Major Market Shakeup: Cryptocurrency Status Report from Early 2025

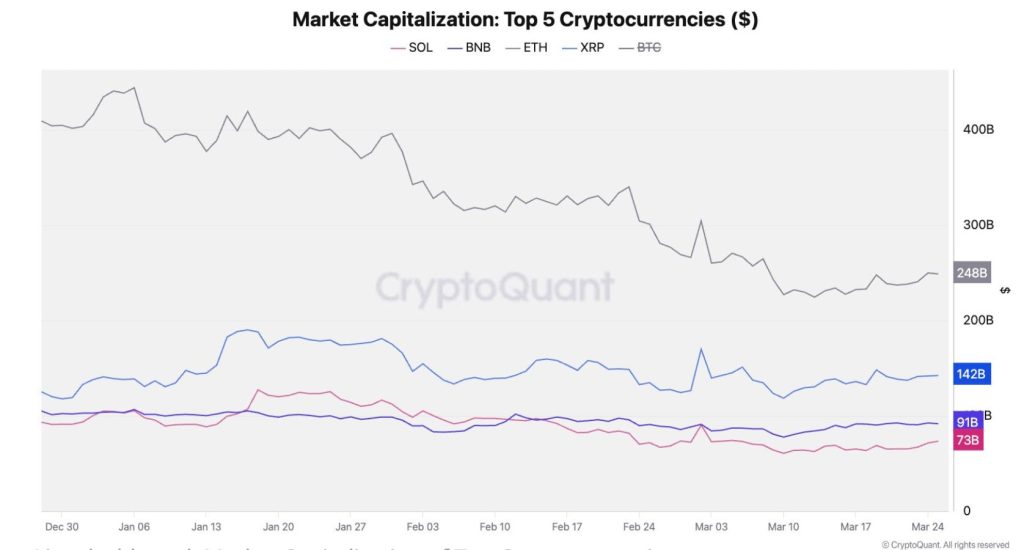

In an eye-opening report released by CryptoQuant, the cryptocurrency market witnessed a staggering decline of $659 billion across the top five cryptocurrencies in the first quarter of 2025. This alarming statistic highlights a substantial correction that has left many investors reeling and reconsidering their strategy. The significant market shift raises crucial questions: what does this mean for the future of digital currencies, and how should investors navigate this turbulent landscape?

Market Dynamics: A Closer Look at Top Performers

Among the cryptocurrencies hit hardest during this downturn were Ethereum (ETH) and Solana (SOL), which experienced sharp price corrections. In contrast, Bitcoin (BTC) and Binance Coin (BNB) demonstrated remarkable resilience amidst the market turbulence, each seeing declines of around 20% from their recent all-time highs. This more subdued drop indicates a potential shift in investor confidence toward assets exhibiting stronger fundamentals.

BNB’s stability is particularly notable, as it has maintained a consistently shallow drawdown range throughout the observed period. This resilience is partly driven by practical utility across the Binance ecosystem, all of which require users to actively hold BNB. ETH and SOL… pic.twitter.com/9d6CagU2jY— CryptoQuant.com (@cryptoquant_com) March 27, 2025

The divergence in performance is notable; while BTC and BNB have shown a firmer grip, the steep losses by ETH and SOL suggest a critical reevaluation of their market positions. XRP is also experiencing mixed fortunes after an initial surge post-2024 U.S. Presidential Election. Though its market cap experienced a meteoric rise—from $30 billion in early November to $141 billion by March—it has since lost momentum, with daily active addresses on the XRP Ledger (XRPL) dropping from a peak of 109,000 to a range of 20,000 to 40,000.

📌 Why This Matters: Understanding the Shifting Landscape

This significant market adjustment is a wake-up call for investors. For many, it signals the potential necessity to pivot investment strategies. As market dynamics evolve, there could be a pressing need to revise the focus toward cryptocurrencies with robust utility, stable fundamentals, and resilient network support. In an environment rife with volatility, these factors may distinguish the winners from the losers.

🔥 Expert Opinions: Industry Insights

Renowned analysts are weighing in on the evolving landscape. One expert noted, “The underperformance of ETH and SOL relative to BTC hints at a market searching for stability. Investors may soon prioritize assets with long-term viability.” Another analyst added, “This market correction could lead to a more cautious approach among investors, emphasizing risk management and measured exposure to volatile assets.”

🚀 Future Outlook: What Lies Ahead?

Looking ahead, the crypto market may undergo a realignment of strategies as investors recalibrate their portfolios to prioritize assets with proven track records. The current trends suggest that those cryptocurrencies capable of showcasing steady network activity and lower volatility are likely to attract more capital. This trend could redefine the very norms of cryptocurrency investment.

📊 A Shift in Capital Allocation

- Expect a reallocation of capital towards coins demonstrating strong network metrics.

- Investors may seek lower volatility options, sparking a reassessment of their risk tolerance.

- Projects that combine robust network effects with scalable, cost-effective solutions may rise in prominence.

Engage in the Conversation!

The cryptocurrency market is undoubtedly experiencing a pivotal moment. As corrections reshape the landscape, it’s vital for investors and enthusiasts alike to stay informed and agile. How do you see the future of cryptocurrency unfolding? Could this be the opportunity for lower-risk, fundamental-driven investments? Share your thoughts and insights below!

In conclusion, the current downturn serves not merely as a drastic market adjustment but as an opportunity for informed investors to cultivate strategic foresight. By embracing a proactive approach, investors may not only survive this market phase but thrive in the future landscape of cryptocurrency.