastest sentiment changes witnessed in crypto history. Bitcoin itself reached a six-month low, illustrating the drastic shift in market psychology.

As the dust begins to settle around this historic event, analysts are sifting through the rubble for signs of recovery or further decline. Bitcoin currently hovers around $111,522 after bouncing back from its recent low, eyeing critical support levels between $110,000 and $113,000. A successful hold above $113,500 could signal a potential relief rally for Bitcoin.

“$BTC dumped to $102,000 level and nearly took down the entire market… right now, Bitcoin is trying to reclaim the $113,500 level.” — Ted (@TedPillows) October 11, 2025

Ethereum has also shown signs of resilience, recovering to around $3,833 after testing the $3,400 mark. However, it too faces resistance, particularly around the $4,000 psychological barrier. For Ethereum, maintaining support in the $3,600 to $3,800 region is crucial, as failing to reclaim $4,000 may lead to further testing of lower levels.

Both Bitcoin and Ethereum must navigate an uncertain landscape in the wake of this monumental liquidation event. Bitcoin needs to decisively reclaim and stabilize above $113,500 to validate a recovery trajectory aiming for levels of $117,000 to $120,000. Conversely, a failure in this regard could see Bitcoin retesting the $102,000 low or even descending towards the $95,000 to $100,000 range. Ethereum faces a similarly precarious situation, requiring sustained performance above $4,000 to shift momentum towards higher price points, while a breakdown could see it testing critical lower boundaries around $3,600 to $3,800.

The recent clearance of heavily leveraged positions has reduced immediate selling pressure. Yet, persistent uncertainties surrounding tariffs and potential volatility suggest that a period of consolidation between current levels and recent lows is likely the outcome, before any definitive direction becomes apparent in this tumultuous market. For ongoing updates and expert opinions on this unfolding situation, stay tuned and engaged with our cryptocurrency news coverage.