Brazilian Lawmaker Proposes Elimination of Crypto Taxes in Bold Move for Bitcoin Holders

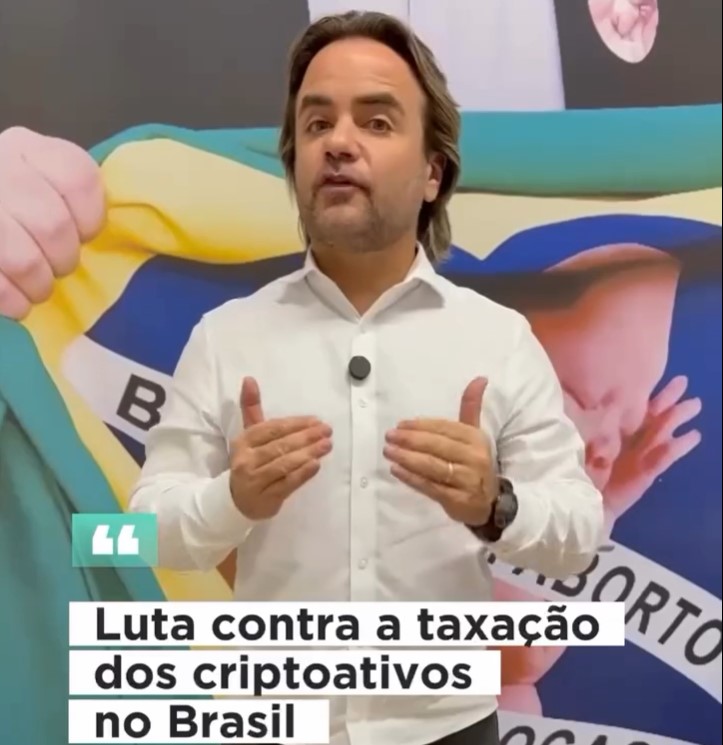

Eros Biondini, a prominent figure in Brazil’s political landscape, has taken a significant step towards reshaping the country’s cryptocurrency taxation policy. He has introduced a groundbreaking draft bill aimed at abolishing taxes on crypto holdings, specifically targeting long-term investors in Bitcoin (BTC). This initiative, reported by the Portuguese-language media outlet Livecoins, could potentially change the financial landscape for many Brazilian citizens.

Why This Matters: A Case for Crypto-friendly Regulations

Biondini’s proposed legislation seeks to remove specific tax obligations currently associated with cryptocurrencies in Brazil. This includes eliminating clauses that dictate the taxation of crypto assets and scrapping a recent law from 2023 that lays out how the government collects taxes from crypto profits. But why is this important?

At its core, this proposal represents a shift towards a more favorable regulatory environment for cryptocurrency. In a world where digital assets are becoming an increasingly vital part of the financial ecosystem, easing the tax burden on investors could stimulate growth in the sector. The crypto community is watching closely—this bill could redefine how Brazil interacts with digital currencies.

Expert Opinions: Industry Voices Weigh In

Financial analysts express varied views on Biondini’s proposal. Some believe that eliminating taxes for Bitcoin holders will encourage more individuals to invest in digital currencies, fostering a vibrant crypto ecosystem in Brazil. Others, however, caution against the potential loss of tax revenue at a time when the country is navigating economic challenges.

“Taxation on cryptocurrency has been a significant barrier for many potential investors,” says a hypothetical financial expert. “Biondini’s initiative could serve as a catalyst for widespread cryptocurrency adoption on a national scale.” Yet, they also warn, “any changes to tax law must be balanced with the government’s need for revenue.”

Future Outlook: What’s Next for Brazil’s Crypto Landscape?

The bill will first undergo scrutiny by a Chamber of Deputies committee before making its way to the lower house for a vote. Should it pass there, it would head to the Senate and require the president’s approval. The path to enactment is complex, but the potential impact is profound.

As Brazil’s tax-to-GDP ratio hits a record 32.32% in fiscal year 2024, Biondini argues against imposing further financial burdens at a time of economic uncertainty. He emphasizes that the government should empower citizens to seek alternative stores of value instead of discouraging them through taxation.

Formal Recognition of Bitcoin: A Vision for the Future

This isn’t Biondini’s first attempt at reforming cryptocurrency policies. He previously proposed that Bitcoin be officially recognized as a strategic asset in Brazil, seeking tax exemptions for Bitcoin buyers and enshrining individuals’ rights to hold and manage their digital assets autonomously.

🇧🇷 Méliuz has become the first Bitcoin treasury company in Brazil after shareholders approved the acquisition of $28.4 million Bitcoin.

#Méliuz #BitcoinTreasury #BitcoinStrategy

https://t.co/v1zZ77GH3h— Cryptonews.com (@cryptonews) May 16, 2025

Mobilizing Support: Biondini Calls for Unity

In an effort to rally support for his bill, Biondini has taken to social media, urging the Brazilian crypto community to amplify the conversation. He believes that widespread public interest could persuade the lower house to reject any attempts to increase crypto taxes.

“This bill is not just legislation; it’s a stand for economic sovereignty,” Biondini stressed, appealing to both taxpayers and industry leaders. He insists that Brazil has the potential to be a leader in cryptocurrency adoption rather than imposing regulations that could hinder progress.

Conclusion: A New Chapter for Brazil’s Crypto Future?

As Eros Biondini’s bill moves forward, the implications for Brazil’s financial landscape could be monumental. A shift towards favorable crypto regulations may attract investment, foster innovation, and potentially position Brazil as a global leader in cryptocurrency. As discussions evolve, what are your thoughts on the future of crypto taxation in Brazil? Will this be a triumph for advocates, or is caution warranted for the sake of economic stability? Join the conversation.