Bitcoin Faces Turbulence Amid Global Volatility

Bitcoin (BTC/USD) experienced a notable downturn on Monday, dipping by 2% and hovering around the $76,500 mark. This decline marks a significant breach of crucial technical thresholds and comes in the wake of renewed macroeconomic turbulence spurred by U.S. President Donald Trump’s aggressive new tariff measures. The tariffs impose a base rate of 10% on imports, with some countries facing increases as high as 54%. The global financial markets didn’t take this news lightly, suffering a staggering loss of nearly $5 trillion in just one trading session—reaching a historic low for the S&P 500 index.

JUST IN: TRUMP’S LIBERATION DAY MARKS ‘CLIMAX OF UNCERTAINTY’ BEFORE CRYPTO MARKET RECOVERY. Tariffs reflect peak uncertainty, says @CryptoMichNL — but a recovery could be near. Source: @Cointelegraph https://t.co/Al0lmXbegy pic.twitter.com/MaKlEn2jgE— Mario Nawfal’s Roundtable (@RoundtableSpace) April 6, 2025

Bitcoin’s Role as a Hedge: A Reality Check

Traditionally viewed as a safe haven amidst fiat currency instability, Bitcoin’s current trajectory has disappointed many investors. Despite its reputation, Bitcoin found itself trending downward alongside numerous risk assets. Notably, MicroStrategy’s CEO, Michael Saylor, who recently acquired 22,000 BTC at an average price of $87,000, faced scrutiny from critics. Gold proponent Peter Schiff sarcastically advised Saylor to stock up to prevent his holdings from dipping below MicroStrategy’s average entry point of $68,000. This interaction highlights the ongoing debate over Bitcoin’s efficacy as a protective asset against market downturns.

Decoding Bitcoin’s Technical Analysis: Breakdown or Bounce?

The technical indicators paint a bleak picture for Bitcoin. It has broken down from what was once a stable symmetrical triangle pattern, experiencing a drop of approximately 9%, from $82,000 to $75,700. The projected target following this breakdown suggests further decreases, potentially reaching between $72,800 and $71,600, raising fresh concerns about short-term bearish momentum.

Key technical observations include:

- The 50-period Exponential Moving Average (EMA) at $82,500 now serves as a critical resistance level.

- The Relative Strength Index (RSI) has plummeted to 24, indicating dangerously oversold conditions.

- Immediate support levels are at $74,400, followed by $72,800 and $71,600.

- Resistance levels sit at $76,800 and $78,400.

For Bitcoin to regain a bullish outlook, a significant move back above $78,000 is essential. Until then, the looming risk of further declines persists. However, some experts posit that this breakdown could actually serve as a bear trap, suggesting that the overall technical framework still supports a potential rebound toward the $85,000 mark once market pressures ease.

Evolving Macro Factors Affecting Bitcoin’s Trajectory

This latest plunge comes as Bitcoin faces its steepest quarterly decline in a decade, with a staggering loss of 11.7%. Nevertheless, a variety of macroeconomic factors imply that a rebound might be on the horizon. Cryptocurrency analyst Michaël van de Poppe believes we may be nearing “peak uncertainty.” He suggests that Trump’s tariffs could eventually be reversed, promoting a more favorable environment for digital assets. Additionally, any movement towards lower interest rates or a potential return to quantitative easing could provide much-needed support to the crypto market.

The last week was part of the reason I was so concerned about Saylor’s manifest destiny assertion…. As BTC wraps its arms around BTC, it becomes LESS attractive to the rest of the world as a hedge. He is chipping away at its credibility as a neutral asset. pic.twitter.com/g26mq28wcS— PDR (@Pumpdotrun) April 6, 2025

On top of this, the upcoming FTX creditor repayments introduce an additional layer of uncertainty. Over 400,000 users are required to complete Know Your Customer (KYC) processes by June 1, or risk forfeiting a staggering $2.5 billion. The next repayment round scheduled for May 30 will involve $11 billion, which could introduce previously frozen assets back into circulation. Though short-term impacts may be limited due to gradual claims processing, increased liquidity may emerge later in the year.

Key Takeaways: The Current State of Bitcoin

- Bitcoin has breached critical triangle support levels, indicating immediate bearish trends.

- Market reactions to U.S. tariffs and FTX repayments are impacting investor sentiment.

- Despite current challenges, long-term technical analysis suggests a resurgence to $85,000 remains plausible if conditions stabilize.

While the current market correction reflects a broader risk-averse attitude, Bitcoin’s underlying structure indicates a potential breakout is possible. If key resistance levels can be reclaimed and macroeconomic conditions improve, the cryptocurrency market may soon see a shift in momentum.

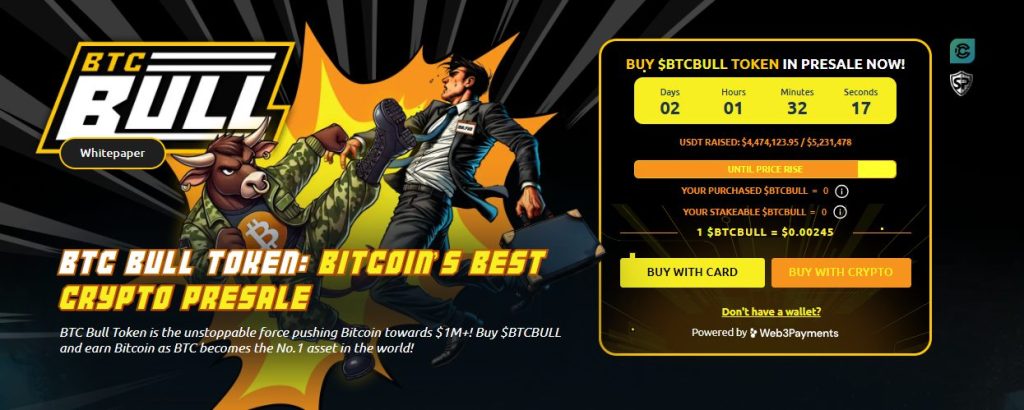

Introducing BTC Bull: A Game-Changer in the Cryptocurrency Presale Space

Amid these chaotic market conditions, new ventures continue to emerge, one of which is BTC Bull ($BTCBULL). This innovative presale is capturing attention by merging the vibrant world of meme culture with practical utility. Designed with long-term holders in mind, BTC Bull automatically rewards investors with real Bitcoin each time BTC climbs to significant price milestones, thus aligning community interests with Bitcoin’s growth aspirations.

Consider Passive Income Through Staking with BTC Bull

BTC Bull also features a highly attractive staking program, offering a remarkable annual percentage yield (APY) of 119%. This allows users to earn passive income while contributing to the network. With over 882.5 million BTCBULL tokens already staked, community participation continues to expand.

Racing Towards the Finish Line: BTC Bull Presale Updates

- Current Token Price: $0.00245 per BTCBULL

- Funds Raised So Far: $4.47 million of an initial $5.23 million target.

Time is of the essence to secure BTCBULL tokens at presale rates before the next expected price surge. As demand grows, now is the prime opportunity to jump on this exciting investment.

Conclusion: What Lies Ahead for Bitcoin and Investors

The volatility and uncertainty surrounding Bitcoin and the broader cryptocurrency market have sparked essential discussions about its future. As we look ahead, the intersection of macroeconomic shifts, technical indicators, and innovative projects like BTC Bull will likely shape the landscape of digital assets. What do you think is next for Bitcoin? Join the conversation below!