Bitcoin Surges Amid Global Market Tensions

Bitcoin is on a remarkable upswing! Currently trading around $84,700, it recently peaked at $85,400, tantalizingly close to a crucial resistance level at $86,100. This bullish momentum comes amid a flurry of macroeconomic and policy shifts that are channeling increased capital into the world of BTC.

🌏 China’s Tariff Hike Fuels Bitcoin’s Rise

This week, markets were jolted as China responded to escalating U.S. tariffs by increasing duties on $50 billion worth of American goods from 84% to 125%. The possibility of extending these tariffs to an additional $144 billion has sent shockwaves through investor sentiment, triggering a flight to safer assets.

As traditional markets faltered, Bitcoin soared, hitting $85,000 as investors sought refuge in its decentralized promise amidst growing geopolitical uncertainties. Will Bitcoin emerge as the preferred sanctuary for wealth in these turbulent times?

Good luck with that… “China has accused Washington of ‘blackmail’ and said it will ‘fight to the end’ after Donald Trump threatened overnight to impose an additional 50 per cent tariff on Chinese imports. At the same time, President Xi Jinping is seeking to present… pic.twitter.com/XNKT8weuLs— The Spectator Australia (@SpectatorOz) April 10, 2025

💵 A Weakening Dollar and Rising Institutional Interest

Alongside international tensions, the U.S. dollar is displaying signs of weakness, which is contributing to a growing crypto-friendly climate at home. In a significant breakthrough, Florida has introduced a bill to permit public funds to invest in Bitcoin, while North Carolina is moving to recognize BTC as legal tender. These regulatory shifts reflect an emerging acceptance of cryptocurrency in mainstream finance.

Moreover, Bitcoin’s hashrate has surged past an impressive 120 TH/s, indicating a robust increase in institutional mining activity. With analysts forecasting a potential climb toward $91,500, the Bitcoin Rainbow Chart suggests we are still in the “HODL” to “Still Cheap” zone. What could this mean for investors looking to leverage the current market conditions?

🚀 Trump Repeals IRS DeFi Rule—A Game-Changer for Crypto

In a landmark victory for the crypto community, President Trump has signed legislation to repeal the contentious IRS DeFi Broker Rule, which would have compelled decentralized platforms to report user transactions. Originally set for implementation in 2027, the rule faced fierce criticism over privacy concerns and technical challenges.

JUST IN: Trump signs a bill overturning an IRS rule that expanded the definition of a broker to include decentralized crypto exchanges. The crypto industry argued DeFi platforms can’t comply because they don’t control user data. A huge win for privacy 🙌 pic.twitter.com/JJ98k3s1q5— Bitcoin News (@BitcoinNewsCom) April 11, 2025

This repeal, championed by Rep. Mike Carey with bipartisan support, marks a significant milestone as the first crypto-specific law to be repealed through Congressional Review. With Trump’s bullish stance on cryptocurrency, confidence is surging, particularly among DeFi enthusiasts and institutional investors.

🇬🇧 Bitcoin’s Educational Horizon Expands in the UK

Another noteworthy development fueling bullish sentiment in Bitcoin comes from Scotland, where Lomond School has become the first institution in the UK to accept Bitcoin for tuition payments, starting Fall 2025. This initiative aims to immerse students in “sound money” principles grounded in Austrian economics.

JUST IN: 🇬🇧 Lomond School became the first UK school to accept #Bitcoin for payments. They will “look to build a Bitcoin reserve.” pic.twitter.com/xnBoDBJuip— Bitcoin Magazine (@BitcoinMagazine) April 11, 2025

While these school fees will initially be converted to fiat, the idea of establishing a Bitcoin treasury in the future showcases a growing trend of educational institutions adopting cryptocurrencies—a trend mirrored by universities in the U.S. This pivot towards Bitcoin education highlights its significance for the younger generations poised to enter the financial landscape.

📈 Technical Analysis: Bitcoin’s Path Ahead

As of April 13, 2025, BTC/USD holds firm at $84,700, resting just below a critical resistance level at $86,100. This level is pivotal, marking the upper boundary of a long-term descending channel, as well as a previously significant supply zone.

- Support Levels: $82,900 and $80,700

- Resistance Levels: $86,100, $88,600, and $90,900

- 50 EMA: Acting as dynamic support at approximately $81,970

- RSI: Currently at 61, indicating strong momentum but nearing overbought territory

If Bitcoin bulls can secure a daily closing price above $86,100 with solid trading volume, we could quickly be looking at a target of $92,800. Conversely, if we see a rejection, a brief pullback may ensue, although the overarching market structure remains bullish.

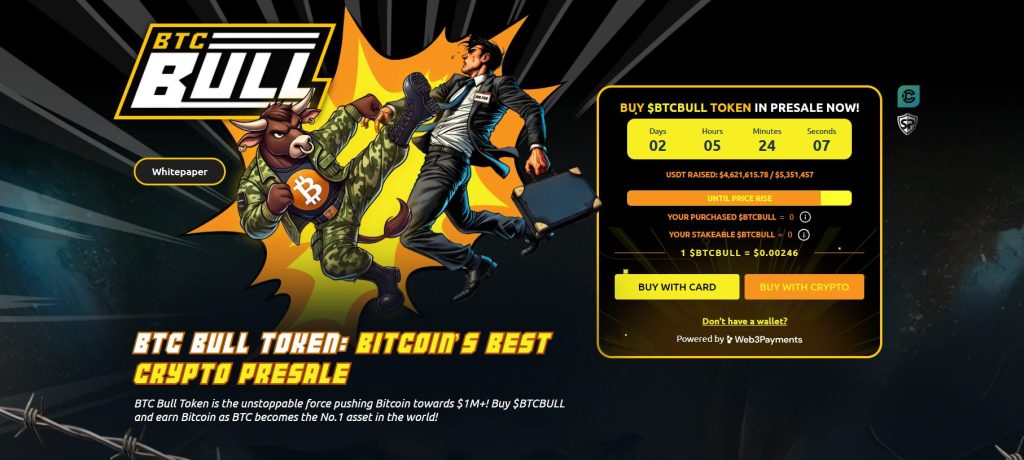

🔥 BTC Bull Presale: An Innovative Investment Opportunity

Exciting developments are also unfolding in the presale front with BTC Bull ($BTCBULL), which is captivating attention by merging meme culture with real utility. This token rewards long-term holders with actual Bitcoin every time the price reaches specific thresholds, aligning the interests of the community with Bitcoin’s growth.

The attractive staking program offers a whopping 119% APY, enabling users to earn passive income while supporting the network’s ecosystem. With over 882.5 million BTCBULL tokens already staked, community participation continues to flourish.

💡 Latest Presale Highlights

- Current Token Price: $0.00246 per BTCBULL

- Total Funds Raised: $4.6 million of a $5.3 million target

With a limited time left in the presale and an uptick in demand, now is the perfect moment to secure your BTCBULL before the next price surge!

💬 Conclusion: Let’s Talk!

As Bitcoin continues to navigate through economic headwinds and regulatory changes, it’s becoming evident that this digital asset is more than just a trend—it’s a cornerstone of the future financial landscape. How do you see Bitcoin evolving in the coming months? Join the conversation and share your thoughts!