In a turbulent yet intriguing turn of events for the cryptocurrency market, Bitcoin’s price is currently situated at $118,688, demonstrating a slight daily dip of 0.06%. This stability follows a compelling spike to an all-time high of $123,091 on July 14, which has triggered a blend of excitement and speculation among investors. With a total market capitalization hovering around $2.37 trillion, the landscape is ripe for analysis and interpretation as smart money navigates the evolving altseason dynamics. What could all of this mean for Bitcoin’s trajectory in the coming months? Let’s delve into the latest insights and projections.

Bitcoin’s healthy consolidation signifies a critical juncture. Record highs are typically followed by a period of valuation stabilization, and the current price fluctuation could be indicative of this phase. Interestingly, Bitcoin’s relatively narrow intraday range of $2,347 — comprising about 2.0% of its current value — suggests controlled volatility, which is often characteristic of institutional buying patterns.

The technical indicators paint a mixed picture. While the Relative Strength Index (RSI) sits comfortably at 63.83, suggesting there’s still room for further appreciation without hitting overbought territory, the Moving Average Convergence Divergence (MACD) has begun to reveal signs of divergence. This raises a flag for potential shifts in momentum, indicating a nuanced hour of examination ahead. As traders and institutions assess both bullish signals and bearish divergences, the rallying cry for Bitcoin breaks down into defining moments in the near future.

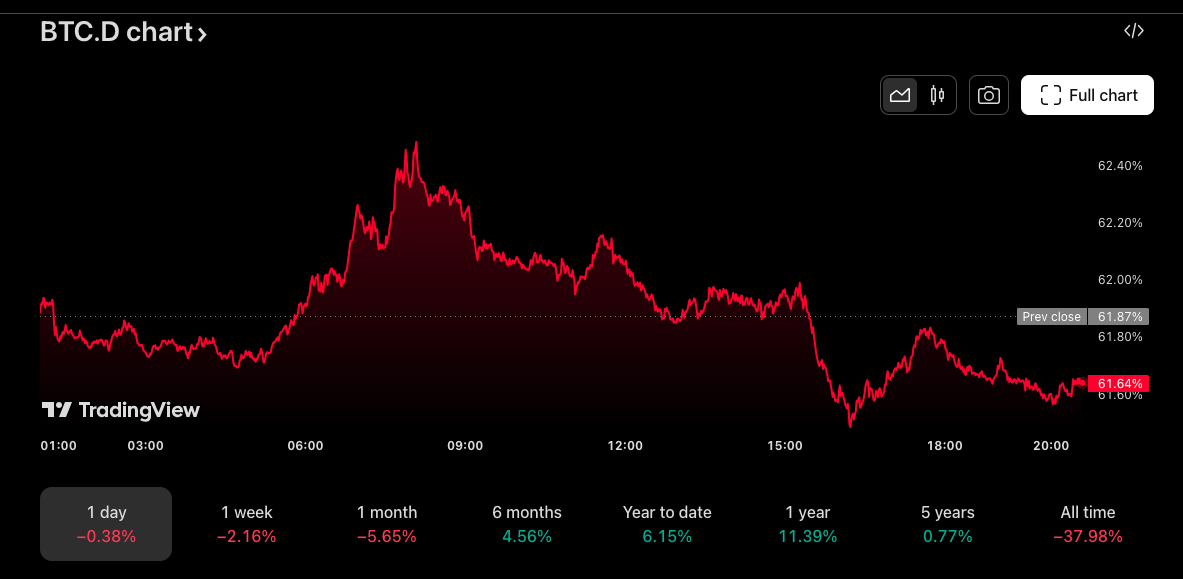

Amidst this backdrop, the looming question emerges: What are the broader implications of Bitcoin’s current standing? The answer lies in understanding the dynamic interplay between Bitcoin and the altcoin market. Bitcoin currently commands a market dominance of 61.64%, but signs indicate a shift could be on the horizon. Investors are increasingly probing altcoins, enticed by what they perceive as heightened profitability. The Altseason Index is a telling barometer here, remaining above 44 — signaling potential capital migration towards altcoins. Should this trend continue, Bitcoin’s grip on the market may weaken, posing a significant challenge to its historically unassailable dominance.

However, this isn’t just a narrative of potential decline. Institutional validation remains robust, as evidenced by Genius Group’s strategic acquisition of 200 BTC with sights set on a grander goal of amassing a 10,000-BTC treasury. Furthermore, Wall Street heavyweights such as Goldman Sachs and BNY Mellon are not sitting idly; their initiation of tokenized money funds showcases a broader acceptance and integration of cryptocurrency into traditional financial systems. Such moves enhance institutional confidence and affirm the long-term potential of Bitcoin as a treasury asset.

Shifting blades, however, indicate a dual narrative at play. The emergence of quantum computing poses a long-term threat to Bitcoin’s security and its allure as a sound investment. Specialists argue that up to 7 million Bitcoin could be exposed to potential vulnerabilities within the next three years. This concern demands that institutions take more than short-term gains into account when allocating resources and may accelerate the development of quantum-resistant alternatives, thereby pressing Bitcoin’s foundational narratives at the same time.

In addition, unseen market movements tell stories of their own. Recently, one ancient Bitcoin wallet activated after 14.5 years, transferring 3,962 BTC valued at approximately $468 million. Such actions often signify the maturation of market cycles rather than foretelling doom, reinforcing the argument that Bitcoin is a resilient long-term investment. For those who bought in at a cost basis near $0.37 per Bitcoin, today’s price of $118,688 represents an astounding appreciation of 32,000,000%—a narrative of wealth creation that cannot go unnoticed.

As institutional players focus on establishing defined support levels, immediate considerations center around $117,103 with the 20-day EMA reinforcing support at $115,993. Major support levels extend further at $111,273 (50-day EMA) and $105,992 (100-day EMA), making this consolidation phase an appealing safety net for institutions amid altseason jitters. Key resistance looms at $120,000-$121,000, further amplified by psychological barriers. Should Bitcoin break through these levels, the sight of $125,000-$130,000 could emerge within the next 90 days, invigorated by ongoing treasury flows.

In summary, Bitcoin is positioned at a significant crossroads, shaped by its past triumphs, current market conditions, and the weight of looming potential threats and opportunities. The next few weeks are pivotal as the cryptocurrency endeavors to confirm its position in a market that is both rich with promise and fraught with challenges. Will it stabilize and lift toward new highs, or will consolidation amid altseason pressures take precedence? Only time will tell, but for now, Bitcoin’s narrative is one of evolution—a digital gold navigating the intricacies of institutional fidelity and innovation in a rapidly changing landscape.

For more insights on crypto market analysis and institutional trends, check out CoinDesk and CoinTelegraph.