Revolutionary Surge: Bitcoin ETFs Attract Massive Inflows

July 10, 2025, marked a significant milestone in the cryptocurrency landscape as Bitcoin spot exchange-traded funds (ETFs) experienced an astonishing influx of $1.18 billion. This surge of institutional investment propelled Bitcoin to unprecedented heights, reaching a staggering price of $116,664 on Thursday. With Bitcoin currently trading around $118,140, having briefly exceeded $118,450, it’s evident that the enthusiasm surrounding crypto assets is far from fading.

What’s noteworthy is the cumulative total net inflows for Bitcoin spot ETFs now exceeding $51 billion for the first time. This figure not only highlights the burgeoning appetite among investors but also signals a notable shift in market dynamics as institutional players become increasingly active.

The Leaders of the Pack: Who’s Driving the Flows?

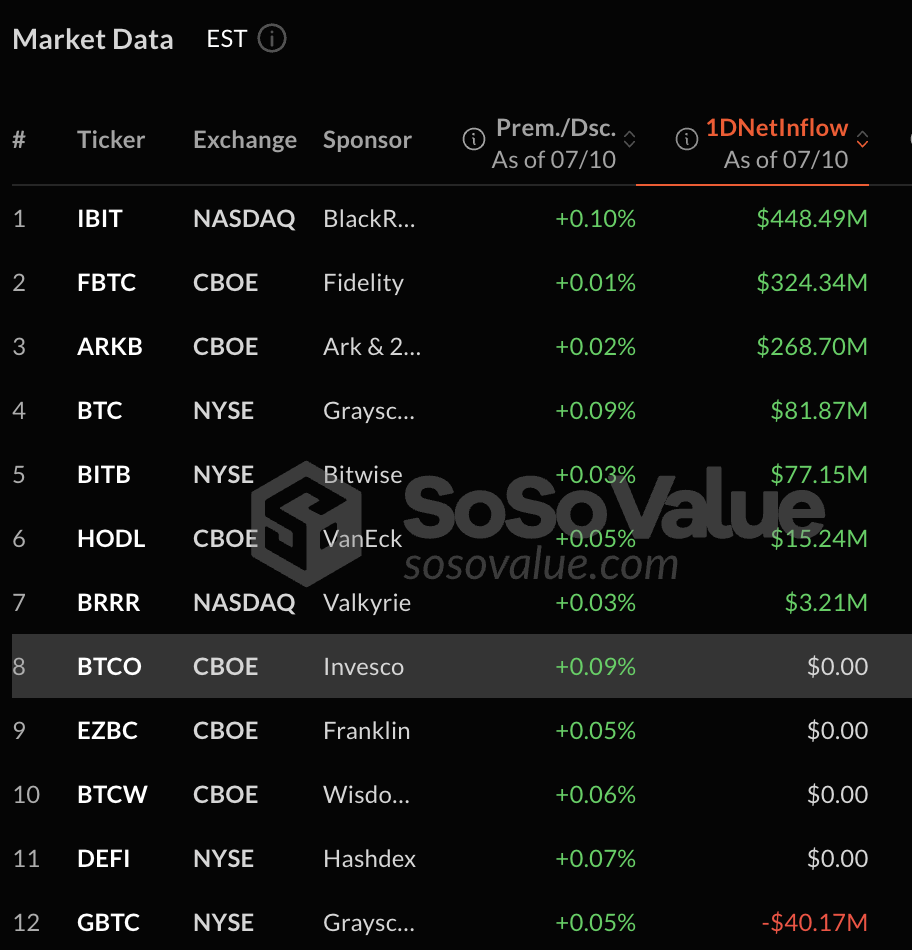

Analyzing the landscape, it’s clear that specific funds are shaping the narrative. On Thursday alone, seven out of twelve Bitcoin-related funds reported net inflows, with BlackRock’s IBIT leading the charge with an impressive $448.49 million influx. Following closely behind, Fidelity’s Bitcoin fund (FBTC) also made significant waves with $324.34 million in positive flows.

Ethereum’s Ascendancy: Spot ETFs Signal Strong Market Sentiment

But the excitement isn’t confined to Bitcoin alone. Ethereum also enjoyed a surge, with spot ETFs amassing a total net inflow of $383 million—its second-largest on record. With cumulative net inflows hitting $5.10 billion, Ether is experiencing a notable upswing, buoyed by the rising demand for ETFs. Currently trading at $3,014, Ether has climbed 8%, showcasing a robust performance that surpasses even Bitcoin’s rally this week.

Ethereum’s up 7% with a clean push to US$3,000. It’s showing more strength than Bitcoin this week, with fresh institutional flows and BlackRock’s ETH ETF hitting record volumes. ETH maxis, enjoy the moment.— Rachael (@Rachael_M_Lucas) July 11, 2025

On July 10, Ether spot ETFs reported net inflows totaling $300.93 million, primarily driven by the BlackShares iShares Ethereum Trust (ETHA). This particular fund has attracted over $1.2 billion from investors since June, reflecting growing bullish sentiment within the market. Rachael Lucas, a seasoned crypto analyst at BTC Markets, emphasized that this momentum marks a pivotal transition for both Bitcoin and Ethereum, stating, “What we’re seeing is not a retail-driven frenzy, but a steady pipeline of capital from asset managers, corporate treasuries, and wealth platforms finally stepping into the market. Weeks of consistent inflows confirm that.”

📌 Why This Matters

The implications of these developments extend beyond price volatility. The influx of institutional capital can be a harbinger of broader acceptance of cryptocurrencies in mainstream finance. As large financial entities engage with these assets, it signals to the market that cryptocurrencies are becoming an integral part of the investment landscape. This shift could pave the way for more innovative financial products and services, further embedding digital assets within the traditional financial ecosystem.

🔥 Expert Opinions on Institutional Trends

Industry analysts are taking note of this changing tide. The consistent inflow of capital into Bitcoin and Ethereum ETFs indicates a solid shift in strategy among institutional investors. Many predict that as these reports of growing investment continue, other institutions will follow suit, looking to diversify their portfolios with crypto assets. Experts argue that this may even trigger a ripple effect, influencing smaller investors and retail markets to allocate funds into digital currencies.

🚀 Future Outlook: Where Do We Go from Here?

Looking ahead, the trajectory seems promising. If the current inflow trends continue, we could witness further price escalations for both Bitcoin and Ethereum. Additionally, as more financial players establish their crypto footprints, the market may become increasingly stable, mitigating the extreme volatility typically associated with these digital assets. The continued success of Bitcoin and Ethereum ETFs could also inspire more innovative financial instruments, enriching the options available to investors.

Conclusion: Join the Discussion

As the cryptocurrency market evolves, it invites both excitement and caution. The momentum surrounding Bitcoin and Ethereum is undeniable, but it raises questions about sustainability and future growth. What are your thoughts on the surge in institutional investments? Are you optimistic about the crypto market’s future? Engage with us in the comments to share your insights!