Bitcoin Surges Amid Market Optimism: What You Need to Know

In an exciting turn of events, Bitcoin (BTC) is trading around $107,343, reflecting a modest increase of 0.28%. This shift in value coincides with soaring U.S. equities that are reaching record highs. The S&P 500 impressively closed at 6,173.07, while the Nasdaq Composite topped 20,273.46. The driving forces behind this bullish sentiment? Progress in U.S.–China trade negotiations and an overall optimistic outlook in global markets.

Bitcoin’s resilience is noteworthy, as it has remained above the $107,000 threshold for much of the week, enjoying a 3.8% gain during this period. This trend is partially attributed to positive statements from U.S. Commerce Secretary Howard Lutnick, who hinted at upcoming finalized trade agreements with China and ten other global partners.

“S&P 500 hits new all-time high as Trump confirms China trade deal. Markets staged historic comeback – tech giants leading. Commerce Secretary Lutnick confirms trade deals with 10 major partners coming imminently. Fed rate cuts still expected despite inflation worries.”

— Boi Agent One (@boiagentone) June 27, 2025

📌 Why This Matters: The Impact of Trade Talks on Crypto Markets

The interplay between traditional equities and cryptocurrency is increasingly evident. The robustness of Bitcoin’s market performance highlights its evolving nature as a macro risk asset rather than merely a speculative investment. This development indicates that traders and investors are beginning to recognize Bitcoin as a legitimate asset class that aligns more closely with mainstream market dynamics.

🔥 Expert Opinions: Navigating Current Market Trends

Market analysts are closely watching Bitcoin’s movement, especially as it behaves in correlation with significant macroeconomic headlines. Some experts note that Bitcoin’s recent upward movements suggest increasing institutional interest. “Bitcoin is firmly establishing itself as a cornerstone of modern portfolio management,” said a leading crypto analyst. “Its resilience amid external economic pressures shows that investors are treating it as a viable asset in uncertain times.”

🚀 Future Outlook: What Lies Ahead for Bitcoin

Despite its current stability, Bitcoin faces formidable macroeconomic challenges. The latest data on inflation reveals that the U.S. core Personal Consumption Expenditures (PCE) index rose to an annual rate of 2.7% in May, slightly above expectations. Monthly core inflation also ticked up by 0.2%, raising concerns about further economic tightening. Fed Chair Jerome Powell has emphasized a careful, data-driven approach moving forward, which keeps investors on their toes regarding potential rate hikes.

The cautious statements from the Federal Reserve suggest that any aggressive bullish momentum in Bitcoin may be constrained until clear signs of inflation cooling or a shift in monetary policy surface.

Market Dynamics: Declining Volume Raises Questions

Adding further complexity to the landscape, Bitcoin’s recent trading behavior implies a phase of consolidation rather than expansion. According to data from Glassnode, daily transfer volumes have dipped significantly, dropping from $76 billion in May to $52 billion recently. Futures markets also reflect a cooling interest, hinting at a potential wait-and-see stance among investors.

Key Technical Levels: Eyes on the Charts

Technical analysis indicates that Bitcoin may be gearing up for a significant move once it breaches the $108,250 resistance level. The cryptocurrency appears to be forming a symmetrical triangle or bullish pennant pattern on the 4-hour chart. Meanwhile, the 50-day Exponential Moving Average (EMA), currently at $105,970, presents a crucial support level, while the MACD shows signs of flattening, signaling caution among traders.

Key Levels to Monitor:

- Resistance: $108,250, $109,257, $110,448

- Support: $105,970, $104,991 (Fib 0.382), $103,984 (Fib 0.5)

Recommended Trade Setup:

- Buy above: $108,300 on breakout

- Targets: $109,257 and $110,448

- Stop-loss: Below $105,970

- Alternative Entry: Consider a dip-buy around $104,991

Given the light trading volume, traders are advised to remain vigilant, as Bitcoin’s journey to the coveted $112,000 mark may require more robust engagement from the market participants.

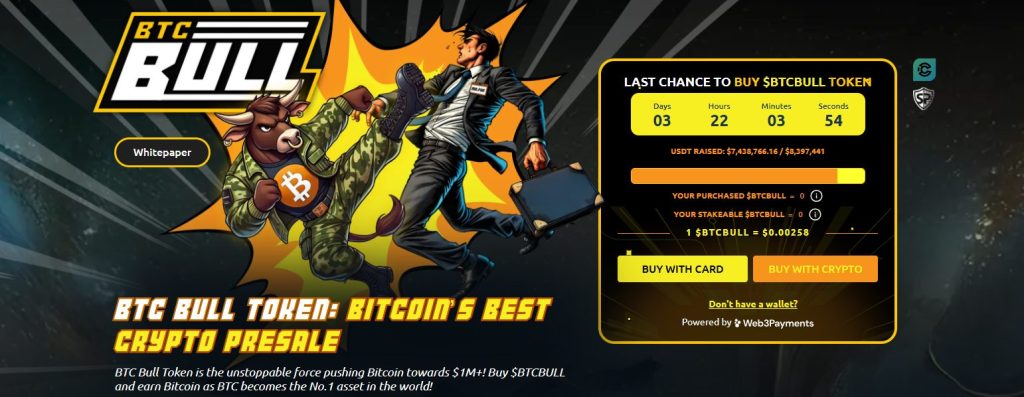

BTC Bull Token’s Surge: A New Investment Opportunity

As Bitcoin hovers around the $105,000 mark, investor interest is also shifting towards the newly emerging BTC Bull Token ($BTCBULL), which is nearing its presale hard cap. The token has amassed $7,438,492.88 of its $8,397,441 target, illustrating strong demand among investors eager to capitalize on its potential.

BTCBULL offers unique value tied directly to Bitcoin’s price through innovative mechanisms such as:

- BTC Airdrops: Regular distributions to holders, prioritizing presale participants.

- Supply Burns: Automatic burns triggered every time Bitcoin increases in increments of $50,000.

This tokenomics model not only creates a solid connection to Bitcoin but also appeals to both seasoned DeFi participants and newcomers eager for hassle-free income streams. With hours left in the presale and the hard cap nearly within reach, momentum is rapidly building as early buyers scramble to seize this opportunity before prices rise to the next tier.

Conclusion: The Road Ahead for Bitcoin and Investors

As Bitcoin navigates this dynamic market landscape, its future remains both promising and uncertain. The interplay between economic indicators and investor sentiment will play critical roles in shaping its trajectory. What stands out is the growing recognition of Bitcoin as a mainstream player, corroborated by its correlation with traditional markets. Investors are encouraged to remain informed and engaged, as these developments unfold in real-time. Could Bitcoin soon reach new heights once more, or are we in for a period of consolidation? Join the conversation and share your thoughts!