Bitcoin’s Resurgence: What You Need to Know

Bitcoin (BTC) has once again captured the spotlight, experiencing a significant rise of over 1.35% on Tuesday, trading near the $85,700 mark. This resurgence is fueled by a variety of bullish catalysts that are counterbalancing ETF outflows and broader market challenges. One notable development is the Brazilian fintech company Meliuz’s proposal to include Bitcoin in its corporate treasury strategy, demonstrating an increasing corporate belief in Bitcoin as a viable asset for long-term financial planning.

Brazil fintech Meliuz proposes expanding bitcoin reserves strategy https://t.co/Zq0MtDuQF6 pic.twitter.com/JxeXKBNIdU— Reuters Tech News (@ReutersTech) April 15, 2025

The Significance of Corporate Adoption

As Meliuz prepares to hold a shareholder vote on May 6 regarding the formal integration of Bitcoin into its financial strategy, this move symbolizes a growing confidence among corporations in Bitcoin as a sound store of value. This kind of adoption not only bolsters Bitcoin’s reputation but also encourages other companies to consider similar paths, establishing a broader acceptance in the corporate sphere.

Market Dynamics: ETF Outflows and Inflows

In April, US-listed Bitcoin ETFs faced notable challenges, with a staggering $812.3 million in net outflows recorded. Key players such as BlackRock’s IBIT and Grayscale’s GBTC took significant hits, with redemptions of $393.2 million and $256.4 million, respectively. However, amidst this wave of selling, Grayscale’s newly launched Mini Trust managed to attract $36.7 million in inflows, demonstrating that selective optimism persists in the market.

Understanding the Macro Environment

The macroeconomic landscape is also shifting favorably for Bitcoin. Federal Reserve Governor Christopher Waller recently indicated that renewed US tariffs might prompt a “bad-news rate cut,” aimed at mitigating recession fears. While such a move isn’t ideal for the economy, it is likely to enhance liquidity—creating a more inviting environment for risk assets, including Bitcoin.

Relatively to the past couple of weeks, it was a quiet trading day for both crypto and U.S. stocks, with both assets drifting modestly higher on Monday.https://t.co/B9KBjjZB35— CoinDesk (@CoinDesk) April 14, 2025

Additionally, the EU has decided to pause its retaliatory tariffs until July 14, providing a breathing space for negotiations with the US. With Polymarket indicating a 65% chance of a successful deal, this positive development could ease tensions and further support Bitcoin’s climb.

Institutional Investors: A “Buy-the-Dip” Mentality

Despite facing a 13% drop in the first quarter—marking Bitcoin’s worst quarterly start since 2018—institutions appear undeterred. Wealth management firm Xapo Bank reported a remarkable 14.2% increase in Bitcoin trading volume as high-net-worth clients seized the opportunity to buy during the downturn. Meanwhile, interest in euro deposits at Xapo surged by 50%, highlighting a shift in strategy as European regulatory pressures mount.

JUST IN: Crypto wealth manager Xapo Bank introduces Bitcoin-backed loans up to $1 million. pic.twitter.com/6QshU65XH0— Whale Insider (@WhaleInsider) March 18, 2025

In the same vein, Bitget exchange reported a remarkable $2.1 trillion in trading volume for Q1 2025, with spot trading up 159%, along with nearly 5 million new user registrations. This uptick in interest and trading activity indicates a robust institutional conviction fueling the long-term bullish narrative for Bitcoin.

Technical Analysis: What’s Next for BTC

From a technical standpoint, Bitcoin is experiencing a promising breakout above the $84,358 resistance and is currently trading around $85,693, maintaining momentum along a rising trendline. The dynamic support provided by the 50-period EMA at $83,870, combined with a bullish RSI nearing 63, suggests a positive outlook while avoiding overbought conditions.

- Entry Point: Consider buying above $86,150 on a confirmed breakout.

- Target Range: $87,350 – $88,500.

- Stop Loss: Set at $83,800.

Timing is everything; wait for a strong candle close above $86,150 with increasing volume. This momentum-driven approach can lead to rewarding trades while effectively managing risks with a tight stop loss.

Conclusion: What’s Next for Bitcoin?

As Bitcoin navigates through the complexities of market dynamics, institutional backing, and macroeconomic factors, it is once again finding its footing above the $85K threshold. While the challenges of ETF outflows persist, the strong conviction evident among retail and institutional buyers paves the way for a potential push towards $88K and beyond. What do you think about Bitcoin’s current trajectory? Join the conversation below!

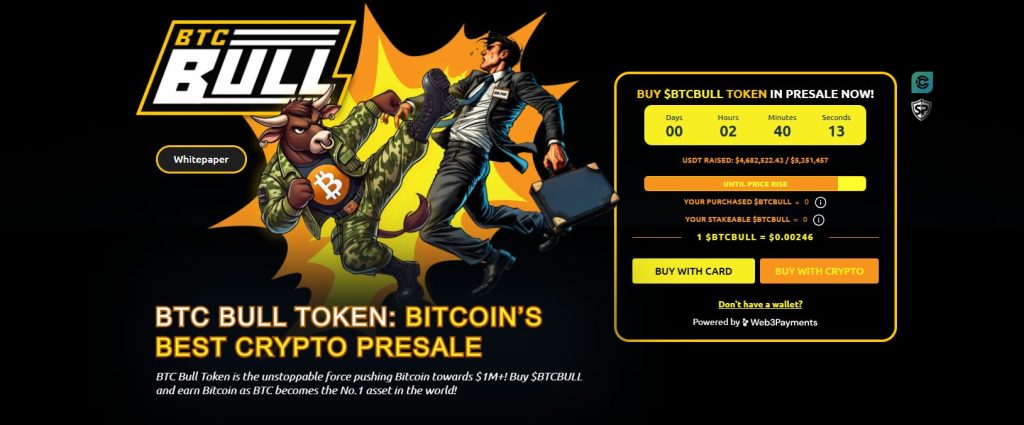

📈 Bitcoin Bull Presale: Capitalizing on Growth

One of the most exciting prospects is the Bitcoin Bull ($BTCBULL) presale, which uniquely marries the excitement of meme culture with functionality. Designed for long-term holders, each token rewards investors with real Bitcoin as BTC hits major price milestones, aligning community growth with Bitcoin’s trajectory.

Additionally, BTC Bull is offering an enticing staking program with a staggering 119% APY, allowing users to earn passive income while contributing to network support. With over 882.5 million BTCBULL tokens staked, interest is heating up.

Latest Happenings in the Presale:

- Current Token Price: $0.00246 per BTCBULL.

- Amount Raised: $4.6M of the $5.3M target.

With limited time left and demand on the rise, now is the perfect moment to grab BTCBULL at presale prices before the next price increase!