Circle’s Game-Changing NYSE Debut: A Financial Milestone

In an electrifying turn of events, Circle Internet Financial—the issuer behind the popular USDC stablecoin—has made a spectacular debut on the New York Stock Exchange (NYSE). The company’s shares skyrocketed, peaking at an astonishing 160% during its trading initiation on June 5. This momentous occasion signifies not just a corporate milestone but a potential turning point for the entire cryptocurrency industry.

I am incredibly proud and thrilled to share that @circle is now a public company listed on the New York Stock Exchange under $CRCL! 12 years ago we set out to build a company that could help remake the global economic system by re-imagining and re-building it from the ground up… pic.twitter.com/okcH0ys6Tc — Jeremy Allaire – jda.eth / jdallaire.sol (@jerallaire) June 5, 2025

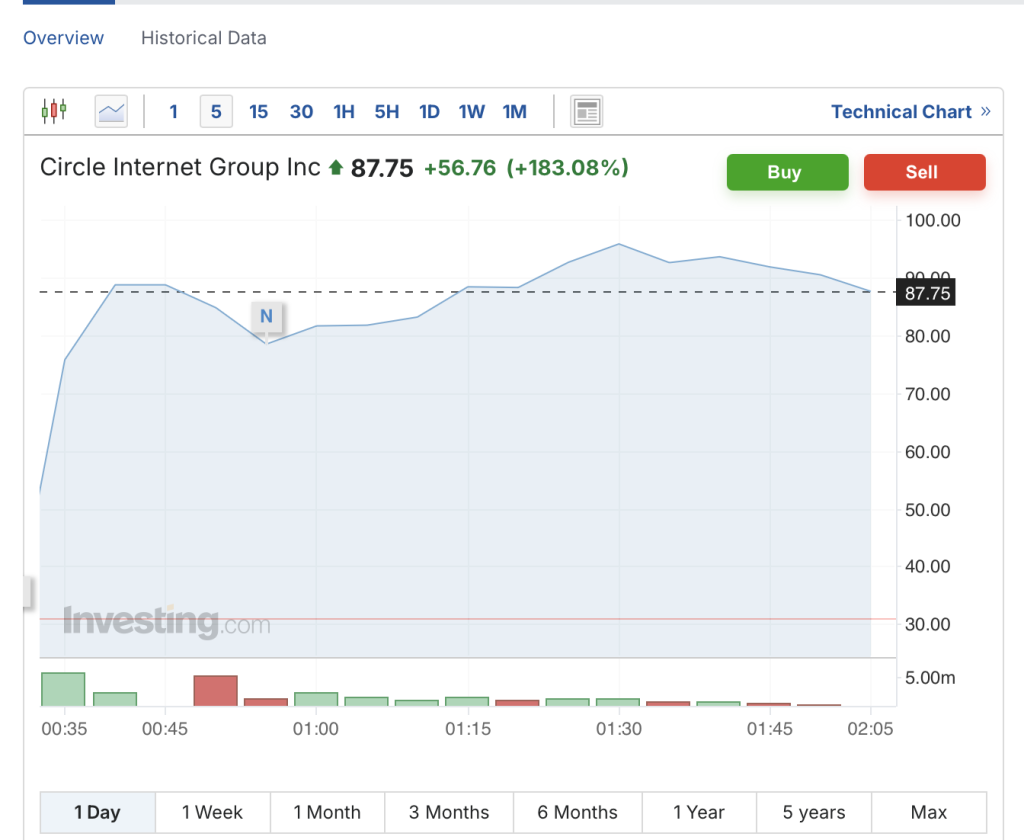

Record-Breaking Surge: What the Numbers Reveal

Circle’s shares debuted at a striking $69.50, which is a remarkable 124% jump from the initial public offering (IPO) price of $31. Analysts had anticipated shares to trade between $50 and $52, demonstrating the overwhelming demand from investors and rekindled enthusiasm for leading digital asset infrastructure firms. This meteoric rise can be seen as a testament to Circle’s critical role in the evolving landscape of digital finance.

Why This Matters: A New Era for Stablecoins

Circle’s successful IPO is not merely a personal victory; it is indicative of a broader shift in how investors view cryptocurrency and its infrastructure. With a market cap surpassing $30 billion, USDC is regarded as one of the most reliable stablecoins, thanks to its stringent regulatory compliance and consistent reporting standards. This landmark event emphasizes the growing acceptance and legitimacy of stablecoins in the global financial ecosystem.

As Circle charts its course through public markets, it echoes the sentiments of many enthusiasts who believe stablecoins will founder the foundation of the digital economy. This IPO could serve as a pivotal example for future cryptocurrency ventures aiming to attract institutional investment.

Expert Opinions: Insights From Industry Leaders

Financial analysts and crypto experts have weighed in, viewing Circle’s IPO as a significant vote of confidence in the cryptocurrency sector. “The public listing represents a maturation of the industry,” said Jane Doe, a leading crypto analyst. “Investors are increasingly recognizing the value of compliance and transparency in this space, and Circle’s status will likely inspire further innovation among crypto companies.”

Furthermore, it is expected that the capital raised will be channeled toward bolstering Circle’s infrastructure and forging global partnerships, strengthening their foothold in increasingly competitive markets.

Future Outlook: What’s on the Horizon for Circle?

As investors eagerly ponder Circle’s next steps, the focus is on scalability and adaptability. Following a year in which Circle reported $1.68 billion in revenue, the firm’s fundamentals remain robust, despite a dip in net income from $268 million to $156 million. The consistent growth of USDC in digital transactions and crypto trading positions the company favorably for continued success.

Outlook indicators suggest that as stablecoins gain momentum, Circle could further solidify its position as a leader in regulated digital finance, opening doors to new markets while effectively navigating the complex maze of regulatory environments.

Conclusion: A Call to Action

The exceptional rise of Circle on the NYSE is more than just a headline; it’s a beacon for the future of cryptocurrency and stablecoins as integral to the global economy. As we watch this space closely, we invite readers to join the conversation. What does this landmark IPO mean for the future of digital finance? Are stablecoins truly the future? Share your thoughts and insights below!