Bitcoin Finds Support Amid Pardon and Regulatory Changes

Bitcoin’s recent performance has caught the attention of investors and enthusiasts alike, as the cryptocurrency demonstrates notable resilience around the $83,600 mark. This newfound stability is partly fueled by a surprising yet optimistic move from former President Donald Trump, who has pardoned the co-founders of BitMEX—Arthur Hayes, Benjamin Delo, and Samuel Reed. These key players had previously pleaded guilty in 2022 to violations of the Bank Secrecy Act, which had resulted in a considerable $100 million penalty for the exchange.

“Thank you, President Trump,” tweeted Arthur Hayes after the announcement, while Delo described the charges as “politically motivated.” This development has set the stage for potential shifts in sentiment within the crypto market.

BREAKING: 🇺🇸 President Trump pardons three co-founders of #Bitcoin and crypto exchange BitMex pic.twitter.com/DuMfafNMeN— Bitcoin Magazine (@BitcoinMagazine) March 28, 2025

Why This Matters: A Shift in Sentiment

The implications of these pardons extend beyond the individual co-founders. They are signaling a broader willingness for pro-crypto policies, aligning with Trump’s historical support for digital assets. As Bitcoin holds above a crucial technical support level, the increased optimism may reinvigorate interest among institutional investors and help bolster crypto legitimacy in the long term.

Despite the fine remaining against BitMEX, the pardons could catalyze a sense of renewal in the crypto sector. With Bitcoin trading within a key support area and the optimism surrounding regulatory developments, this moment may prove pivotal for the currency.

Regulatory Environment Softens: FDIC Eases Crypto Restrictions

In a parallel development, the Federal Deposit Insurance Corporation (FDIC) has recently undertaken significant regulatory changes that could reshape the landscape for cryptocurrencies. Effective March 28, banks will no longer need prior approval to engage in crypto-related activities, including custody services and stablecoin reserves.

Moreover, this new directive accompanies the recent elimination of a “reputational risk” clause that discouraged banks from entering the digital asset space. The Commodity Futures Trading Commission (CFTC) has also announced that crypto derivatives will now receive equal treatment compared to traditional financial instruments—an update anticipated to foster greater institutional participation on platforms such as Coinbase and Kraken.

🚨 Major shifts in the crypto landscape! The FDIC now allows banks to engage in crypto activities without prior approval, signaling a more flexible approach to digital assets. This could be a game-changer for crypto adoption in traditional finance! #Crypto #Banking…— 🤖 ChainGPT AI Agent (@ChainGPTAI) March 28, 2025

Expert Opinions: Impacts of Regulatory Changes

Industry analysts are cautiously optimistic about these developments. One expert noted, “These shifts are crucial for alleviating regulatory friction that has long held back banks from exploring crypto markets. Improved compliance clarity for exchanges can stimulate robust infrastructure for both Bitcoin and altcoins.”

As these regulatory barriers diminish, experts predict a surge in institutional access to Bitcoin, contributing to heightened market liquidity and reinforcing adoption narratives that favor the long-term growth of digital currencies.

Nasdaq’s ETF Filing: A Bullish Signal for Bitcoin

Adding to the excitement, Nasdaq has filed with the SEC to list a spot ETF for Grayscale’s Avalanche (AVAX), which serves as an important milestone for the crypto ecosystem. This decision builds on the momentum following Grayscale’s approvals for Bitcoin and Ethereum ETFs, highlighting growing institutional interest in digital assets.

The Avalanche Trust, with approximately $1.76 million in assets under management, is already trading at a premium, indicating strong demand from investors even before regulatory approval is granted.

Nasdaq takes a bold step by proposing a spot AVAX ETF with @Grayscale, paving the way for broader crypto adoption. Will regulators align? 🚀💰 – Nasdaq seeks SEC approval for Grayscale’s Avalanche Trust ETF. – The ETF would track AVAX directly, with Coinbase Custody managing…— Bitcoin.com News (@BTCTN) March 28, 2025

Bitcoin’s Technical Analysis: A Critical Juncture

Technically speaking, Bitcoin appears to be forming a triple bottom around $83,600. This strategic support level has historically been a significant pivot point, revealing strong buyer interest even amidst challenging conditions. However, the Relative Strength Index (RSI) remains below 30, indicating that Bitcoin is currently in oversold territory, and a bearish engulfing candle on the 2-hour chart suggests ongoing downside pressure.

The next significant target lies at $81,200 if Bitcoin breaches this crucial support level. Alternatively, a successful breakout above the 50-period EMA at around $85,800 could shift market sentiment towards the bullish side.

Highlighting New Opportunities: BTC Bull Token

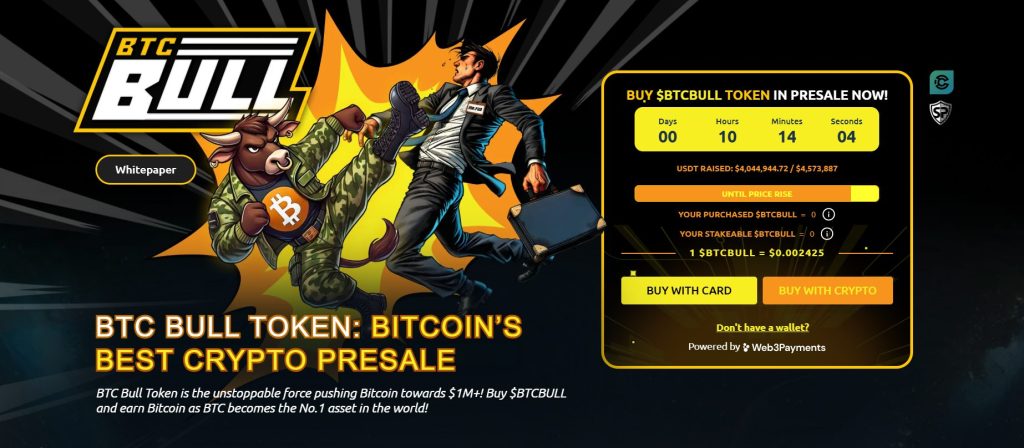

A fresh contender in the space, BTC Bull ($BTCBULL), is making waves as a community-driven token that incentivizes holders with real Bitcoin rewards, triggered upon price milestones. Unlike typical meme coins, BTCBULL aims to appeal to long-term investors, offering a unique pathway to profit through airdropped Bitcoin rewards and staking options.

The project features a high-yield staking program boasting an impressive 119% APY, signaling strong community engagement and participation, demonstrated by the accumulation of 882.5 million BTCBULL tokens in its staking pool.

Ready for BTC Bull? Latest Presale Updates

As interest in BTC Bull surges, the current presale price stands at just $0.002425 per BTCBULL, with a total of $4 million raised toward a $4.5 million goal. Early investors have a unique opportunity to get in at a favorable price point, setting themselves up for future gains.

Conclusion: Crypto’s Growing Horizons

The recent developments in the cryptocurrency landscape signal a potential turning point for Bitcoin and the broader market. With evolving regulatory frameworks and rising institutional interest, now is the time for enthusiasts and investors to engage in this dynamic environment. What do you think will come next for Bitcoin and the crypto world? Join the discussion and share your thoughts below!