Crypto Market Faces a New Downturn: What You Need to Know

The cryptocurrency market is experiencing yet another decline today, sending ripples of concern through the community. With only a couple of the top 100 cryptocurrencies showing any signs of growth over the past 24 hours, the market capitalization has taken a hit, plummeting 3.9% to $3.38 trillion. In the meantime, total trading volume remains stagnant at around $112 billion, mirroring yesterday’s figures.

📌 Why This Matters

This latest downturn is significant not only for traders but for the entire cryptocurrency ecosystem. The declining market cap and trading volume can indicate decreasing investor confidence, and potentially foreshadow further volatility. As the landscape evolves, understanding the interplay between macroeconomic trends and crypto movements is crucial for navigating these choppy waters.

🔥 Market Overview: The Current State of Major Coins

Today’s market data paints a gloomy picture, especially for top performers:

- Bitcoin (BTC): Plummeted 1.6%, dipping below the critical $105,000 mark and currently trading at $104,971.

- Ethereum (ETH): Experienced a 2% drop, now valued at $2,530 after a notable fluctuation from a high of $2,584 to a low of $2,464.

- XRP (XRP): Hit the hardest among the top coins, falling 3.6% to $2.15.

- Solana (SOL): Registered a decrease of 3.5%, now priced at $147.

- Tron (TRX): Managed to limit its losses to just 1.1%, trading at $0.2742.

Interestingly, only two coins, Kaia (KAIA) and Nexo (NEXO), emerged unscathed, reflecting increases of 6.1% and 0.6%, respectively. On the other hand, Sky (SKY) took a steep plunge, losing 8.8% to settle at $0.08404.

🚀 Major Developments: XRP ETF Approval

In a promising turn of events, Canada has approved the first-ever XRP exchange-traded fund (ETF) in North America, called the Purpose XRP ETF (XRPP), set to begin trading shortly. This move is significant as it allows for regulated, direct exposure to XRP, a welcome addition to the growing investment options in the crypto space. The Evolve XRP ETF is also on the horizon, set to commence trading on June 18.

June 18th. TSX. Get ready. Announcing the Purpose XRP ETF, offering regulated, direct exposure to spot #XRP, the native token powering fast, low-cost cross-border payments ⚡️🔗 Fund page: https://t.co/CfCEdbOUEp 🔗 Press release: https://t.co/8v1FPkXSdU… pic.twitter.com/uzNgZyRpC3— Purpose Investments (@PurposeInvest) June 16, 2025

‘Stablecoins Are Here to Stay’

In legislative news, the U.S. Senate has made headlines by passing the GENIUS Act—marking a pivotal regulatory framework specifically aimed at stablecoins. This legislation now moves to the House of Representatives for further consideration, heralding a new chapter in the oversight of digital assets.

Liat Shetret, Vice President of Global Policy and Regulation at Elliptic, emphasized the importance of this move, labeling it a necessary step toward establishing consumer protections and financial stability within the rapidly evolving digital assets landscape.

The U.S. Senate has passed the GENIUS Act — landmark stablecoin legislation that provides regulatory clarity, enhances consumer protection, and extends U.S. dollar dominance online. Thanks to President Trump for his leadership on crypto & @SenatorHagerty for authoring the bill.— David Sacks (@davidsacks47) June 17, 2025

📉 Why Are Crypto Prices Falling? Factors to Consider

At this moment, Bitcoin is trading at $104,971, down from an intraday high of $106,795. The cryptocurrency initially failed to maintain above the significant thresholds of $107,000, $106,000, and $105,000, breaking through the crucial support level of $106,196. This has led traders to eye the next support level at $104,633. While Bitcoin’s all-time high remains distant at $111,814, the potential for a recovery is always on the horizon.

Market analysts caution that short-term price fluctuations could hit Bitcoin with losses ranging from 10% to 20%, especially if the U.S. becomes more deeply entangled in the conflict following Iran’s recent military actions. Global crises often trigger a flight to safe-haven assets, impacting speculative markets like cryptocurrency.

💡 Current Market Sentiment and Future Outlook

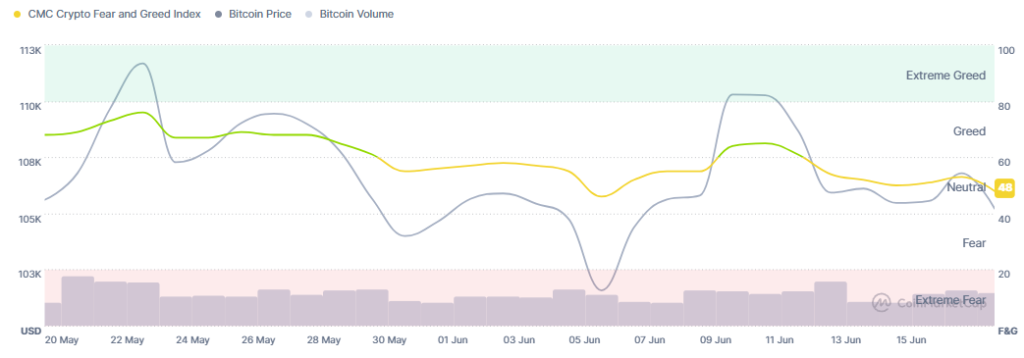

The mood among investors has turned sour, with the Fear and Greed Index nosediving from 54 to a precarious 48, signaling the first signs of fear creeping into the market. While still within neutral bounds, a further decline could indicate potential buying opportunities for savvy investors.

Meanwhile, U.S. spot BTC ETFs saw inflows continue for the seventh consecutive day, totaling $216.48 million on Tuesday. Interestingly, BlackRock accounted for a significant portion of this influx, illustrating the unabated institutional interest in Bitcoin.

🔍 Looking Ahead: what’s Next for Crypto Investors?

As the crypto market grapples with these unsettling trends, all eyes are trained on two primary factors influencing investor sentiment:

- The United States’ potential deeper involvement in the escalating tensions in the Middle East, especially surrounding Iran.

- The upcoming decision by the U.S. Federal Reserve on interest rates, which could have broad implications for various asset classes, including cryptocurrencies.

Tomorrow at 2:30 p.m. ET: Chair Powell hosts live #FOMC press conference: https://t.co/fXt6ew8I9A pic.twitter.com/OPKhd6eRKt— Federal Reserve (@federalreserve) June 17, 2025

🔗 Final Thoughts

The crypto market is in turbulent waters, but this is where opportunity lies for those willing to navigate the choppy seas. With the right insights and strategies, investors can position themselves to not just survive but thrive in the changing landscape. What strategies are you employing in this volatile environment? Share your thoughts in the comments below!