Bitcoin’s Strategic Status: Analyzing the Current Market Dynamics

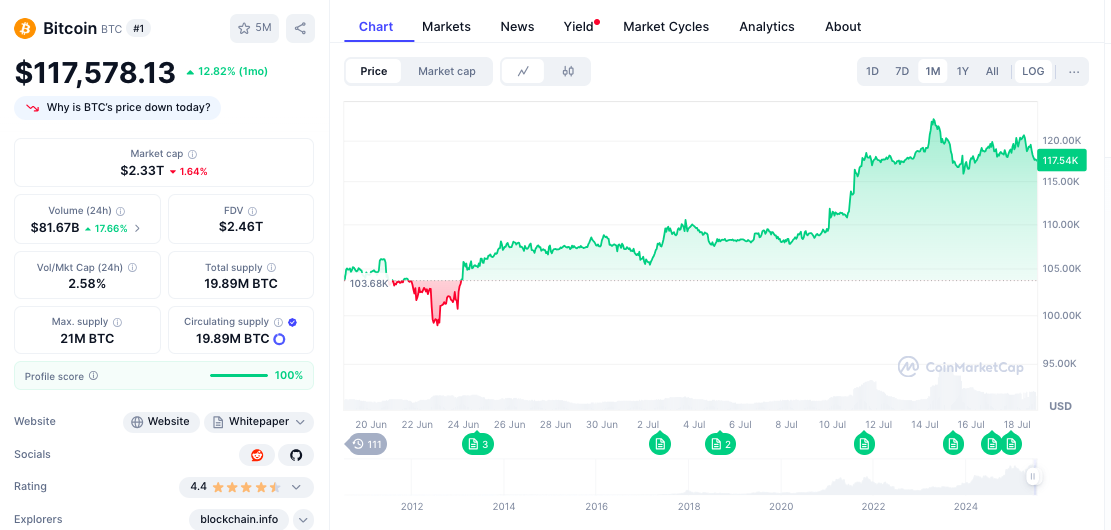

In a gripping analysis provided by ChatGPT’s AI model, Bitcoin stands at a pivotal point, trading at $117,600 after touching a remarkable all-time high (ATH) of $123,091 on July 14th. The drop of 1.32% in daily trading raises crucial questions: Are we witnessing the onset of a significant bull market, or is this a sign of peak exhaustion? Bitcoin’s ability to remain above key exponential moving averages (EMAs) while boasting a robust Relative Strength Index (RSI) of 64.37 indicates a period of consolidation and potential technical recalibration.

This article dives deep into Bitcoin’s recent performance, market influences such as institutional trading dynamics, the implications of regulatory changes, and a forward-looking price trajectory to provide a comprehensive perspective on what’s next for the world’s leading cryptocurrency.

📌 Why This Matters: The Significance of Bitcoin’s Current Position

Bitcoin’s current market dynamics are incredibly relevant. A steady foundation is emerging as its price consistently sits 16.9% above the 200-day EMA of $97,723. This resilience is complemented by MACD signals that continue to indicate bullish momentum, even in the face of resistance at the ATH. These factors underscore a robust market sentiment and suggest that the cryptocurrency is making earnest attempts to solidify its place in mainstream finance.

The introduction of Charles Schwab’s Bitcoin and Ethereum trading services is particularly noteworthy. As a $10 trillion asset manager, Schwab’s move into cryptocurrency reinforces its validity as a market player. This could attract a wave of conservative, institutional capital—an essential shift in market dynamics that may cement Bitcoin’s position as a long-term store of value.

🔥 Expert Opinions: Insights from Market Analysts

Market analysts are closely monitoring Bitcoin’s price action. Some experts believe that the bullish momentum will persist if Bitcoin can break through the $121,000 resistance level. “This is not just about numbers; it’s about sentiment and structure,” one analyst commented. “If Bitcoin can maintain its position above the 200-day EMA and sustain its RSI levels, we could see a swift rally toward $130,000 and beyond.” Another analyst expressed caution, suggesting that without significant retail and institutional buying in this range, Bitcoin risks prolonged consolidation before any upward breakout occurs. As volatility remains, the market’s mindset will play a crucial role in influencing Bitcoin’s next steps.

🚀 Future Outlook: Bitcoin’s 90-Day Price Predictions

Looking ahead, several scenarios loom. The market currently forecasts three potential paths for Bitcoin over the next 90 days:

- Institutional Momentum Continuation (40% Probability): Should the retirement market’s integration affirm regulatory clarity and institutional adoption, there could be continued upward movement towards targets in the $130,000 to $140,000 range.

- Historical High Consolidation (45% Probability): A period of consolidation between $115,000 and $125,000 may offer opportunities for further institutional accumulation, stabilizing the market as it adapts to the recent ATH.

- Correction from Historic Levels (15% Probability): In case of failing to hold significant support levels below $114,000, Bitcoin could see a drop towards the $100,000 mark, possibly impacting investor confidence.

Market Metrics: A Glimpse at Institutional Backing

Bitcoin enjoys a formidable market capitalization of $2.34 trillion and a daily trading volume around $82.25 billion. This indicates strong institutional interest and support, a crucial driver of Bitcoin’s price stability. This unmatched trading volume, up by 18.9%, emphasizes the solid backing Bitcoin has as a store of value—a narrative that many institutional investors are keen to embrace.

Social Sentiment: The Community’s Mixed Signals

Interesting shifts in community sentiment have also surfaced, according to data from LunarCrush. While Bitcoin maintains a positive sentiment of 81%, total engagement dropped to 130.79 million with 385.92K mentions. This mixed atmosphere indicates a divide among investors regarding whether Bitcoin will lead the charge or if a significant altcoin season lies just around the corner. The prevailing silence amidst social chatter creates an atmosphere ripe for speculation.

#Altcoin Season Index is Indicating the biggest and the final altcoin season of this cycle. pic.twitter.com/zv8PSsC1GG— Mags (@thescalpingpro) July 18, 2025

Conclusion: A Defining Moment for Bitcoin

Bitcoin’s current positioning presents a compelling case for both immediate attention and long-term investment strategies. Whether it validates a new pricing paradigm or requires further consolidation will be determined in the coming weeks. With institutional momentum growing, regulatory frameworks solidifying, and community engagement signaling potential indecision, now is an exhilarating time for Bitcoin enthusiasts and investors alike. What do you think lies ahead for Bitcoin? Join the conversation below!