Bitcoin Whale Bets Big on Price Drop Ahead of FOMC Meeting

In a high-stakes game that has the cryptocurrency world buzzing, a mysterious whale has opened a staggering $368 million short position on Bitcoin, leveraging 40 times their investment. This significant bet comes just days before the Federal Open Market Committee (FOMC) meeting set for March 19, where pivotal monetary policies may shake up markets. The short position was established at a price of $84,043, and analysts warn that if Bitcoin (BTC) climbs past $85,592, the position will face liquidation, potentially resulting in massive losses.

Currently, the whale appears to be sitting on $2 million in unrealized profits, but the costs are adding up; they’ve already shelled out $200,000 in funding fees. In a recent update, it was reported that this whale has ramped up their short position to a staggering $380 million, adjusting the liquidation level to $86,593.

JUST IN: WHALE WHO SHORTED BITCOIN WITH 40X JUST INCREASED HIS POSITION TO $380 MILLION AND MOVED LIQUIDATION TO $86,593. MARKET MAKERS HUNTING HIS SHORT TO LIQUIDATE HIS 8 FIGURE POSITION TO SQUEEZE BTC HIGHER.

Source: @Ashcryptoreal

https://t.co/1IdsA1kcpq

Why This Matters

The implications of this whale’s move are profound, casting a long shadow over market sentiment. Analysts caution that Bitcoin must maintain support above $81,000 this week to avert a more pronounced decline. Although no sudden changes in interest rates are expected from the Federal Reserve, any hint of a more hawkish policy could heighten existing selling pressures, making this whale’s position a critical point of focus as a potential market catalyst.

The Current Landscape: Bearish Sentiments and Price Predictions

As the market watches closely, Bitcoin is oscillating around the $83,500 mark, reflecting a cautious sentiment among traders in anticipation of the FOMC’s impending decision. A breakthrough above $84,000 could trigger a wave of short liquidations, propelling BTC towards $86,670 or even higher. Conversely, failing to sustain support at $81,000 could initiate a deeper correction, putting $79,900 and even $76,600 under scrutiny. The next few days are crucial for Bitcoin’s trajectory.

ECB’s Warnings on U.S. Crypto Embrace

In an unrelated but equally noteworthy development, François Villeroy de Galhau, a prominent figure at the European Central Bank (ECB), has issued stark warnings regarding the United States’ increasing acceptance of cryptocurrencies. He fears that this embrace could lead to global financial instability, echoing concerns from previous financial crises that originated in the U.S. Nevertheless, he reassured that Europe’s financial ecosystem remains robust, emphasizing the need for a stronger euro through prudent savings and investment strategies.

ECB Governing Council member Francois Villeroy de Galhau says the US risks bringing about the next financial emergency through its support of cryptocurrencies and non-bank finance

https://t.co/TiLKfwuabd

Interestingly, amid these warnings, former President Donald Trump’s pro-crypto initiatives have sparked optimism in the market. His administration’s rollback of SEC enforcement actions against crypto firms and the introduction of a Strategic Bitcoin Reserve have bolstered investor confidence, creating a juxtaposition of regulatory perspectives.

The Unfolding Saga of Bitcoin’s Lost Treasure

In a peculiar twist, James Howells, an IT worker from the UK, faces growing desperation in his quest to recover a hard drive believed to hold 8,000 BTC, currently valued at around $660 million. After losing an appeal to excavate a landfill where the drive may lie buried, Howell has decided to escalate his fight to the European Court of Human Rights, claiming his property rights have been violated. The clock is ticking for Howell, as the landfill is expected to close operations soon, possibly extinguishing his hope of recovering the lost Bitcoin.

⚡ LATEST: A UK man’s appeal for a permit to search a landfill for his 8,000 Bitcoin hard drive has been rejected by the UK Court of Appeals. He now plans to file an international human rights case with the European Convention on Human Rights (ECHR) as his ‘last legal option’.

Bitcoin Price Analysis: The Market’s Tightrope Walk

Currently, Bitcoin (BTC/USD) finds itself teetering around $83,500, sealed within a symmetrical triangle formation on the two-hour chart. The 50-period exponential moving average (EMA) at $83,400 acts as a dynamic support level, indicative of the market’s indecisiveness. Traders are on high alert as they await FOMC developments.

Should BTC manage to breach the $84,000 resistive wall, it could trigger a cascade of short liquidations, driving prices higher towards $86,670 and possibly testing the psychological barrier of $89,600. Yet, if the price fails to hold above $83,500, we might witness a retest of $79,900, with an even deeper drop toward $76,600 looming on the horizon.

BTC Bull: A New Wave of Incentives for Investors

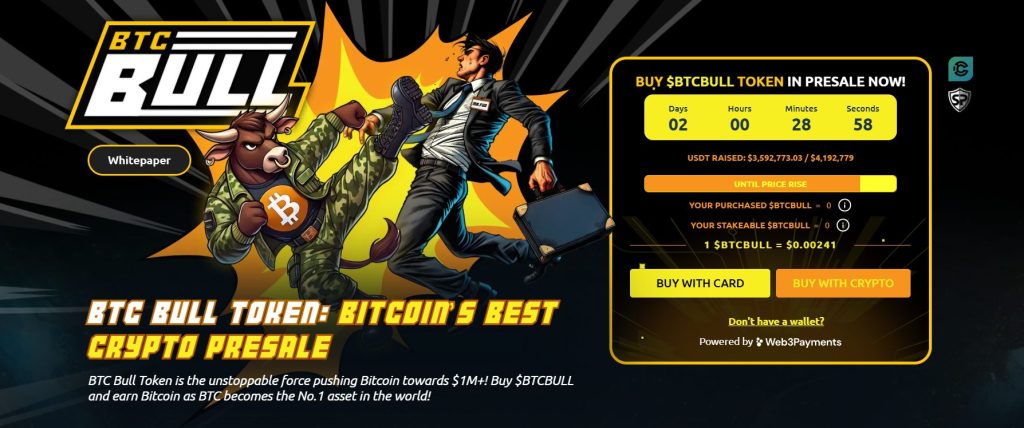

Introducing BTC Bull ($BTCBULL), an innovative token that stands out by offering community-driven support and automatically rewarding holders with real Bitcoin when BTC hits key price milestones. Unlike typical meme coins that suffer from volatility, BTCBULL is structured for long-term stability and investments. It provides tangible incentives for users through airdropped Bitcoin rewards and compelling staking opportunities.

The BTC Bull staking program offers an enticing 119% annual percentage yield (APY), which allows users to earn passive income while boosting community engagement. Notably, the staking pool has already attracted a stunning 882.5 million BTCBULL tokens, indicating robust community excitement.

Presale Insights: Seize the Opportunity

As the presale progresses, the current price is set at just $0.00241 per BTCBULL, with a total of $3.5 million raised out of a targeted $4.1 million. With demand on the rise, this presale presents an excellent opportunity to secure BTCBULL tokens before the next price hike.

As the market maneuvers through these uncertain times, it’s crucial for investors and crypto enthusiasts to stay informed and engaged. What moves will you make in this dynamic crypto landscape?