Cryptocurrency Market Takes a Hit: A Deep Dive into Q1 2025 Trends

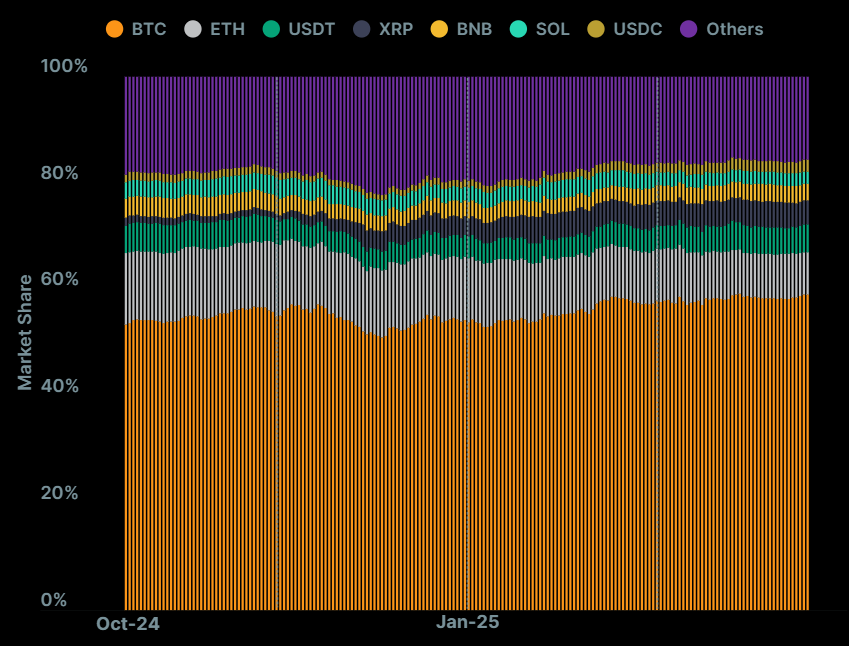

The cryptocurrency landscape has recently experienced a seismic shift as we delve into the first quarter of 2025. Following the remarkable peak of late 2024, the market faced a notable decline, sparking curiosity and concern among investors and enthusiasts alike. A report from CoinGecko reveals stark figures highlighting the market’s performance and the shifting dynamics among digital assets. This downturn not only shook altcoin investors but also showcased Bitcoin’s growing dominance during turbulent times.

According to CoinGecko’s findings, the total cryptocurrency market capitalization plunged by $633.5 billion, a staggering 18.6% drop that brought it down to $2.8 trillion. This plummet followed an impressive high of $3.8 trillion reached on January 18, just two days prior to Donald Trump’s inauguration as U.S. President. The report indicates a clear downward trajectory from that peak, driven not just by market movements but also by diminished investor activity.

📌 Why This Matters

The significance of this market shift is profound. Not only does it reflect investor sentiment and economic pressures, but it also sheds light on the ongoing struggle for stability within the cryptocurrency sector. A 27.3% decline in average daily trading volume, dropping to $146 billion from $200.7 billion in the previous quarter, underscores the growing hesitance among traders. But why does this matter? For both seasoned investors and newcomers, understanding these shifts can inform decisions and strategies moving forward, particularly in a market that remains volatile.

🔥 Expert Opinions

Market analysts have varying perspectives on the implications of this downturn. Some posit that Bitcoin’s ascendance, despite the overall market decline, suggests a flight to safety as investors seek refuge in the leading cryptocurrency. “Bitcoin is proving to be a digital gold,” says crypto analyst Jamie Lin, “offering a stable haven during turbulent market conditions.” This view echoes the increasing sentiment that Bitcoin’s appeal continues to rise even as altcoins falter.

Conversely, Ethereum’s steep decline, losing 3.9 percentage points of market dominance to settle at 7.9%, has raised alarms. According to market strategist Ava Garcia, “Ethereum’s struggles serve as a cautionary tale, reminding us that not all cryptocurrencies have the resilience of Bitcoin.” Analysts worry that this trend might represent broader issues within the Ethereum ecosystem, particularly as it shifts back to levels not seen since 2019.

🚀 Future Outlook

As we look ahead, what does the future hold for the cryptocurrency market? Will Bitcoin maintain its stronghold, or will altcoins find a way to recover? Many predictors point to evolving market dynamics influenced by regulatory developments and technological advancements within blockchain technology.

In addition, as the total value locked (TVL) in multichain decentralized finance (DeFi) dropped 27.5% to $128.6 billion by the end of March, it raises further questions about the sustainability of DeFi projects in the changing landscape. Ethereum’s loss of TVL was particularly striking, with a staggering 35.4% decrease affecting confidence in the chain’s prospects.

Examining the Trading Environment

Centralized exchanges (CEXs) and decentralized exchanges (DEXs) faced their own challenges in this tumultuous market. The top 10 CEXs reported a 16.3% decline in spot trading volume, totaling $5.4 trillion, with Binance holding a substantial 40.7% market share. Nevertheless, some exchanges, like HTX, managed to grow by 11.4%, proving that opportunities remain despite widespread declines.

On the DEX front, Solana shone brightly with a remarkable 35.3% increase in trading volume, capturing an impressive 39.6% market share. The spike can be attributed to a surge in interest surrounding political-themed memecoins. However, the competitive tension between Solana and Ethereum is palpable as both vie for dominance in a crowded marketplace.

Conclusion: A Call for Discussion

As the dust settles on a challenging first quarter, the cryptocurrency market’s trajectory remains uncertain. Investors are left to ponder whether this volatility is a temporary setback or part of a longer-term trend. As we witness the interplay of dominant players like Bitcoin and evolving projects like Ethereum and Solana, one question remains: How will you navigate this dynamic ecosystem in your investment journey? Join the conversation, share your thoughts, and let’s explore what lies ahead!