Market Overview: Crypto Faces Challenges Yet Again

In a twist of events, the cryptocurrency market has seen a slump today after a brief surge in the afternoon yesterday (UTC). Although 20 of the top 100 cryptocurrencies reported minor gains in the past 24 hours, with increases mainly below 1%, the overarching trend has trended downward. The market capitalization has dipped by 2.3%, settling at $3.37 trillion, while the total trading volume hit a low of $66.6 billion—its weakest level in days.

Key Highlights: Steady Yet Stagnant

In a nutshell:

- The crypto market has been in a state of consolidation for two consecutive days.

- Bitcoin (BTC) and Ethereum (ETH) have remained largely unchanged, both making attempts to hit higher ground.

- Currently, ETH is hovering above $2,400, a positive sign that investor confidence may be returning.

- Bitcoin stands firm above $104,000, with analyst Dom Harz noting it is “still sitting on vast, untapped liquidity.”

- Recent geopolitical tensions could put this resilience to the test, especially with concerns over rising oil prices.

- The market remains sensitive to immediate news events, keeping investors on edge.

Crypto Winners & Losers: Analyzing Today’s Performance

Despite a turbulent environment, all top 10 cryptocurrencies in terms of market cap posted minor declines today. Bitcoin has slightly decreased by 0.1%, trading at $104,705, while Ethereum mirrors this loss, also down 0.1% at $2,521—indicating minimal movement over the past two days.

Dogecoin (DOGE) experienced the largest drop among these contenders, falling by 1.7% to settle at $0.1679. XRP, meanwhile, declined by 0.8% to $2.14. Notably, the crypto analyst known as ‘Crypto Beast’ recently spotlighted XRP’s upside potential, now that regulatory concerns have lessened. He boldly predicts that XRP could soar to at least $8, calling the current market conditions a prime opportunity:

“XRP is about to explode. I’m eyeing at least $8, and the market still hasn’t caught up to the fact that the SEC doesn’t consider it a security. $XRP holders are about to PRINT.” — Crypto Beast (@cryptobeastreal)

Emerging Trends: Noteworthy Performers

On a more positive note, among the larger group of the top 100 cryptocurrencies, 20 have actually gained value within the same timeframe. Leading the pack is Gate (GT), witnessing an impressive surge of 14.2%, now priced at $17.28. Following close behind is Kaia (KAIA), which saw a 9.8% increase to $0.1958. On the flip side, Fartcoin (FARTCOIN) experienced the steepest drop of 7.4% to $1.01, accompanied by a 6.3% decline from SPX6900 (SPX) to $1.31.

Investor Sentiment: Geopolitical Turbulence and Bitcoin’s Resilience

James Toledano, COO at Unity Wallet, noted that Bitcoin has maintained its strength even amid global geopolitical turmoil, particularly in the Middle East. However, he cautioned that this stability might be jeopardized if oil prices begin to escalate again. Complementing this, Gadi Chait from Xapo Bank acknowledges Bitcoin’s steady performance as a reflection of its growing maturity in the face of significant geopolitical challenges.

Chait pointed out, “The passing of the GENIUS Act with bipartisan support serves to legitimize the crypto market further. For the industry, this represents a crucial milestone—both in policy and in building trust.”

Looking at Ethereum, Dom Harz pointed out its consolidation above the $2,400 level—a significant recovery from its earlier lows in April (around $1,400). “This signals a resurgence in investor confidence,” he noted, as many investors seem to be choosing to stake their ETH rather than sell.

Expert Insights: What Lies Ahead?

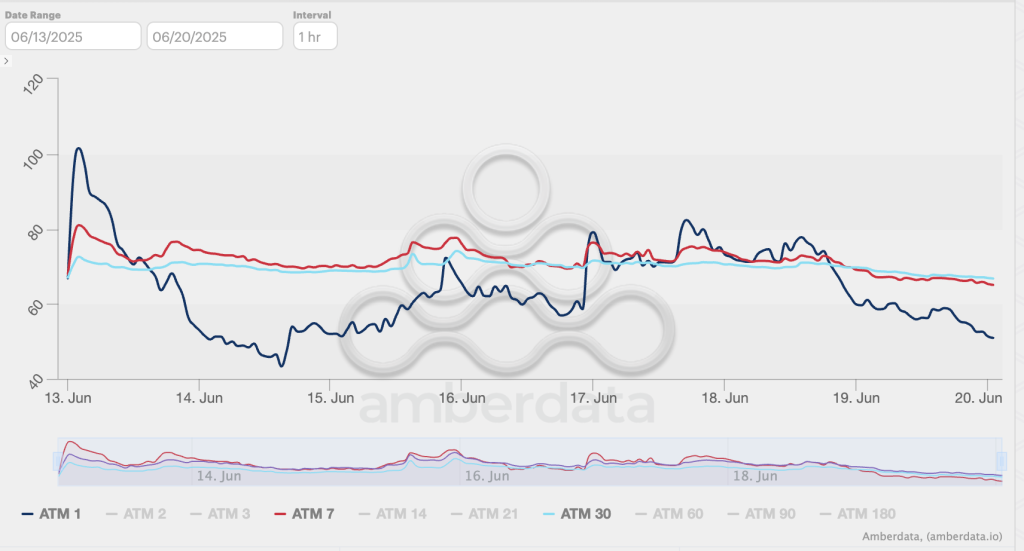

Nick Forster from the decentralized on-chain options platform Derive.xyz mentioned the recent drop in ETH volatility, which could set the stage for future price movements. “If tensions in the Middle East ease, we could see a breakout, especially considering the upcoming expiry buildup for BTC on September 26,” he cautioned.

Current Pricing Levels: A Snapshot

As of now, Bitcoin continues to hover at $104,705, showing little change since yesterday’s price point. Its trading has largely fluctuated around this level without managing to break the $105,000 barrier, though it did venture as high as $105,036 earlier in the day. Conversely, Ethereum is trading around $2,521, having fluctuated between $2,541 and $2,488 during the day. Both cryptocurrencies have remained stable over the last couple of days, and overall market sentiment remains stagnant, with the Fear and Greed Index pegged at 48—hinting at a neutral market sentiment ripe for potential shifts.

Looking Ahead: What’s Next for Crypto?

With the U.S. markets observing a holiday for Juneteenth National Independence Day on June 19, fresh insights into BTC and ETH’s ETF performance are anticipated later today. Nevertheless, BTC ETFs have seen significant inflows of $389.57 million over the past eight days, while ETH ETFs enjoyed $19.1 million in net inflows during the same period.

In South Korea, a notable policy shift is underway as the Financial Services Commission prepares a framework to approve crypto ETFs in the latter half of 2025. Such developments could signal a brighter future for crypto liquidity in the region.

Conclusion: Steady as She Goes

The current state of the cryptocurrency market showcases a landscape marked by careful consolidation and external pressures. As investors navigate through these uncertain waters, the underlying resilience of Bitcoin and Ethereum is noteworthy. Will they break free from their current levels, or will market sentiment dictate a different path? As always, staying informed is crucial, and we encourage open discussions around these developments.

What are your thoughts on the current crypto trends? Share your insights and let’s connect in the comments below!