Bitcoin Steady at $95,832: A Glimpse into Current Market Conditions

Bitcoin, the giant of the cryptocurrency market, is currently trading at approximately $95,832, demonstrating impressive resilience following a recent dip to the pivotal 0.5 Fibonacci retracement level at $95,444. Despite a slight contraction of 0.52% in the past 24 hours, Bitcoin has shown a positive trend overall, climbing 1.71% for the week. This recent fluctuation hits a notable high of $97,754, reaffirming that bullish sentiment in the market is still very much alive.

Technical analysis illustrates that Bitcoin is maintaining a strong position above the 50-period Exponential Moving Average (EMA) of $94,971 and the crucial support level at $94,872. This convergence of technical indicators creates a robust foundation for potential upward movements. If Bitcoin successfully rebounds from these levels, traders could set their sights on targets of $96,782 and $97,329.

Understanding Bitcoin’s Current Dynamics: Why This Matters

The significance of Bitcoin’s current price action goes beyond mere numbers; it reflects the overall health and sentiment of the cryptocurrency market. With institutional players gaining prominence in Bitcoin transactions, the price stability can serve as a launching pad for further growth. The interaction between retail investors and institutional demand could shape the landscape as we move forward, impacting everything from trading strategies to long-term investment decisions.

Market Indicators: What’s Next for Traders?

The MACD currently signals a bearish trend, yet the prevailing low trading volumes hint at a lack of conviction among sellers. This scenario creates an opportunity for a future rebound, particularly as buyers may reclaim their footing soon. Here’s a concise trading setup for those looking to capitalize on potential movements:

- Entry Point: Look for a confirmed bounce above the $95,444 mark.

- Targets: Aim for $96,782 → $97,329.

- Stop Loss: Set below $94,870.

Institutional Investors Make Their Mark: Bitcoin Ownership Rising

How is Bitcoin managing to stay afloat in a volatile market? The answer lies in burgeoning institutional interest. Recent on-chain analysis reveals that approximately 9% of Bitcoin’s total supply is now held by institutions, including heavyweight names like BlackRock and Fidelity. These firms are significantly impacting Bitcoin prices, primarily through inflows into spot Bitcoin exchange-traded funds (ETFs), effectively laying down a new price floor for the asset.

9% of the total #BTC supply is now held by #Bitcoin ETFs and public companies. Let that sink in. pic.twitter.com/bGd0Fmpdij— Crypto Decode (@TheCryptoDecode) May 4, 2025

These ETFs facilitate easier access to Bitcoin, particularly for traditional finance players, while also stabilizing the market. Unlike short-term traders, institutions generally have a long-term holding strategy that diminishes circulating supply, applying upward pressure on prices over time.

Institutional Impact at a Glance

- Key players like BlackRock and Fidelity see increased ETF inflows.

- ETFs enhance accessibility and reduce sell-side pressure on Bitcoin.

- Long-term holdings help stabilize prices by tightening supply.

Global Crypto Expansion: Bitcoin’s Future Looks Bright

In an exciting turn of events, Binance, the largest cryptocurrency exchange worldwide, is actively promoting Bitcoin’s adoption through significant global partnerships. Their recent agreement with the investment agency of Kyrgyzstan is a perfect example, where Binance will introduce Binance Pay and blockchain education initiatives throughout the country—an effort that has the endorsement of the nation’s President, Sadyr Japarov. The overarching aim is to establish a comprehensive crypto infrastructure nationwide.

Binance to launch crypto payments in Kyrgyzstan with new partnership https://t.co/G6iPDG5iA4 https://t.co/Yvy8YQ63FS https://t.co/kU4g3w6B54 pic.twitter.com/Y3oUlTd125— Crypto Xplosive (@CryptoXplosive) May 4, 2025

Amidst this growth, Binance is also advising nations like Pakistan on crafting effective cryptocurrency policies, further solidifying Bitcoin’s place in emerging markets. This global expansion underscores Bitcoin’s increasing relevance and its potential for mainstream adoption in diverse settings.

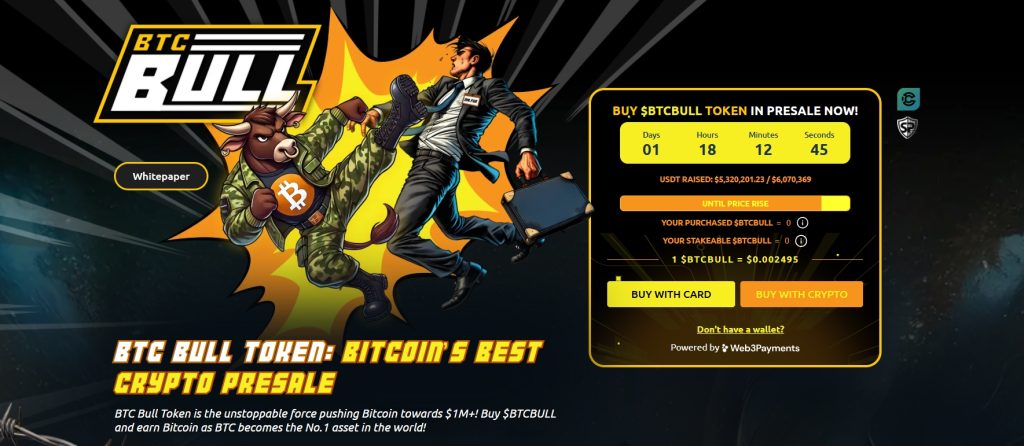

Innovative Ventures: BTC Bull Token Seeks Attention

On a different front, the BTC Bull Token ($BTCBULL) is making waves, having amassed over $5.28 million in its presale as it approaches a cap of $5.96 million. Priced attractively at $0.00249, BTCBULL is not just another meme coin; it combines community appeal with genuine utility through its flexible, high-yield staking options.

Utility-Driven Tokenomics Fuel Demand

Setting itself apart from traditional meme tokens, BTCBULL offers a compelling model that allows investors to earn an astonishing estimated annual percentage yield (APY) of 78% while retaining full liquidity of their assets—without the worry of penalties or lockup periods when unstaking. This innovative approach resonates with investors seeking tangible benefits amidst the unpredictable crypto landscape.

Current Presale Stats:

- USDT Raised: $5,320,201.23 of $6,070,369

- Current Price: $0.002495 per BTCBULL

- Staking Pool Total: 1,342,549,903 BTCBULL

- Estimated Yield: 78% annually

With only around $680K remaining before reaching the next milestone, the presale window is closing rapidly. For those on the hunt for attractive yields paired with the flexibility of capital access, BTCBULL is shaping up to be a hot contender in the cryptocurrency market as we venture further into 2025.

Conclusion: A Market to Watch

In conclusion, as Bitcoin remains anchored in the high $90,000s, the interplay between institutional investments and global adoption underscores an intriguing environment for both traders and investors alike. What are your thoughts on Bitcoin’s trajectory? Will institutional support pave the way for a new price paradigm? Join the conversation and share your insights!