Bitcoin Holds Steady Amid Growing Institutional Interest

As the sun rises over Asia, Bitcoin is making headlines by holding its ground at a remarkable price of $83,180. This stabilizing trend arrives amid increasing interest from institutional investors, even as regulatory apprehensions brew across Europe. A recent statement from an official at the European Central Bank (ECB) has sparked dialogue, warning that the pro-cryptocurrency position of the U.S. might lead to global financial turbulence due to the inherent risks linked with digital assets.

U.S. vs. Europe: A Tale of Two Regulatory Approaches

Across the Atlantic, the mood is decidedly different. The former U.S. president, Donald Trump, has made headlines by signing an executive order aimed at creating a Bitcoin reserve. Additionally, lawmakers are contemplating the acquisition of 1 million BTC to reinforce the U.S.’s leadership in the digital asset space. States like Texas are also stepping up by establishing state-backed Bitcoin reserves, which further solidifies the cryptocurrency’s integral role in American financial policy.

🇫🇷JUST IN: François Villeroy de Galhau, a member of the European Central Bank (ECB) and Governor of the Bank of France, warns that U.S. pro-crypto policies could trigger global financial instability. He argues that promoting crypto and non-bank financing risks future crises…

Shifting Regulatory Landscape in the U.S.

In a parallel shift, the Securities and Exchange Commission (SEC) has notably relaxed its regulatory grip on the cryptocurrency sector. Following the exit of former Chair Gary Gensler, the SEC dropped lawsuits against several crypto firms, a move interpreted as a significant boost toward Bitcoin’s integration into mainstream finance. Analysts are now asserting that Bitcoin’s price surge reflects this growing embrace by U.S. regulators, forming a stark contrast to Europe’s wariness.

Institutional Demand: The MicroStrategy Effect

Adding fuel to this bullish sentiment is MicroStrategy, led by CEO Michael Saylor, which recently acquired 130 BTC for a staggering $10.7 million. This most recent investment, made at an average price of $82,981 per Bitcoin, propels the company’s total Bitcoin holdings to a jaw-dropping $41.6 billion. Not resting on its laurels, MicroStrategy plans to raise $42 billion by 2027 through stock sales and fixed-income securities, thereby positioning itself as a formidable player in the corporate Bitcoin landscape.

Michael Saylor’s Strategy said it bought $10.7 million of Bitcoin, a week after unveiling plans to issue up to $21 billion of preferred stock to acquire more of the cryptocurrency.

Market Dynamics: The Rise of Gemini

Meanwhile, optimism is surging across the trading landscape as Gemini, a prominent cryptocurrency exchange, prepares for a potential initial public offering (IPO). The recent appointment of Dan Chen, a former executive from Affirm, as its new Chief Financial Officer signals a promising shift toward increasing institutional legitimacy in the crypto sector. Describing Bitcoin as “the most dynamic sector in finance,” Chen may well steer Gemini toward becoming a publicly listed entity, joining the ranks of Kraken and Circle. Such moves could instill more confidence among investors, uplifting the entire crypto market.

🚨NEWS ALERT: Crypto exchange Gemini has appointed Dan Chen as its new CFO, formerly with Affirm, in anticipation of its potential IPO.

Bitcoin’s Technical Landscape: Trends and Predictions

Currently, Bitcoin is consolidating around the critical price point of $83,180, developing a symmetrical triangle pattern on the 2-hour chart. This configuration indicates a pivotal moment for traders, who are awaiting a breakout that could define the next significant price movement. Immediate support is observed at the 50-day EMA of $83,080. If Bitcoin breaks above the resistance level of $83,500, it is likely to target $85,100 and extend further to $86,800. Conversely, should it falter and drop, critical support levels of $81,200, $80,000, and potentially $78,300 could be tested.

What’s Next for Bitcoin? Expert Insights

The trajectory of Bitcoin is not just a matter of charts and numbers; it reflects broader economic sentiments and regulatory landscapes. Experts predict that creeping corporate adoption and favorable regulatory changes could lead to a sustained rally for Bitcoin. With institutions like BlackRock and Fidelity increasing their investments, the market is increasingly ripe for a long-term increase in Bitcoin’s value.

Final Thoughts: The Road Ahead

In conclusion, Bitcoin stands at a crucial juncture, supported by shifting regulatory narratives and institutional backing. As the U.S. embraces digital currencies while Europe remains cautious, observers will be keenly watching how market dynamics evolve. What are your thoughts on Bitcoin’s future? Will it continue to rise, or are we in for a round of corrections? Join the conversation below!

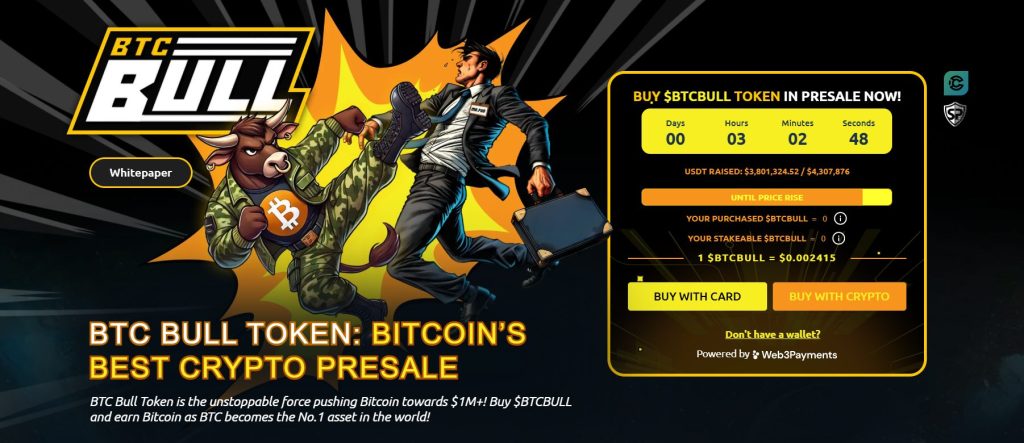

As an added note, if you’re looking to dive deeper into the cryptocurrency world, consider the emerging presale of BTC Bull, a community-driven token designed to reward holders with real Bitcoin upon reaching key pricing milestones. With a generous staking program and high yields, BTC Bull is attracting attention as a promising opportunity.