Whales on the Move: Cardano’s Significant Accumulation in April

In a striking turn of events that caught the attention of the crypto community, Cardano (ADA) has seen notable accumulation activity from whale investors throughout April. As revealed by analyst Ali, major players in the market acquired over 410 million ADA tokens, seizing the opportunity presented by the token’s price fluctuations. This aggressive buying spree underscores a growing belief in ADA’s potential for long-term growth.

Whales accumulated over 410 million #Cardano $ADA in April! pic.twitter.com/8Qa6xCaWtb— Ali (@ali_charts) May 2, 2025

Understanding the Market Dynamics: Why This Matters

This rally in whale accumulation isn’t merely a passing trend. It reflects a significant vote of confidence in Cardano’s mid-term outlook from entities not hampered by liquidity constraints. Typically, such behavior from institutional or large-scale investors can set the stage for substantial price movements, especially in markets as volatile as cryptocurrency.

Despite facing price swings driven by macroeconomic factors and initial buzz around a potential crypto reserve initiative, ADA ended April on a positive note, achieving a modest 4.6% gain. The narrative of accumulation against such volatility could signal better days ahead for ADA, positioning it as a resilient contender in the crypto space.

Cardano’s Current Price Action: A Crucial Test of Support

At present, Cardano is trading around $0.6876 and has recently dipped below its ascending trendline support. This decline places the 50-period Exponential Moving Average (EMA) at $0.6966 just above the current market price, presenting a barrier to bullish momentum. As ADA flirts with critical support levels, traders are keenly watching how this will influence its short-term direction.

However, the market is showing mixed signals. Momentum indicators suggest a softening outlook, with the MACD histogram turning red, and both signal lines dropping below zero. Despite these warning signs, a solid support level at $0.6704 remains intact—for now. Traders are closely monitoring the price movement for potential upside or downside triggers.

Key Levels to Watch for Traders

- Immediate resistance: $0.7014

- Upside targets: $0.7268 → $0.7470

- Support levels: $0.6704 → $0.6430

Strategic Trading Insights: The Awaited Breakout

For those looking to dive into Cardano trading, patience is paramount. Observing a confirmed breakout above $0.7014, particularly on rising trading volume, would present an enticing bullish entry point. A MACD crossover could further bolster confidence. However, traders should exercise caution, as there remains a risk of false breakouts in the current market environment.

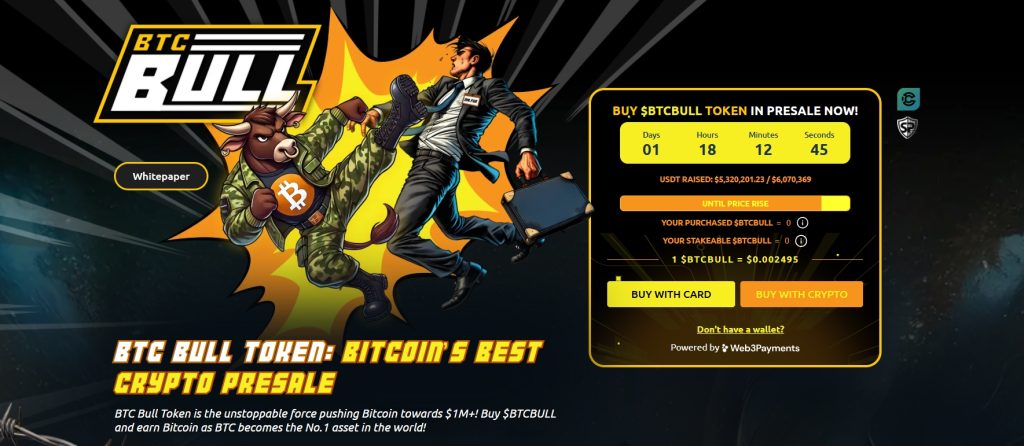

BTC Bull Token Achieves New Heights Amidst Staking Interest

Meanwhile, away from the Cardano spotlight, the BTC Bull Token ($BTCBULL) is making waves within the presale realm, surpassing $5.32 million in funds raised. This remarkable figure underscores the excitement surrounding its staking potential, currently offering an impressive 78% annual yield, drawing in a wave of investors eager for income without the usual constraints of traditional investments.

Final Thoughts: The Road Ahead

As Cardano continues to carve its path, the active participation of whale investors coupled with critical price levels presents an intriguing landscape for both traders and long-term holders. With key tests on the horizon, the market may be gearing up for significant movements that could redefine ADA’s position over the next few weeks.

Engagement from institutional investors, ongoing fluctuations in price, and the underlying sentiment within the crypto market all contribute to this ever-evolving story. What will the next chapter hold for Cardano and its community? Only time will tell, but one thing is certain: the excitement surrounding this cryptocurrency is palpable.