Bitcoin Surges as Global Tensions Ease: What You Need to Know

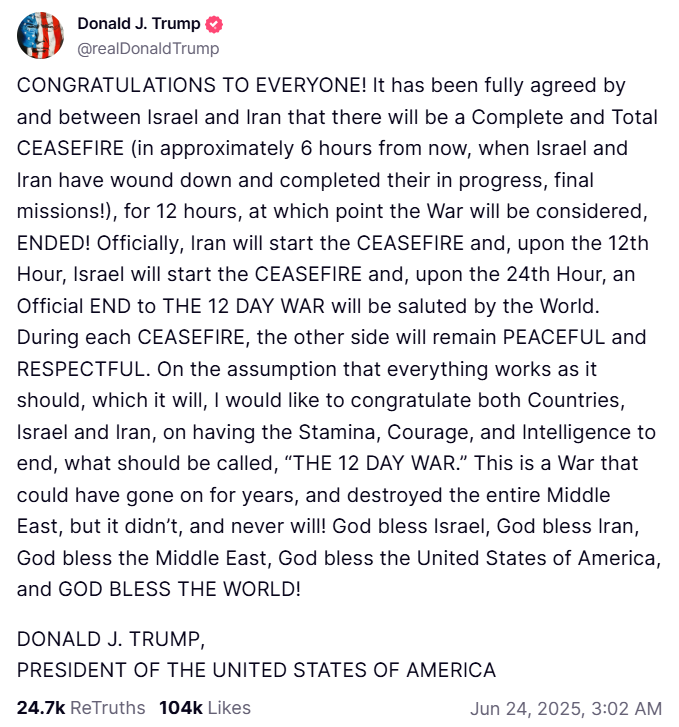

In a remarkable turn of events, Bitcoin has reclaimed its position above $105,000, rallying nearly 4.5% within 24 hours, following the announcement of a ceasefire agreement between Israel and Iran. This significant development, brokered by U.S. President Donald Trump, has sparked renewed optimism in the cryptocurrency market. The deal, facilitated through Gulf intermediaries and direct discussions with officials from both countries, signals a potential de-escalation in a region that has seen nearly two weeks of military conflict.

📌 Why This Matters

The immediate reaction of the crypto market to the ceasefire illustrates how intertwined geopolitical events are with economic behaviors. As tensions between Israel and Iran subside, investors are shifting their strategies. The return to stability often inflates the appeal for riskier assets, including Bitcoin. With traditional safe havens like gold showing signs of stagnation, traders are increasingly looking to speculative investments that might yield higher returns.

When President Trump highlighted that Iran’s early warning about a potential missile strike had prevented casualties at U.S. bases in Qatar, it became clear that diplomatic efforts were making headway. This breakthrough has led investors to ditch defensive positions—such as gold and fixed-income securities—in favor of more volatile assets like cryptocurrencies. Indeed, the decreasing uncertainty fosters an environment conducive for capital inflow, resulting in Bitcoin’s current spike.

🚨🚨🚨Breaking News🚨🚨🚨Trump has posted that he has brokered and “complete and total ceasefire” between Iran and Israel.#Iran #IranIsraelConflict #Trump #ceasefire pic.twitter.com/zQPraXx7Qa— The Blue Collar Intellectual (Julian) (@JulianAcciard1) June 23, 2025

🔥 Expert Insights: Analysts Weigh In

Market analysts suggest that geopolitical stability is a critical component for a sustained recovery in both cryptocurrency and stock markets. “Peace agreements tend to rekindle investor confidence, allowing higher-risk assets to flourish,” says cryptocurrency analyst Maria Chen. “As we see Bitcoin regain its footing, it’s possible we may witness a similar resurgence in altcoins.”

The current environment might not only signify a recovery for Bitcoin but could also open doors for other digital assets, as they often follow Bitcoin’s lead. Investors are keenly watching how these dynamics play out in the coming weeks.

🚀 Future Outlook: What’s Next for Bitcoin?

With Bitcoin surging past the significant resistance of $103,806 and charting a bullish pattern, traders are eyeing a potential breakout above $106,000. This isn’t just a technical milestone; it could set the stage for a bullish run towards $109K if sustained buying pressure continues. Yet, caution prevails; if the market fails to maintain momentum at $106K, we could see a retracement back to $102K.

Critical Levels to Watch:

- Resistance: $106,000, $107,580, $109,041

- Support: $103,965, $102,199, $100,487

With a bustling daily trading volume exceeding $64.9 billion and a market cap nearing $2.09 trillion, Bitcoin stands at a pivotal junction. If this ceasefire holds, traders may eagerly chase higher highs, reinvigorating the entire crypto landscape.

Bitcoin Hyper Presale Hits New Heights

In addition to Bitcoin’s extraordinary price movements, another project has been making headlines. The Bitcoin Hyper ($HYPER) presale has skyrocketed, surpassing $1.5 million, with a total of $1,527,516.42 raised toward a target of $1,763,403. As the presale approaches its next tier, early investors can still secure $HYPER tokens at just $0.012 each.

Bitcoin Hyper is the first Bitcoin-native Layer 2 project powered by the Solana Virtual Machine (SVM), enabling quick, cost-effective smart contracts on the BTC network. This project aims to deliver high-speed decentralized applications, meme coins, and payment solutions characterized by ultra-low fees and seamless BTC integration.

As the presale continues to gain traction, Bitcoin Hyper stands out as a beacon of utility within the meme culture, potentially positioning itself as a breakthrough player in the Layer 2 domain for 2025. With a promising future, the project has already garnered substantial interest, emphasizing its potential impact on the broader cryptocurrency ecosystem.

Conclusion: Engaging in Tomorrow’s Market

The recent developments in Bitcoin and the broader crypto market underscore how sensitive cryptocurrencies are to global events. As we navigate through these evolving circumstances, traders and investors alike are encouraged to keep an eye on the interplay of geopolitical factors and market sentiments.

What are your thoughts on Bitcoin’s surge? Will the ceasefire lead to a sustained rally, or should we brace for volatility? Join the discussion below!