In the dynamic world of cryptocurrency, where fortunes can shift at the speed of light, Cardano (ADA) is currently standing tall, showcasing a remarkable 18% gain over the past week. This surge not only highlights the bullish sentiment surrounding ADA but also cements its position among the elite ranks of cryptocurrencies, now standing as the 8th largest by market capitalization, testing its mettle against incumbents like Dogecoin and Tron. As broader market activities appear stagnant, Cardano’s resilience offers a fascinating lens into the altcoin’s potential trajectory.

🏆 CARDANO TAKES ‘TOP 8’ ON CMC! $ADA has overtaken DOGE & TRON on Coin Marketcap — now the 8th largest crypto in the world. Is this the start of its climb toward the Top 3? 📈 pic.twitter.com/ICuTxUeNGN — Coin Bureau (@coinbureau) August 19, 2025

With ongoing geopolitical tensions impacting global markets and inflationary pressures influencing monetary policy, the altcoin scene is undeniably fraught with challenges. Notably, analysts are optimistically pointing to the prospect of up to four rate cuts by year-end, a shift that could breathe new life into riskier assets, including cryptocurrencies like ADA. Investors and traders are clearly responding; Coinglass data shows a significant uptick in speculative interest, with open interest for Cardano derivatives soaring by 32% just over the past week, reaching a staggering $1.87 billion.

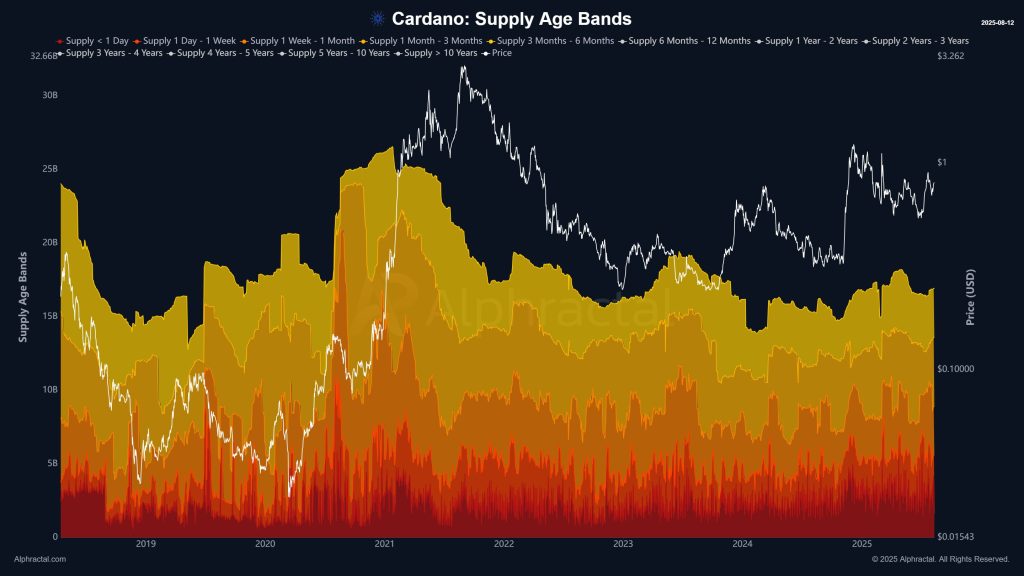

This surge in open interest signals not just a revival of trader confidence reminiscent of January’s bull run but also highlights an intriguing trend: more than 72% of traders on Binance are currently betting on ADA’s price to rise. This overwhelming bullish sentiment is complemented by a notable behavioral shift among short-term holders. According to reports from Alphractal, these traders are increasingly choosing to hold onto their assets instead of selling, suggesting a strong belief that ADA’s upward trajectory has significant room to grow.

As we analyze ADA’s price pattern further, a critical juncture is emerging. After breaking out of a long-term 8-month descending channel this past July, traders are eyeing the prospect of a climb toward $2. However, the technical landscape displays mixed signals. The Relative Strength Index (RSI) reached a high of 70—indicating an overbought condition—but is now reversing, hinting at potential buyer exhaustion. Furthermore, the Moving Average Convergence Divergence (MACD) is on the verge of a bearish crossover, alerting us to the possibility of a downturn, which could bring ADA back toward its significant support level around $0.90.

The upcoming Federal Open Market Committee (FOMC) meeting in September will be a critical event for the entire cryptocurrency market. Should the Fed signal an easing of monetary policy, the recovery could lead ADA back toward its 2023 highs of around $1.30, with some analysts even eyeing the distant possibility of reaching $2—a lucrative 120% rise from current levels. On the flip side, ADA would need approximately a sixfold increase to surpass XRP and claim the title of the third-largest altcoin, a feat that would necessitate a substantial influx of new demand from institutional channels, especially considering the excitement around potential 401(k) adoption and upcoming decisions regarding a spot Cardano ETF.

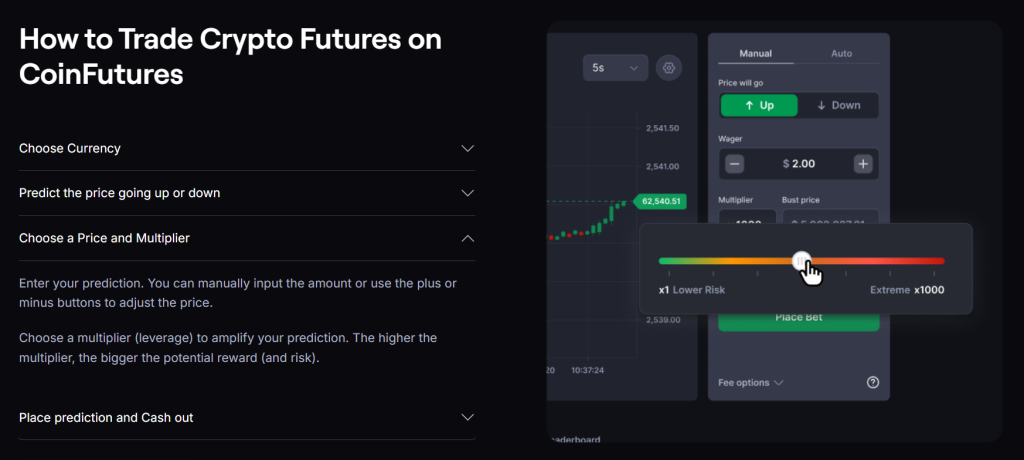

While some traders may find themselves HODLing Cardano and monitoring the market for the next movement catalyst, more aggressive traders can capitalize on volatility through leveraged trading. Platforms like CoinFutures allow users to navigate the crypto market by predicting price movements with leverage options up to 1000x.

This innovative platform allows traders to maximize their potential while providing tools to manage risks effectively through built-in stop-loss orders. Whether you believe in the ongoing bullish narrative around Cardano or prefer to take a more cautious approach, the upcoming weeks are bound to be pivotal for ADA and the broader cryptocurrency market.

In conclusion, as Cardano continues its ascent in a sea of uncertainty, its future looks bright yet complex. For investors, the question remains: is Cardano your ticket to the crypto frontier, or will you take a more cautious approach while watching the market unfold? Stay tuned and stay informed as this story develops.

For more insights into cryptocurrency trends and predictions, check out the latest updates on [CoinMarketCap](https://coinmarketcap.com/) and [Coinglass](https://coinglass.com/).