Cardano’s Ambitious Leap: A $100 Million Proposal for DeFi Dominance

Cardano, the innovative blockchain platform known for its robust technology and visionary leadership, is on the cusp of an exhilarating transformation in the decentralized finance (DeFi) landscape. Charles Hoskinson, the founder of Cardano, has set the stage for a bold move that could redefine the network’s ecosystem. He has proposed the creation of a $100 million sovereign wealth fund designed to bolster Cardano’s DeFi capabilities while potentially enhancing long-term price forecasts for ADA, the platform’s native cryptocurrency.

Understanding the Proposal: A Self-Reinforcing Ecosystem

At the heart of Hoskinson’s proposal lies a savvy financial strategy aimed at diversifying a portion of Cardano’s treasury. He suggests allocating 5% to 10% of the treasury into a mix of assets, including Bitcoin and Cardano’s own stablecoin, USDM, which acts as a yield-bearing instrument. This strategy isn’t just a novelty; it’s about creating a self-reinforcing feedback loop. By earning passive income through staking, the fund could use these earnings to buy back more ADA, effectively fortifying the treasury while generating additional liquidity.

Competing with Giants: The Challenge of Ethereum and Solana

The proposal is also a critical move in leveling the playing field against established players like Ethereum and Solana, which currently lead in terms of stablecoin to total value locked (TVL) ratios. With this new strategy, Cardano could not only close the existing gap but also create a more stable foundation for DeFi activities. By including Bitcoin in its portfolio, the fund would not only amplify potential returns but also act as a hedge against the inflation risks associated with fiat-pegged stablecoins.

Cardano Founder Proposes Deploying $100M of $ADA Treasury to Boost #Cardano DeFi and Reinvest in $ADA. pic.twitter.com/JSNAIIYfkv— Altcoin Daily (@AltcoinDaily) June 12, 2025

Community Concerns: Governance and Market Reactions

While Hoskinson’s vision is ambitious, implementing such a strategy faces hurdles, particularly regarding community governance. Not every member of the Cardano community is in favor of his plan, with concerns about the potential market impact of selling large quantities of ADA. As one community member voiced on X, “If you hope to sell 140m at $0.7 next month, the market will ensure you sell it for $0.5,” highlighting the skepticism surrounding large-scale sell pressure in a delicate market environment.

Analyzing ADA: Price Patterns and Future Implications

With uncertainties surrounding the governance process, the market could respond to the news with a “buy-the-rumor” sentiment, potentially leading to a breakout from a significant seven-month falling wedge pattern. After several attempts, the Cardano price has been navigating near the critical 0.236 Fibonacci retracement level, currently serving as support at approximately $0.60.

This level has historically provided significant demand since late 2024, but indicators suggest that bulls are losing momentum. The RSI has recently dipped below the neutral line, indicating waning bullish strength, while the MACD displays widening gaps below the signal line—a bearish sign.

If ADA fails to maintain the $0.60 level, we might see a downturn leading to a potential drop towards the next support level at $0.50. This could also postpone any aspirations for a breakout towards the $1 target based on the 1.618 Fibonacci extension, representing an 80% gain from its current standing.

Looking Ahead: What’s Next for Cardano?

The imminent decision regarding the Cardano ETF on July 15 could serve as a pivotal moment for ADA, catalyzing renewed interest from traditional investors and possibly reviving momentum within the community. As investors hold their breath, the potential for Cardano to rise and establish itself firmly in the DeFi space remains tantalizingly close.

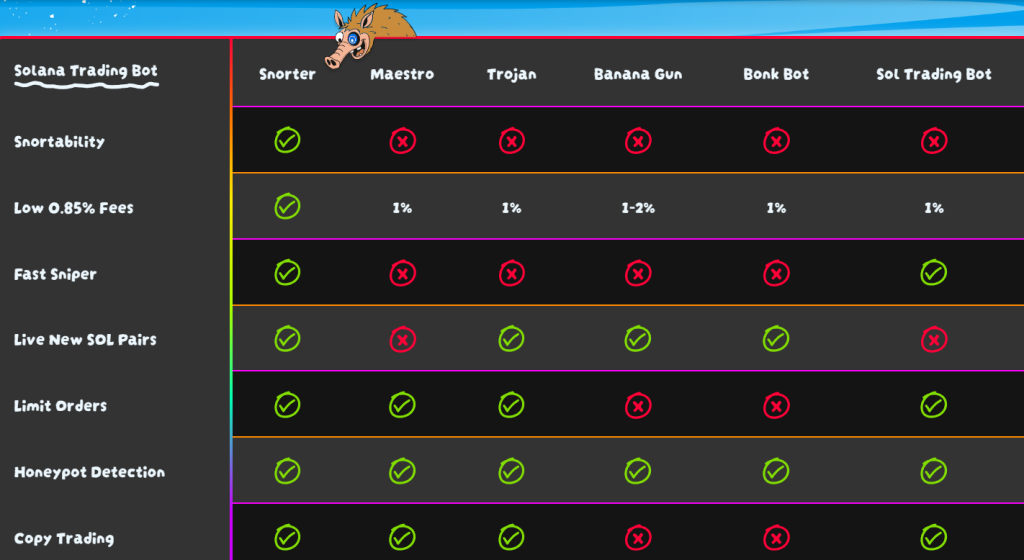

To maximize gains during this period of uncertainty, traders often turn to sophisticated tools that provide real-time insights. Snorter ($SNORT), a trading bot designed to capture early market momentum, is quickly gaining traction. . Its unique features such as limit orders, MEV-resistant token swaps, and rug-pull protection are appealing to investors looking to ensure their profits while navigating the volatile crypto landscape.

. Its unique features such as limit orders, MEV-resistant token swaps, and rug-pull protection are appealing to investors looking to ensure their profits while navigating the volatile crypto landscape.

Conclusion: A New Dawn for Cardano?

The unfolding narrative of Cardano’s potential DeFi transformation underlines the dynamic nature of the cryptocurrency landscape. As the community evaluates its future, the proposed sovereign wealth fund could usher in a new era of financial innovation and stability for Cardano. Will the community rally behind this initiative, or will skepticism reign? One thing is certain: the dialogue surrounding Cardano’s future is just beginning, and your insights are valuable. Join the conversation and let us know what you think about this ambitious proposal!