Bitcoin Breaks New Ground: Trading Surge Nears $95,000

Bitcoin has made a striking comeback, currently trading at around $94,200, marking an impressive rise of nearly 8% after it recently reclaimed the crucial $90,000 threshold. This surge can be attributed to a resurgence in institutional interest and geopolitical factors that are increasingly favorable to cryptocurrency. As Bitcoin approaches significant resistance at $95,100, market observers are on high alert. A decisive breakout above this level could pave the way for BTC to reach $97,000 and even $99,700. However, traders should remain cautious as a brief consolidation phase may be imminent due to market exhaustion.

From a technical standpoint, indicators show a bullish trend: the Moving Average Convergence Divergence (MACD) remains positive, and the 50-period Exponential Moving Average (EMA) is providing robust support near $86,960. Yet, as the price nears the upper boundary of its rising channel, the question looms: will traders witness a confirmation of a breakout, or are we on the brink of a pullback?

Wall Street’s Bold Move: $3 Billion Crypto Venture Takes Shape

Institutional players are taking significant steps in the crypto world yet again. A heavyweight consortium, including Cantor Fitzgerald, SoftBank, Bitfinex, and Tether, has reportedly initiated plans for a groundbreaking $3 billion Bitcoin acquisition vehicle named 21 Capital, as reported by the Financial Times. This initiative aims to position Bitcoin as a cornerstone treasury asset for a publicly traded entity, mirroring the successful strategies of MicroStrategy.

🚨 JUST IN: Cantor Fitzgerald teams up with SoftBank, Tether, and Bitfinex on a massive $3 billion Bitcoin acquisition fund, per FT. Cantor’s CEO Brandon Lutnick aims to replicate MicroStrategy’s successful crypto investment model. pic.twitter.com/URjiYfS2xA— Cointelegraph (@Cointelegraph) April 23, 2025

The funding breakdown is substantial:

- Tether: $1.5 billion

- SoftBank: $900 million

- Bitfinex: $600 million

Bitcoin will be directly acquired and exchanged for shares in the new firm, capitalizing on favorable regulatory conditions and government support. This initiative is a clear indication of growing confidence in the potential of crypto assets to anchor institutional financial structures instead of merely existing on the sidelines.

Malaysia Seizes Blockchain Opportunity with Binance Founder

In a bold move in Southeast Asia, Malaysian Prime Minister Anwar Ibrahim confirmed a high-level discussion with Changpeng Zhao (CZ), the founder of Binance, aimed at leveraging blockchain technology to foster financial innovation. The overarching ambition is to establish Malaysia as a key regional hub for tokenized assets and digital finance.

Prime Minister Ibrahim noted that various regulatory bodies, including the Central Bank and the Securities Commission, are actively working on policy frameworks designed to balance innovation with risk management. CZ also commented on the meeting, describing it as “constructive.” This kind of proactive governmental engagement around cryptocurrency enhances its credibility and could serve as a catalyst for global advancements in the sector.

JUST IN: 🇲🇾 Binance Founder CZ meets with Malaysia’s Prime Minister to discuss boosting crypto and blockchain innovation. pic.twitter.com/Q7xVvg0L0s— Watcher.Guru (@WatcherGuru) April 22, 2025

Tesla’s Steadfast Bitcoin Stance Amid Market Turbulence

Tesla has revealed it holds 11,509 BTC in its Q1 earnings report, maintaining its substantial crypto reserves despite a notable decline in year-over-year earnings. This significant holding, now valued at over $1 billion, showcases Tesla’s long-term commitment to Bitcoin, even as CEO Elon Musk shifts his focus back to core company operations.

🚨 Musk Says His Time With DOGE Will ‘Drop Significantly’ Next Monthhttps://t.co/24O8kyH4Ej— The Epoch Times (@EpochTimes) April 23, 2025

Tesla’s choice to retain its Bitcoin assets, notwithstanding external market pressures, may offer a degree of stability in a landscape often characterized by volatility. The recent regulatory change allowing Bitcoin to be recorded at fair market value only enhances its appeal as a treasury holding.

Understanding Bitcoin’s Trade Outlook: Key Resistance and Support Levels

Bitcoin is now navigating a critical trading zone, where the next price movement could set the tone for the upcoming quarter. A confirmed breakout above $95,100 with robust trading volume could lead to targets of $97,000—and potentially $99,700. However, if the price is rejected at this resistance level, a healthy retreat to support near $92,600 is likely.

Trade Plan Overview:

- Stop Loss: Below $90,700

- Buy Breakout: Above $95,100 with strong volume

- Buy Dip: Around $92,600 with bullish signals

- Target Levels: $97,000 and $99,700

As institutional flows gain momentum, Bitcoin’s narrative is evolving, entering a more sophisticated market phase. The upcoming movements could significantly influence the crypto landscape for Q2.

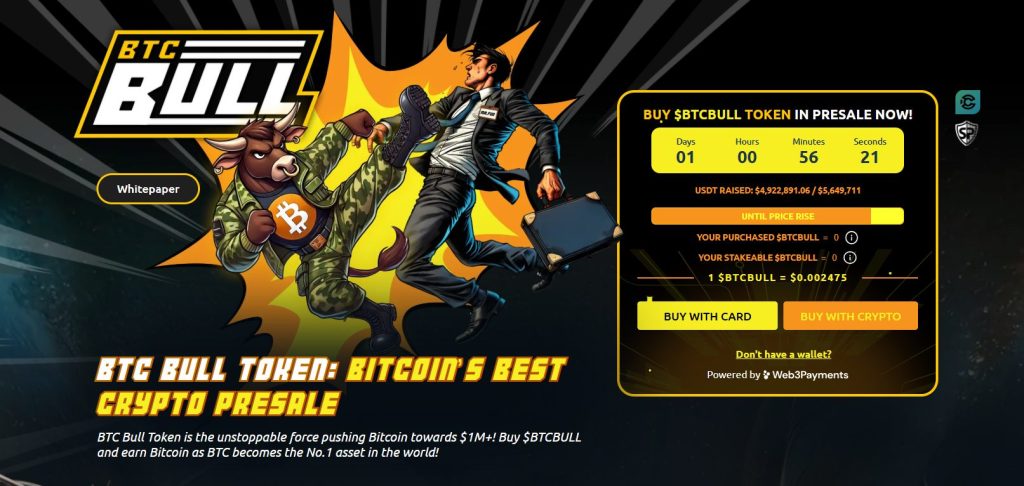

BTC Bull Token Presale: An Investor’s Delight

With Bitcoin hovering around the $95,000 mark, excitement is building for BTC Bull Token ($BTCBULL), which has raised nearly $4.8 million in its presale, edging closer to its next price milestone of $5.64 million. While the presale isn’t over, this point is critical as the token price is set to increase from the current rate of $0.002475.

Key Features of BTC Bull Token:

- Annual Yield: 84% APY

- Total Staked: 1,252,015,807 BTCBULL

- Flexible Staking: Unstake anytime

This dual-reward mechanism—offering both high staking yields and Bitcoin airdrops—positions $BTCBULL as more than just another meme coin. It presents genuine utility with growth potential, appealing to both seasoned crypto enthusiasts and casual investors alike.

As the demand for BTCBULL escalates, securing your tokens during this presale period could be a strategic advantage before the price embarks on its next upward journey. Are you ready to make your move?