Bitcoin’s Price Reacts to Historic Hash Ribbon Signal: What’s Next?

Bitcoin (BTC), the cryptocurrency titan, is back in the limelight with an intriguing development that has caught the attention of traders and investors alike. Currently hovering around $84,500 after a slight 3.9% dip in the last 24 hours, Bitcoin faces a cocktail of macroeconomic pressures. However, an exciting on-chain indicator—the Hash Ribbon—has just flashed its eighth significant buy signal in the illustrious history of Bitcoin. Could this be the turnaround we’ve been waiting for?

$BTC Hash Ribbon indicator has appear a buy signal. This signal is the first since October 2024. Since the last buy signal, $BTC has risen from 68k to 108k. Another positive signal has occurred. pic.twitter.com/h7KO91Rjg6— CW (@CW8900) March 28, 2025

The Hash Ribbon: An Indicator of Recovery or a False Hope?

Developed by industry expert Charles Edwards, the Hash Ribbon indicator is designed to measure miner activity through the 30-day and 60-day hash rate moving averages. An upward crossover of the 30-day MA over the 60-day MA signifies a pivotal moment: it is historically interpreted as the conclusion of miner capitulation. Intriguingly, past data reveals that Bitcoin has never dropped lower post-signal in 85% of instances. This indicator has often been a reliable beacon for navigating Bitcoin’s tumultuous waters, leading many to ponder—can history repeat itself?

Market commentators, including influential Bitcoin Archive, have pointed out that the previous seven buy signals have led to substantial BTC rallies, with no false triggers reportedly recorded. It’s hard to ignore the excitement brewing among investors as they recall how Bitcoin surged in the wake of past signals.

#Bitcoin Wow, it has finally happened again.👀🔥The Hash Ribbons indicator for $BTC signals a “buy” signal. In most cases, this has always been a great signal in the past. pic.twitter.com/emMB3I02pG— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) March 25, 2025

Mixed Market Signals: A Cautionary Tale

Despite the promising signs from the Hash Ribbon, the market sentiment remains cautiously optimistic, and not without reason. Analysts, including Tony Severino, a Chartered Market Technician, have flagged concerning divergences in the market. “Bitcoin is making higher highs while the RSI shows lower highs. That’s a troubling indicator—it’s a warning sign,” Severino cautioned. Currently, Bitcoin continues to linger below the 50-period Exponential Moving Average (EMA) near $86,000, which exerts a bearish pressure on the short-term outlook.

The Relative Strength Index (RSI) rests around 36, which signals a recovery from oversold levels but lacks the momentum needed for a compelling rebound. Until Bitcoin decisively breaks above $86,800, uncertainty in its recovery path looms.

Broader Economic Context: A Perfect Storm?

The backdrop to Bitcoin’s current predicament is further complicated by macroeconomic uncertainties. Recent robust data from the U.S., which includes a Q4 GDP revision to 3.4% and a decline in jobless claims, suggests a hawkish Federal Reserve stance may be on the horizon. Such developments could stifle the appetite for riskier assets like Bitcoin.

Geopolitical issues are also re-emerging. Proposed auto tariffs by Trump, set to take effect on April 2, have injected further anxiety into global markets. While gold celebrated an all-time high at $3,059 due to these tensions, Bitcoin’s lack of similar momentum raises questions about its status as ‘digital gold.’ Jamie Coutts from Real Vision indicated caution: “While the Hash Ribbons are a reliable signal, external conditions have not aligned as they have in previous cycles.”

Current Price Analysis: Where is Bitcoin Headed?

As Bitcoin stabilizes at around $84,500, it has appeared to find temporary support near $83,000 following its recent decline. The RSI’s recovery hints at waning bearish pressure. Nevertheless, remaining below the critical 50-EMA at $86,000 continues to lean the market sentiment towards a cautious outlook.

Market Outlook: An Uneasy Balance

Currently, Bitcoin’s price action is at a crossroads. Should it manage to break above $86,800, a rally towards $88,800 could be on the horizon. Conversely, a slip below $83,000 could open the door for a deeper dip to around $81,200. With a daily trading volume around $34 billion, the market continues to exhibit caution amidst a 2.86% drop.

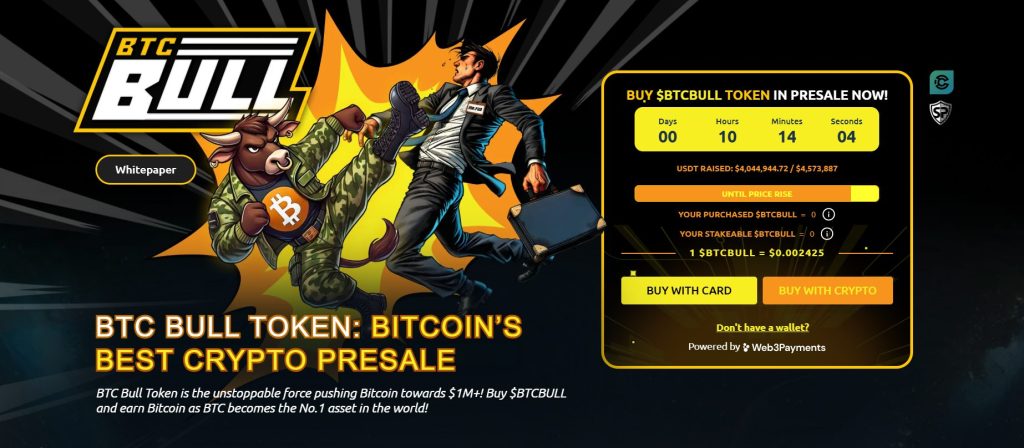

Opportunities on the Horizon: Bitcoin Rewards with BTC Bull

Amidst the market fluctuations, innovative projects like BTC Bull ($BTCBULL) are attracting attention. This community-driven token rewards holders with real Bitcoin as BTC hits specified price milestones, distinguishing it from typical meme tokens. As a unique opportunity for long-term investors, BTCBULL offers substantial benefits through airdropped Bitcoin rewards and engaging staking opportunities.

Conclusion: What’s Next for Bitcoin?

The resurgence of the Hash Ribbon buy signal presents an enticing prospect amid varying perspectives from market analysts. As investors navigate through macroeconomic challenges and mixed chart signals, the market remains in a state of flux. Will Bitcoin break free from its current chains and ascend, or will it falter against the broader economic pressures? Your insights and opinions matter—what are your thoughts on Bitcoin’s upcoming trajectory? Share your views below!