Bitcoin has once again seized the spotlight, and this time it has a powerful ally in its corner: Elon Musk. The Tesla and SpaceX CEO recently reignited discussions around the cryptocurrency, declaring it “energy-based” and “inflation-proof.” As delightful as that sounds for Bitcoin holders, there’s a larger narrative at play here, with multiple dynamics influencing the market. Let’s dive deeper into why this matters, what experts are saying, and how the future looks for BTC.

In the light of Musk’s remarks, Bitcoin is dancing near the $111,000 mark, indicating a potential resurgence after a rough patch, while simultaneously, the International Monetary Fund (IMF) has thrown a cautionary flag about global market risks. To add another layer of complexity, Japan’s Metaplanet, despite holding over $3.5 billion in Bitcoin, faces a troubling valuation decline. The landscape is rich with insights and predictions.

Elon Musk’s statement about Bitcoin’s “energy-based” existence contrasts starkly with the unpredictability of fiat currencies, which he criticized as being susceptible to inflation and government manipulation. In his view, the proof-of-work model of Bitcoin makes it fundamentally different from “fake fiat,” as it guarantees an intrinsic, energy-backed value. This marks Musk’s most significant comment on Bitcoin since the tumultuous aftermath of the FTX collapse in 2022, showing his renewed belief in Bitcoin as a safeguard against inflation in our increasingly digital world driven by artificial intelligence.

JUST IN: 🇺🇸 Elon Musk says, “#Bitcoin is based on energy: you can issue fake fiat currency, and every government in history has done so, but it is impossible to fake energy.” pic.twitter.com/5cSOGzZINp— Bitcoin Magazine (@BitcoinMagazine) October 14, 2025

This endorsement has sent waves through the market, and Bitcoin is surging as investor confidence rekindles. With each upward tick, the crypto community seems optimistic about Bitcoin’s long-term future, despite the IMF’s discouraging outlook on global market stability.

The IMF recently issued a stark warning, suggesting that complacency among investors might lead to significant market corrections. They highlighted escalating trade tensions and unsustainable debt levels as potential catalysts for a downturn. The warning drew immediate reactions, reminding everyone that while cryptocurrencies like Bitcoin can be volatile, external economic pressures can amplify these swings in unexpected ways. As a precautionary measure, the IMF has urged governments to tighten regulations on cryptocurrencies and stablecoins, underscoring the need for fiscal responsibility.

The IMF just issued a stark warning: risk asset prices are “well above fundamentals,” raising the odds of a “disorderly” market correction. The International Monetary Fund’s semiannual Global Financial Stability Report, released Tuesday morning, warns that investors have grown… pic.twitter.com/6BUOSaAWwQ— Aiime (@Aiime_ai) October 14, 2025

Despite these headwinds, Bitcoin has shown remarkable resilience, bouncing back from short-term volatility and reinforcing trader sentiment. Meanwhile, attention turns to Japan’s Metaplanet, a major player in the cryptocurrency treasury landscape. After recently experiencing a valuation drop below the value of its Bitcoin assets for the first time, Metaplanet’s enterprise value now stands at 0.99 compared to its impressive 30,823 BTC holdings. This dramatic fall—losing 75% of its value since June—has raised eyebrows within the trading community.

Metaplanet’s market-to-Bitcoin NAV just dropped below 1 for the first time ever, meaning the company’s market value is now less than the value of its Bitcoin holdings. Metaplanet is trading at a discount to its Bitcoin—a rare event for one of the largest public BTC holders. pic.twitter.com/yW8EKavdXX— Satoshi Club (@esatoshiclub) October 14, 2025

While some analysts view this as a mispricing, akin to early skepticism faced by Tesla, the drop signals a moment of introspection for the crypto treasury strategy. Yet, the steadfast nature of Metaplanet’s Bitcoin reserve suggests a strong foundation for long-term growth, reaffirming institutional confidence in Bitcoin’s value.

On the technical side, Bitcoin appears to be forming an intriguing triple-bottom pattern around the $109,600 mark—a price point that has historically acted as a springboard for reversals. Analysts observe decreasing selling pressure with growing buying interest, leading to an optimistic outlook. A bullish engulfing candle above $114,500 could further validate a breakout, propelling Bitcoin towards the sought-after $130,000 milestone.

As we observe the oscillating market and influential comments from figures like Musk, it’s clear that Bitcoin has positioned itself not just as a digital asset but as a cornerstone of a new financial frontier. The convergence of these insights and technical patterns suggests that Bitcoin may be on the brink of a significant rally as we progress through the fourth quarter. Engaged traders are making strategic moves, setting their sights on long positions with calculated stops, ready to harness the upward momentum.

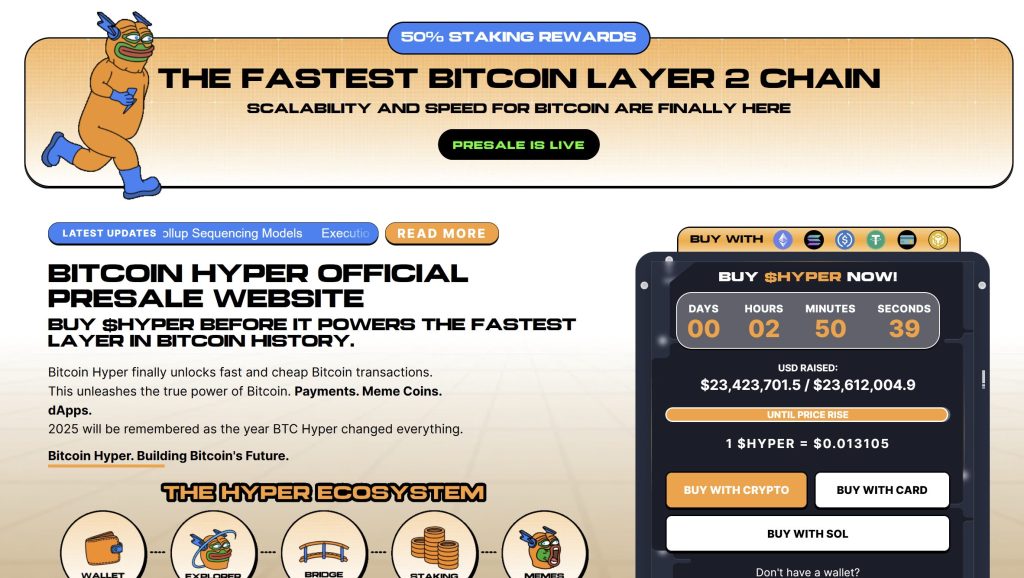

Additionally, the crypto ecosystem is continually evolving. The introduction of Bitcoin Hyper ($HYPER) symbolizes a fresh wave aimed at enhancing the Bitcoin landscape. This new entrant merges Bitcoin’s stability with the blazing speed of the Solana blockchain, creating a platform where smart contracts and decentralized applications can thrive. Audited for trust and scalability, Bitcoin Hyper has already garnered interest with its presale exceeding $23.4 million. This innovative fusion hints at a vibrant future where Bitcoin’s functionalities can expand rapidly.

In this vibrant, often unpredictable landscape, BTC is more than just a coin; it’s a pivotal player poised for an exciting journey ahead. Are you ready to navigate this evolving frontier? Whether you’re a seasoned trader or a curious newcomer, the potential of Bitcoin and the innovations surrounding it offer a wealth of opportunities just waiting to be explored. Join the conversation and stay informed about the future of finance.

Want to stay in the loop about Bitcoin and other cryptocurrencies? Check out more updates and insights on CoinDesk and join our community for actionable investment advice!